Avalanche

Grade: B

Summary

Avalanche, launched in 2020 by AVA Labs, is designed for scalability and interoperability, tweaking the proof-of-stake consensus protocol for higher throughput and finality. It supports subnetworks – interoperable custom blockchains – which can be tailored for specific use cases in decentralised finance.

| Pillar | Grade |

|---|---|

| Financial Prospects of the Network | C |

| Network and Usage | B |

| Comparison with Traditional Finance Alternatives | B |

| Future Utility | B |

| Weighted Grade | B |

I. Financial Prospects of the Network

Tokenomics

Avalanche is a Layer-1 blockchain that uniquely advances the proof-of-stake (PoS) consensus mechanism to confirm transactions. Its native currency – AVAX – is capped at 715,748,719 tokens, 395mm of which are in circulation (55.2%). In total, 444,444,808 AVAX have been minted (62.1%), but the protocol incentivises staking to keep the circulating supply of AVAX lower. Avalanche bases validator rewards on a) amount of time a node has staked its tokens, called Proof of Uptime, and b) whether the node has historically acted according to the software’s rules, called Proof of Correctness. Unlike other blockchains, fees are burned rather than paid out to validators. This further increases scarcity, avoiding token inflation to support network longevity.

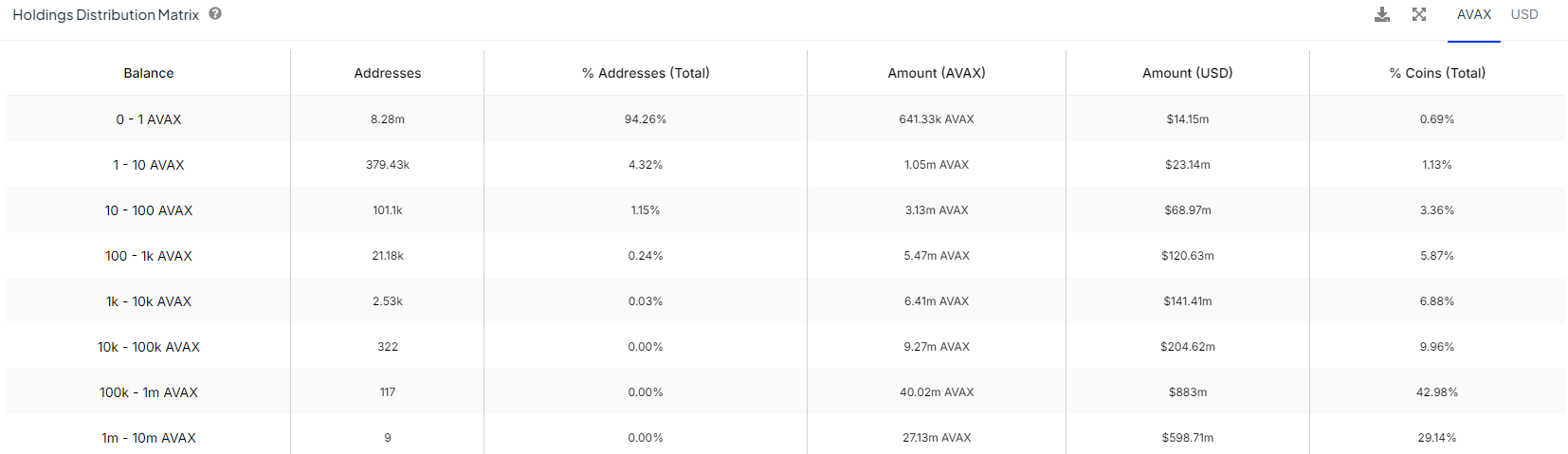

An altcoin, AVAX is currently priced US$21.75 per token, making Avalanche the 12th most valuable chain at US$8.59bn. The token powers Avalanche, used for payment, rewards and staking. To Avalanche’s detriment, tokens are consolidated with large wallets: retail investors hold just 27.58% of tokens, whales 30.16%% and institutional investors 42.26%. This is extremely poor, noting retail hold 88.11% of BTC, 48.56% of ETH and 71.35% of ADA. The largest 126 wallets own 72.12% of all tokens – US$1.48bn in value – and the top 9 wallets hold nearly 30% of tokens. This consolidates a huge proportion of tokens to a few investors, exposing small participants to unpredictable price moves if a large holder trades. It also degrades decentralisation, since users can vote and earn fees based on their ability to stake AVAX tokens. Large users have an outsized hold on Avalanche governance.

Revenue Streams

Blockchains require users to pay fees when they perform a transaction, compensating validators for work. Avalanche fees are dynamic, fluctuating with demand and typically float between 75-225 nAVAX (one-billionth of one AVAX). In dollar terms, users may expect to pay US$0.033-0.1 per transaction, though this increases during times of network congestion and as AVAX appreciates. Fundamentally, Avalanche offers a cheaper alternative to Ethereum, which charges 0.0004-0.0005 ETH on average (US$1+).

Fees, paid in the native token, indicate how much users will pay to use a blockchain. Among leading protocols, Avalanche generates low fees. Interestingly, only TRON has sustained growth over the last 30 days, with all other blockchains in the red. This may be expected, noting the market downturn, as price declines reduce validator rewards and the attractiveness of work. Users decrease, decreasing fees, and so on.

Dividing market capitalisation by fees generates a price-to-fee (PF) ratio. Avalanche’s ratio suggests its fair value is currently 866x higher than the economic value it captures. This is not abnormal; in fact, Cardano and Algorand perform far worse, and Ethereum looks high at 252x. This may indicate that Layer-1 protocols are overpriced given their fundamentals.

| Network | Fees (L30D, USD) | Fees (annualised, USD), 30d% Change | Price-to-Fees Ratio |

|---|---|---|---|

| Algorand | $23.05k | $280.43k (-33.9%) | 3,584x |

| Avalanche | $851k | $10.35mm (-1.0%) | 866x |

| BNB Chain | $11.26mm | $136.97mm (-19.5%) | 550x |

| Cardano | $169k | $2.05mm (-4.3%) | 6,096x |

| Ethereum | $102mm | $1.24bn (-39.0%) | 252x |

| Solana | $51.95mm | $632mm (-7.6%) | 120x |

| Tron | $155mm | $1.88bn (+9.5%) | 5.9x |

Date: 10 August 2024

Source: token terminal

Financial Metrics

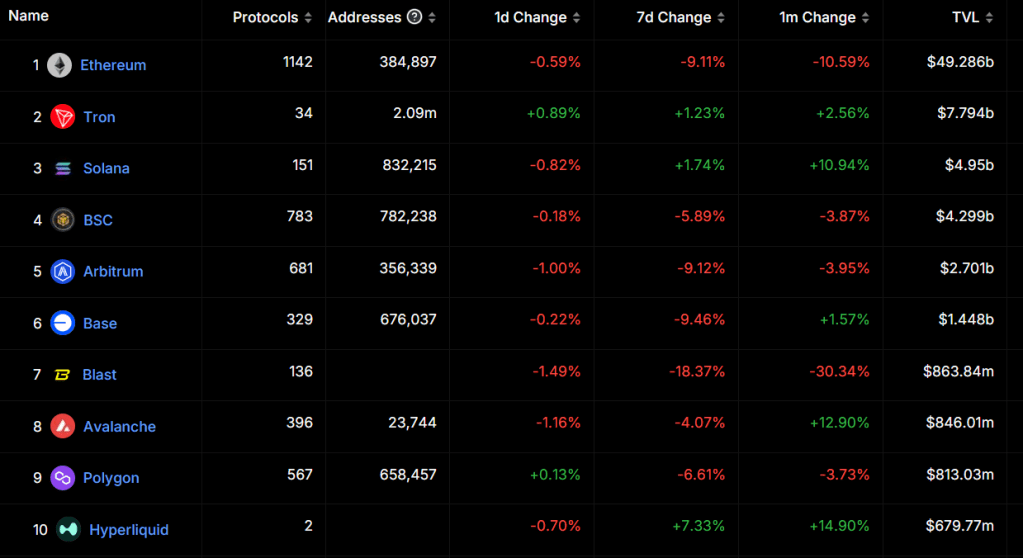

Total Value Locked (TVL) on Avalanche stands at US$846mm, a high sum and 8th largest of all blockchains. Bitcoin, for instance, supports US$646mm. However, other Layer-1 blockchains such as TRON and Solana host US$7.71bn and US$4.98bn, respectively, and Ethereum hosts US$49.29bn. There is a large gap to match its competitors.

TVL is crucial for blockchains, revealing capital inflow from users, and higher sums indicate greater trust in the blockchain. It is correlated strongly with both value and utility. Avalanche’s market cap is 10x greater than the value locked on its network – a ratio of 1.0 is considered healthy. TVL has been stable since the turn of the year, though spiked to US$1.488bn in mid-April.

In all, this is positive for Avalanche. The blockchain supports 396 protocols, so we crudely allocate US$2.14mm to each decentralised application (dApp) operating on chain. Users find utility in the ecosystem. However, to catch competitors, Avalanche must expand its services and encourage more capital deposits. This is achieved through partnerships with entrepreneurs and developers, who add economically valuable tools to the network.

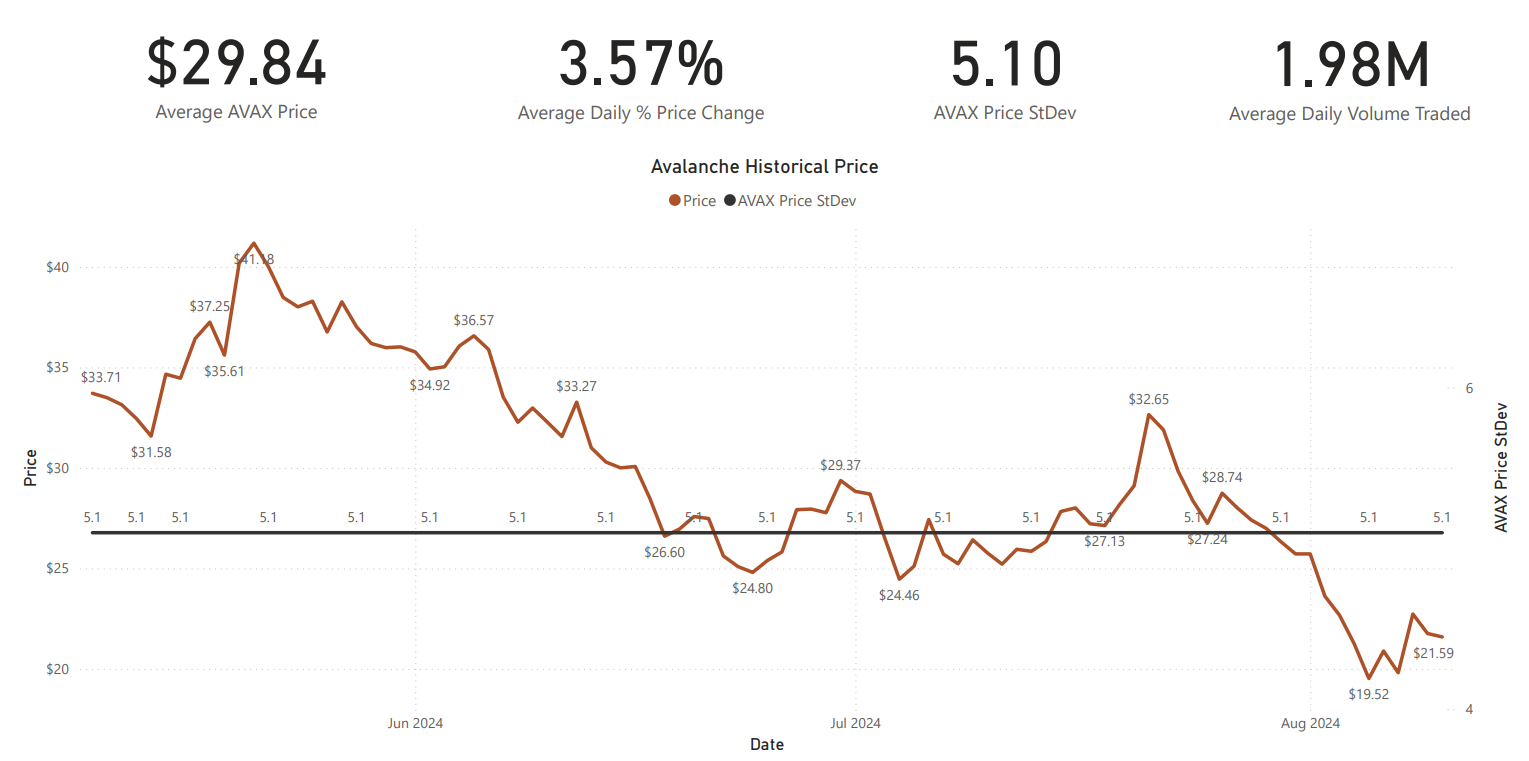

We map price, volume and volatility of AVAX over the last 90 days, observing a 56.2% price decline between the highest and lowest price points. The market also declined: total crypto capitalisation dropped 26.7% across the period, but AVAX experienced a far more severe downturn. On average, 1.98mm AVAX are traded each day, contributing to an average daily value of US$59.08mm. This is substantially lower than market leaders Ethereum and Bitcoin, but higher than the likes of Filecoin, Algorand and Litecoin, indicating AVAX has prominence as an altcoin among investors.

Date: 10 August 2024

Source: Investing.com

II. Network and Usage

Network Metrics

Blockchains must create a single version of truth and reach this state through a consensus protocol. Avalanche builds on the PoS consensus deployed by other Layer-1 networks with three design features.

Firstly, when a transaction occurs, one validator node receives the data and samples a small, random set of other validators, who all check for agreement. Subsequently, validators sample other sets, “gossiping” to ultimately reach consensus. This snowballs to quickly achieve full network agreement, hence avalanche.

Blockchains must scale quickly to be suitable for mass adoption. So, Avalanche deploys subnetworks: groups of nodes allocated to validate a designated set of specialised chains. This works similarly to Layer-2 solutions, since subnets are separate yet connected instances of a blockchain. However, unlike Layer-2s, subnets are fully interoperable and let developers launch specialised chains whilst retaining control over parameters such as validator rules, governance and fee structures. So, two developers with opposing views can run different subnets with differing block sizes, without needing to fork. This way, Avalanche scales horizontally, multiplying the number of blockchains rather than prioritising a single chain.

Lastly, Avalanche is constructed from three different blockchains:

- Exchange Chain (X-Chain): the default blockchain on which assets, including AVAX, are created and exchanged.

- Contract Chain (C-Chain): allows the creation and execution of smart contracts.

- Platform Chain (P-Chain): coordinates validators to create and manage subnets.

The blockchain trilemma states that a blockchain may prioritise only two of decentralisation, security and scalability. Scalability suffers due to tension between three vectors: the amount of data a block can store; the time it takes to generate a new block; and the number of transactions the network must handle. This hinders a blockchain’s ability to process transactions. For example, Ethereum processes 12 transactions per second (TPS), Bitcoin 7, and transactions take 15 minutes and one hour to complete, respectively. And congestion drives up fees.

Avalanche intends to resolve this, pitching time to finality (TTF) as the key metric. TTF captures both processing speed and the time required to reach a state of transaction finality. This is vital for situations in which transaction permanence is key, for example, for a high-frequency trader (HFT). Though a blockchain may process tens of thousands of trades per second (high TPS), if it takes time to finalise each trade, HFTs would be uncertain whether trades are complete. Ultimately, the market is unsuitable for user requirements.

- Real-time TPS: 1.3

- Maximum recorded TPS: 92.74

- Theoretical maximum TPS: 4,500

- Block time: 2.07 seconds

- Time to Finality: 1 second

A short TTF highlights an efficient consensus mechanism and means users can trust the system to finalise transactions quickly. Avalanche achieves finality in under one second, faster than any Layer-1 blockchain. For developers, consistent and short TTF means applications operate smoothly, without unexpected delays that could degrade user experience.

By unlocking near-instant finality, Avalanche positions itself well to support decentralised finance (DeFi) applications.

Smart Contracts and dApps

Like Ethereum, Avalanche supports smart contracts to run dApps on its network. C-Chain, based on the Ethereum Virtual Machine (EVM) and coded in Solidity (the language used Ethereum), enables this. So, Avalanche smart contracts are interoperable, meaning DeFi ecosystems can be integrated between different chains. This is useful for users, who can move assets across Ethereum, Avalanche and other Layer-1s based on the EVM.

In addition to supporting Ethereum’s entire toolkit, Avalanche can finalise transactions in under one second. It is one of the fastest blockchains and very suitable for DeFi. 613 dApps have been recorded as operational in the last month, of which 263 fall under the DeFi category. Avalanche is recognised as a popular environment for dApp and DeFi development, hosting more services than a number of competitors (Arbitrum – 578; Optimism – 291). However, it falls some way short of Ethereum (4,724), BNB Chain (5,446) and TRON (1,387).

User Adoption

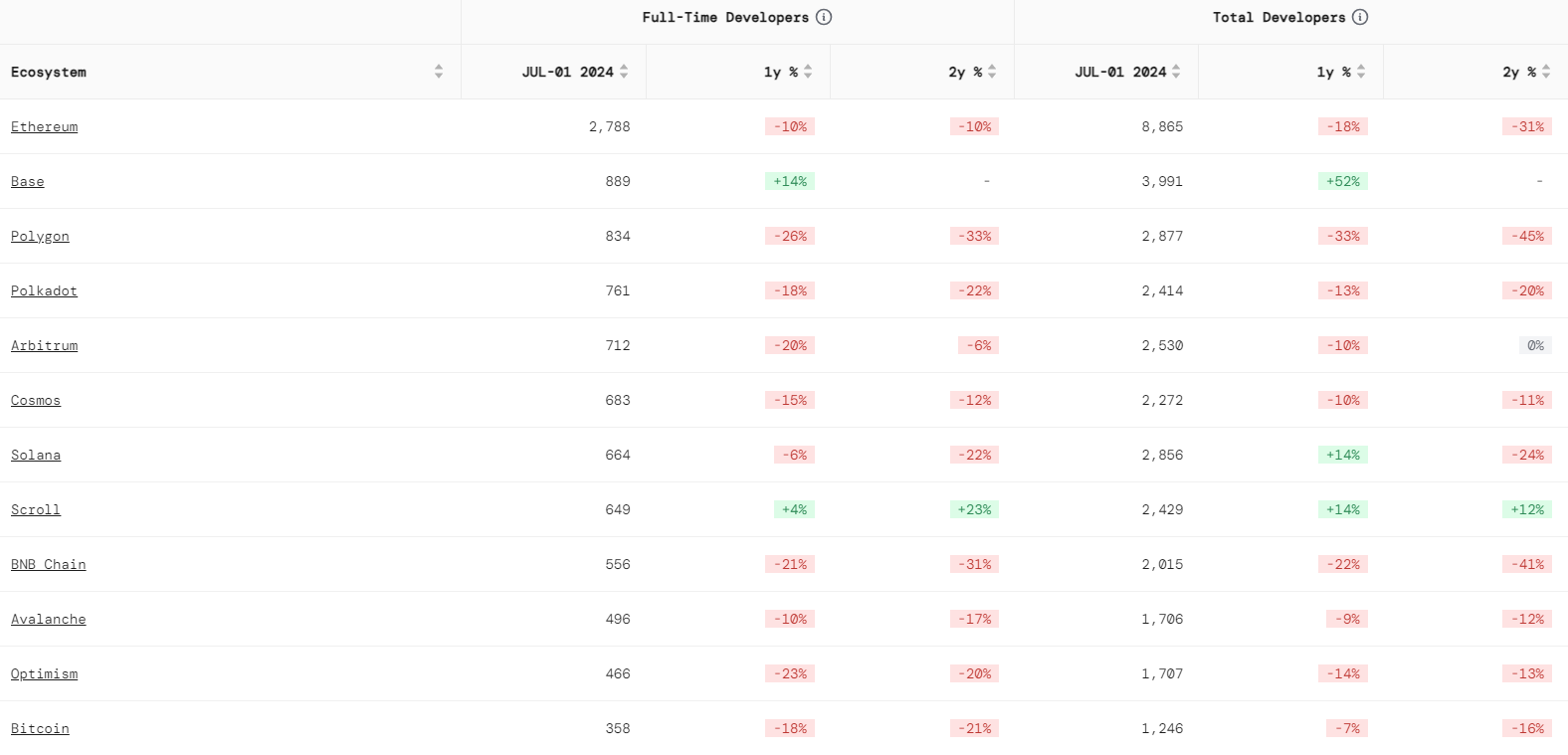

Across 2023, over 1,000 developers wrote code for just 19 ecosystems. Avalanche made it to the top 10, with 2,440 developers. It has retained its position; 496 full-time developers partaking in July 2024.

Date: July 2024

Source: Electric Capital

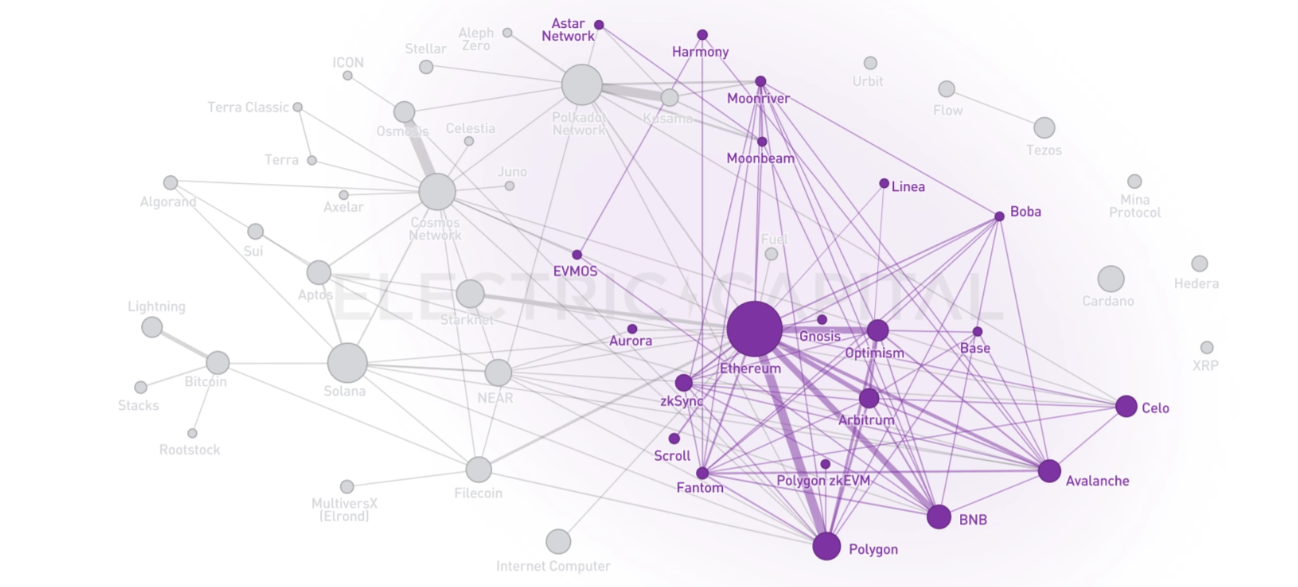

The EVM supports developers across several clusters of interconnected ecosystems. Positively for Avalanche, this encourages re-deployment of smart contracts and innovations across Avalanche, Ethereum and other EVM-compatible chains. It supports short- and long-term utility of the ecosystem. Avalanche shared 18% of developers with Ethereum and 27% with each of BNB Chain and Polygon. Notably, though, this is fewer than Optimism, Arbitrum, BNB Chain and Polygon, which shared 19%, 24%, 39% and 36% with Ethereum, respectively. Given Ethereum’s code is, initially, unique and homegrown, we suggest that more developmental interoperability will support better outcomes for users.

Source: Electric Capital

Developers are key to economically valuable applications, which should encourage users. However, total addresses holding Avalanche decreased 63.61% between 28 July 2023-24, from 209,090 to 76,080. The number of active addresses also decreased, from 209,090 to 51,610. Linking back to holding statistics, where we identified just 27.58% retail participation, evidence suggests that Avalanche is struggling to onboard users.

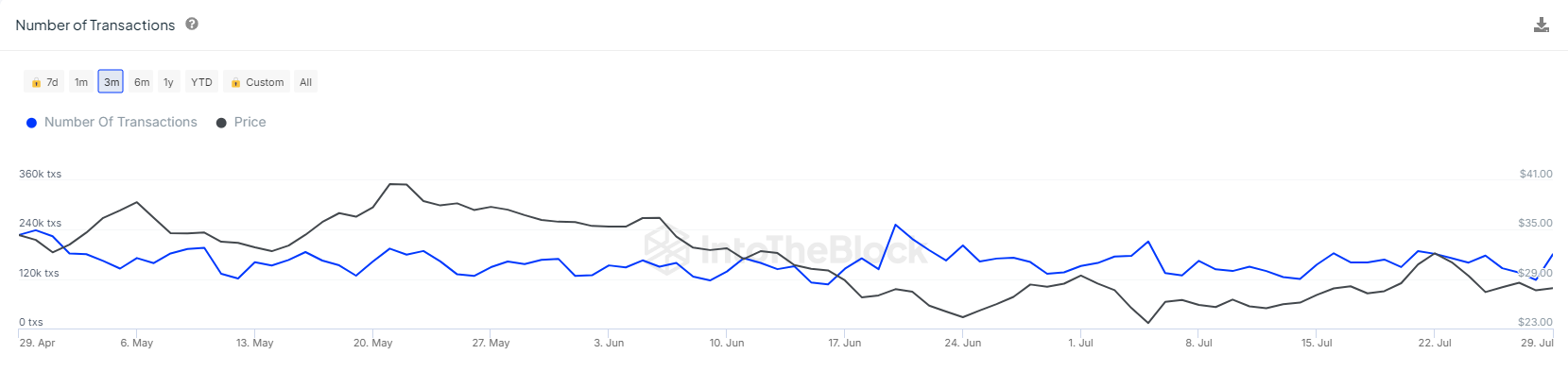

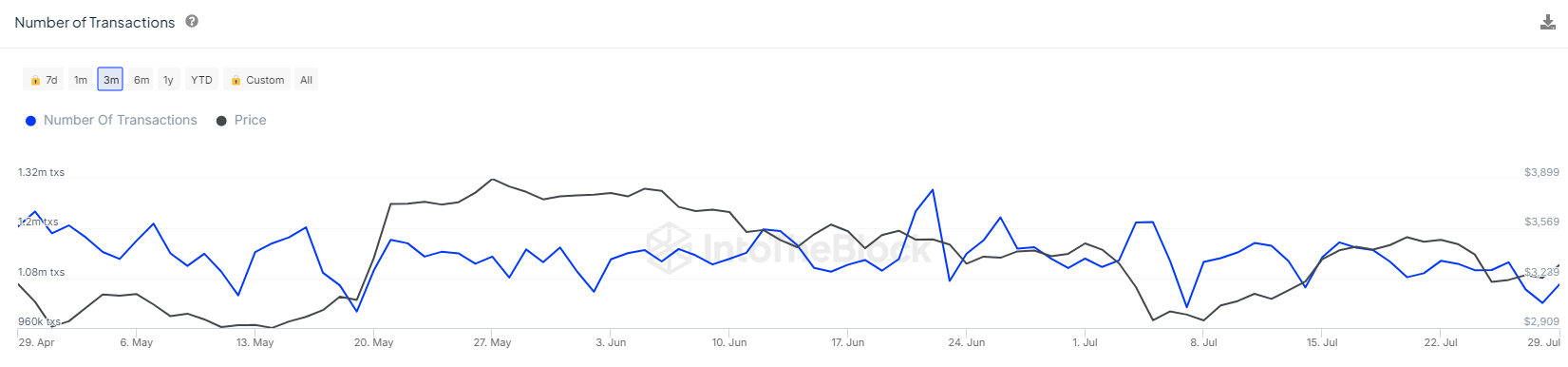

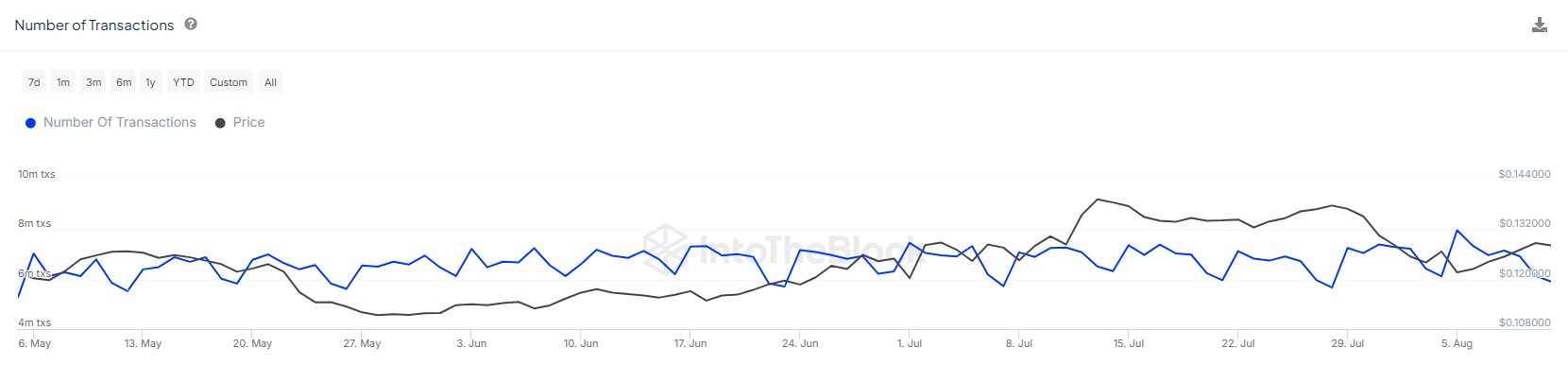

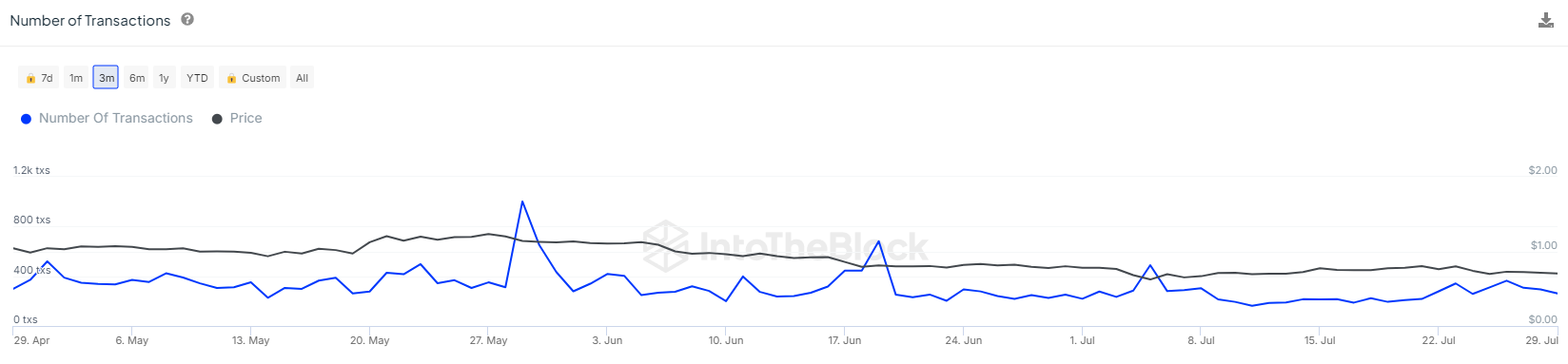

To compete with Ethereum, this must change. Users transact and exchange value, locking capital into DeFi protocols and supporting liquidity, lending and more. Avalanche currently counts just 2.4% and 0.37% of the daily transactions of Ethereum and TRON, respectively. Users do not find it as useful.

Source: IntoTheBlock

Source: IntoTheBlock

Source: IntoTheBlock

Source: IntoTheBlock

III. Comparison with Traditional Finance Alternatives

Cost-Benefit Analysis

Avalanche posits that, as blockchain develops, transaction TTF directly impacts real-world efficiencies. Near-instant finality positions the blockchain to excel across several functions.

| Activity | Problem | Solution |

|---|---|---|

| High-Frequency Trading | HFTs execute millions of trades in fractions of a second, meaning speed of execution is pivotal to their competitiveness | Near-instant finality ensures that executed trades are confirmed and irreversible almost immediately, reducing the risk of disputes and enhancing market efficiency |

| Smart Contract Automation | Smart contracts self-execute based on predefined rules to automate various industry processes. To run smoothly, they require transaction outcomes to be determined quickly and accurately | Near-instant finality ensures that, once conditions are met, smart contracts execute without delay, improving automation efficiency |

| Cross-border Transactions | Traditional cross-border transactions are inefficient, often taking multiple days to finalise | Near-instant finality can support the security and speed of international transactions, revolutionising global trade and asset transfer |

| Supply Chain Efficiency | Modern supply chains encompass complex global networks of producers, suppliers and transporters. Products can be exposed to counterfeit, and it can take time for a consumer to trust the origin or authenticity of a product | Near-instant finality ensures that all updates in a lifecycle are recorded and verified promptly, enhancing supply chain transparency and empowering consumers to make conscious decisions |

Near-instant finality is a huge technical advantage that could transform the way buyers and sellers interact. This potential is not lost on investors: Avalanche raised US$42 million in an Initial Coin Offering (ICO) in July 2020 and funding has not stopped there. Ava Labs, the start-up behind Avalanche blockchain, raised US$230 million from large venture capitalists such as Polychain and Three Arrows Capital in 2021. In 2023, they raised a further US$350mm, totalling US$715mm since inception.

But there is risk. Token distribution is a glaring weakness of Avalanche, as small investors hold just 27.58% of AVAX (Section I) and are exposed to institutional players profit-taking at their expense. For users to find utility in the token, greater decentralisation is required.

Security and Trust

Avalanche is governed by AVAX holders and secured through validators and subnets. Avalanche does not limit how many validators can partake – a token holder can become a validator by staking at least 2,000 AVAX. The architecture splits across X-Chain, C-Chain and P-Chain; a design which secures the network against Sybil attacks since no user can gain 51% control of the network.

However, Avalanche has suffered hacks on DeFi protocols operating on its network. Decentralised exchange Platypus Finance was hit twice in 2023 for US$8.5mm and US$1.65mm, exposing staked AVAX tokens. Though an issue with code of the DeFi protocols rather than Avalanche, the impact is keenly felt by AVAX holders and Avalanche must do more to protect its network.

Accessibility and Inclusivity

To support its technology, Ava Labs partnered with Amazon Web Service (AWS) for its cloud solutions and global presence. The primary driver was to help users launch a validator node from any legal jurisdiction. It has also explored tokenisation of assets, partnering with Australia and New Zealand Banking Group (ANZ) and Chainlink to support the purchase of New Zealand dollar stablecoins on Avalanche and use them on Ethereum.

Other partnerships include:

- Coachella Quests: an Avalanche powered game rewards attendees for engaging in both virtual and on-site activities at Coachella festival.

- Partnership with Stripe to facilitate the direct purchase of AVAX through Stripe’s platform, bypassing traditional crypto exchanges so users can easily fund their wallets and transact.

IV. Future Utility

Roadmap and Development

Avalanche was created by Ava Labs, co-founded by Emin Gün Sirer, Kevin Sekniqi and Ted Yin, to create a scalable and global digital asset market. Sekniqi has stated the goal of reducing transaction finality to as low as 250 milliseconds (1-2 rounds of validation), which would make Avalanche the fastest network by far and provide exceptional utility for users.

In practice, this entails evolving its own HyperSDK virtual machine. A demonstration in April showed the HyperSDK processing 5 billion micropayments at 100,000 transactions per second. Additional developments, such as Avalanche Wallet Messaging (AWM) and the Teleporter, could support nearly instantaneous movement of assets between different chains.

The intention is to develop Avalanche into a serious rival of Ethereum.

Risks and Mitigations

Key risks with Avalanche concern are a) the relative youthfulness of the technology compared to older blockchains like Ethereum and b) token concentration with insiders and venture capital firms. It is at risk of a significant price shock if these holders take profits.

Additionally, a hack on a Turkish crypto exchange – BtcTurk – coincided with a 10% drop in the price of AVAX. When hacks occur, users often flee to safer assets, as here, with US$54.2mm AVAX exchanged for bitcoin (BTC). This underscores persistent vulnerabilities of crypto services, which can affect token prices without warning. AVAX, as an altcoin, is more volatile in the event of contagion.

Relevance

Avalanche provides value through technology and scalability and is positioned well for use in DeFi. It has the goal of catching Ethereum and performs exceptionally well in terms of raw network performance, with developments planned to offer even greater capacity for trading support and supply chain management.

Compatible with the EVM, Avalanche offers all the tools available on Ethereum. It also sufficiently differentiates itself through subnetworks, addressing the need for custom blockchain environments in DeFi. Developers can create networks with rules and applications that best suit their target user base, and this feature also solves the scalability issues prevalent in Ethereum. It provides exceptional utility for both developers and users.

Developer and user numbers are not nearly as high as Ethereum and fall short of close competitors. This may be due to token distribution, which shows heavy consolidation with large wallet holders. This restricts the influence small users can have on the network and may discourage participation due to the risk profit-taking presents for AVAX.

If it can rectify this, as DeFi increases in popularity, Avalanche has the potential to become one of the most appreciated blockchains around.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Readers are encouraged to conduct their own research and seek professional advice before making investment decisions.

The author has held a stake in Avalanche since 2024.

References

Adejumo, O., & Wang, L. (2024). BtcTurk Hack Triggers Avalanche’s AVAX Decline to 6-Month Low of Under $25. Availableat: BeInCrypto (Accessed: 11 August 2024).

Asim, U. (2023). Time to Finality (TTF): The Ultimate Metric for Blockchain Speed. Available at: Avalanche (Accessed: 11 August 2024).

Avalanche. (2024). Avalanche Watch: April 2024. Available at: Avalanche (Accessed: 10 August 2024).

Avalanche. (2024). What are the transaction fees on Avalanche®? Available at: Avalanche (Accessed: 11 August 2024).

Bloomberg. (2023). Crypto startup Ava Labs is said to raise $350 million at $5 billion valuation. Available at: Economic Times (Accessed: 11 August 2024).

Certik. (2022). How Avalanche Tackles the Scalability Problem. Available at: Certik (Accessed: 11 August 2024).

Dudhe, N. (2023). Avalanche Fundamentals — Consensus Mechanism Explained! Available at: Medium (Accessed: 10 August 2024).

Electric Capital. Developer Data. Available at: https://www.developerreport.com/.

Kraken. (2023). What Is Avalanche? Available at: Kraken (Accessed: 10 August 2024).

Marquez, R. (2024). AVAX Soars 9% As Avalanche And Chainlink Announce Partnership For Global Asset Circulation. Available at: NewsBTC (Accessed: 11 August 2024).

Otto-AA. (2024). Ethereum Virtual Machine (EVM). Available at: Ethereum (Accessed: 11 August 2024).

Shen, M. (2024). 2023 Crypto Developer Report. Available at: Electric Capital (Accessed: 06 April 2024).

Talpas, L. (2024). What is nAVAX? Available at: Avalanche (Accessed: 12 August 2024).

Leave a comment