Bitcoin

Grade: B

Summary

In 2008, a white paper titled Bitcoin: A Peer-to-Peer Electronic Cash System set out the theory and design for a digital currency free of centralised control. The author, under the pseudonym Satoshi Nakamoto, launched the software in January 2009 and Bitcoin was born. It is open source, meaning anyone can view, use or contribute to the code for free.

Bitcoin was designed as a peer-to-peer network, facilitating secure and transparent transactions without the need for intermediaries. It sought to address concerns over traditional financial systems in the aftermath of the Global Financial Crisis.

Our analysis finds that Bitcoin performs well financially and has strong perceived utility, based on historic price performance and Bitcoin ETF approvals. However, loyalty to Proof-of-Work consensus is a glaring weakness and could see Bitcoin’s value proposition challenged by competitors in future.

| Pillar | Grade |

|---|---|

| Financial Prospects of the Network | A |

| Network and Usage | D |

| Comparison with Traditional Finance Alternatives | B |

| Future Utility | B |

| Weighted Grade | B |

I. Financial Prospects of the Network

Tokenomics

Bitcoin’s innovation lies in a Proof-of-Work (PoW) consensus algorithm which ensures integrity of its ledger, known as the blockchain. Nakamoto created a public digital ledger that records all transactions on the network and copies are stored on computers across the globe. Anyone can set up a node and participate. Consensus on transaction validity is achieved cryptographically across nodes rather than relying on a central entity, such as a clearing house. Miners bundle new transactions into a block and add this permanently to the chain every ten minutes, creating an immutable ledger for all.

Bitcoin’s native currency, bitcoin (BTC), incentivises miners to do this. Miners compete to solve a cryptographic problem to a) confirm transactions, and b) earn rewards of newly minted BTC (if they solve the problem). In Bitcoin’s formative years, it was possible to mine BTC on a personal computer. But, as the network has grown and BTC appreciated, more miners joined, decreasing the chances of being the one to solve the hash. Today, miners generate around 560 quintillion hashes per second and machines – Application Specific Integrated Circuits – are purpose built for mining.

Touting itself as decentralised implies that ownership of BTC is well distributed. Statistics reveal that the top 105 wallets (size >10,000 BTC) hold 15.01% of all coins in circulation. Three hold over 100,000 BTC – cumulatively US$35.6bn – equating to 2.87% of total coin supply. 858,410 wallets hold 10.82% of circulating supply with 1-10 BTC – US$68.77bn in total. At the low end, 28.69 million addresses hold 0-0.001 BTC, demonstrating broad participation across a range of investor profiles.

| Balance | Addresses | % Addresses (Total) | Amount (BTC) | Amount (USD) | % Coins (Total) |

|---|---|---|---|---|---|

| 0 – 0.001 BTC | 28.69m | 53.99% | 5.61k BTC | $353.7m | 0.03% |

| 0.001 – 0.01 BTC | 11.89m | 22.37% | 43.4k BTC | $2.74b | 0.22% |

| 0.01 – 0.1 BTC | 8.02m | 15.09% | 272.09k BTC | $17.15b | 1.38% |

| 0.1 – 1 BTC | 3.53m | 6.65% | 1.09m BTC | $68.77b | 5.54% |

| 0.1 – 1 BTC | 858.41k | 1.62% | 2.13m BTC | $134.29b | 10.82% |

| 10 – 100 BTC | 136.99k | 0.26% | 4.35m BTC | $274.26b | 22.11% |

| 100 – 1k BTC | 13.84k | 0.03% | 3.89m BTC | $245.09b | 19.75% |

| 1k – 10k BTC | 2.02k | 0.00% | 4.95m BTC | $311.76b | 25.13% |

| 10k – 100k BTC | 102 | 0.00% | 2.39m BTC | $150.66b | 12.14% |

| > 100k BTC | 3 | 0.00% | 564.9k BTC | $35.6b | 2.87% |

Source: IntoTheBlock

It is challenging to distinguish retail activity from professional or institutional. Many retail investors could have purchased BTC from 2010-2016, when the price held between US$0.06-US$1,000. A relatively insignificant expenditure would have secured significant long-term value. Therefore, wallets of size 10-10,000 BTC, though holding the greatest number of coins, do not necessarily indicate consolidation of BTC. The data suggests widespread distribution, supporting Bitcoin’s utility as a global network.

Revenue Streams

Many reject BTC because of its volatility. But the network does not prioritise exchange rate stability, instead implementing a mechanism to limit supply while allowing the free flow of capital. The current reward is 6.25 BTC per block solution, US$414,840 at market price, increasing the quantity of BTC by just 1.73% per annum. In mid-April, the reward will be halved. Nakamoto introduced halving to limit the circulating supply, prevent uncontrolled production and combat inflation, and halving happens every four years until the year 2140 when all 21 million BTC will have been mined. It is a unique control mechanism that challenges inflationary pressures experienced by fiat currencies. 6.25 BTC at current market price is the highest dollar value reward of any blockchain network and is a key factor in Bitcoin’s market dominance.

A common criticism is that BTC has no intrinsic value, given its lack of revenues, but value is not derived solely from cash flows. Bitcoin requires intense computational work and electricity to mine, so we can value BTC in relation to cost of production. Unlike commodities, the mining rate is insensitive to price; Bitcoin’s supply function is programmatically implemented and adjusts to network processing power to produce new bitcoins every 10 minutes. When the halving decreases rewards to 3.125 BTC per block, Bitcoin’s price will arguably drive the cost of production, since higher prices attract more miners which increases the difficulty and expense required to win.

Rewards have attracted miners in droves, likely increasing the value of BTC. In the short term, halving will impact miners as more investment is needed to mine less BTC. Specifically, the maximum a miner can earn each day for validating transactions will drop from 900 to 450 BTC which, at current price, incurs over US$10bn of losses per annum. However, should BTC appreciate to reflect the increased effort, long-term profits may increase. Today could be a period of strategic positioning for an investor, considering either BTC or mining businesses, ahead of possible appreciation.

Miners have also received substantial fees over Bitcoin’s lifetime. The average transaction fee is US$5 but this increases greatly during busy network periods. Cumulative daily fees can spike to over 2000 BTC, as on 11 December 2024. This is remarkably expensive compared to other networks (Algorand, for example, costs under one penny per transaction) and could impact Bitcoin’s long-term utility if users can find cheaper methods elsewhere. And this is likely to get worse. To incentivise miners as rewards decrease with each successive halving, fees must compensate. Over the next 20-40 years, block rewards will become so small that fees will be the primary source of miner revenue. Currently, transaction fees represent a fraction of miner compensation, but this trend will likely reverse, to the detriment of network users.

Financial Metrics

Despite infamous volatility, Bitcoin has been the best-performing asset class for eight of the past eleven years, according to data from VanEck. In the five years prior to 31 December 2023, BTC returned 99.77% and over ten years has returned 6,172.12%.

Bitcoins can be subdivided by seven decimal places: one-thousandth of a bitcoin is a milli and one-hundred millionth of a bitcoin is known as a satoshi. 93.72% of all possible BTC are in circulation – 19,680,231 – giving Bitcoin a market capitalisation of US$1.389tn, which far exceeds any other network. Ethereum, Bitcoin’s rival, is second at US$421bn. The level of circulating supply is also higher than most networks in the top 100, potentially improving decentralisation, and this is observed in wallet holdings discussed above. Total Value Locked (TVL) in decentralised finance (DeFi) applications on Bitcoin stands at US$1.386bn: 8th largest of all networks and only 2.46% of that locked on Ethereum (US$55.6bn). This is positive for Ethereum, less so for Bitcoin, since support suggests preferential recognition of Ethereum’s utility.

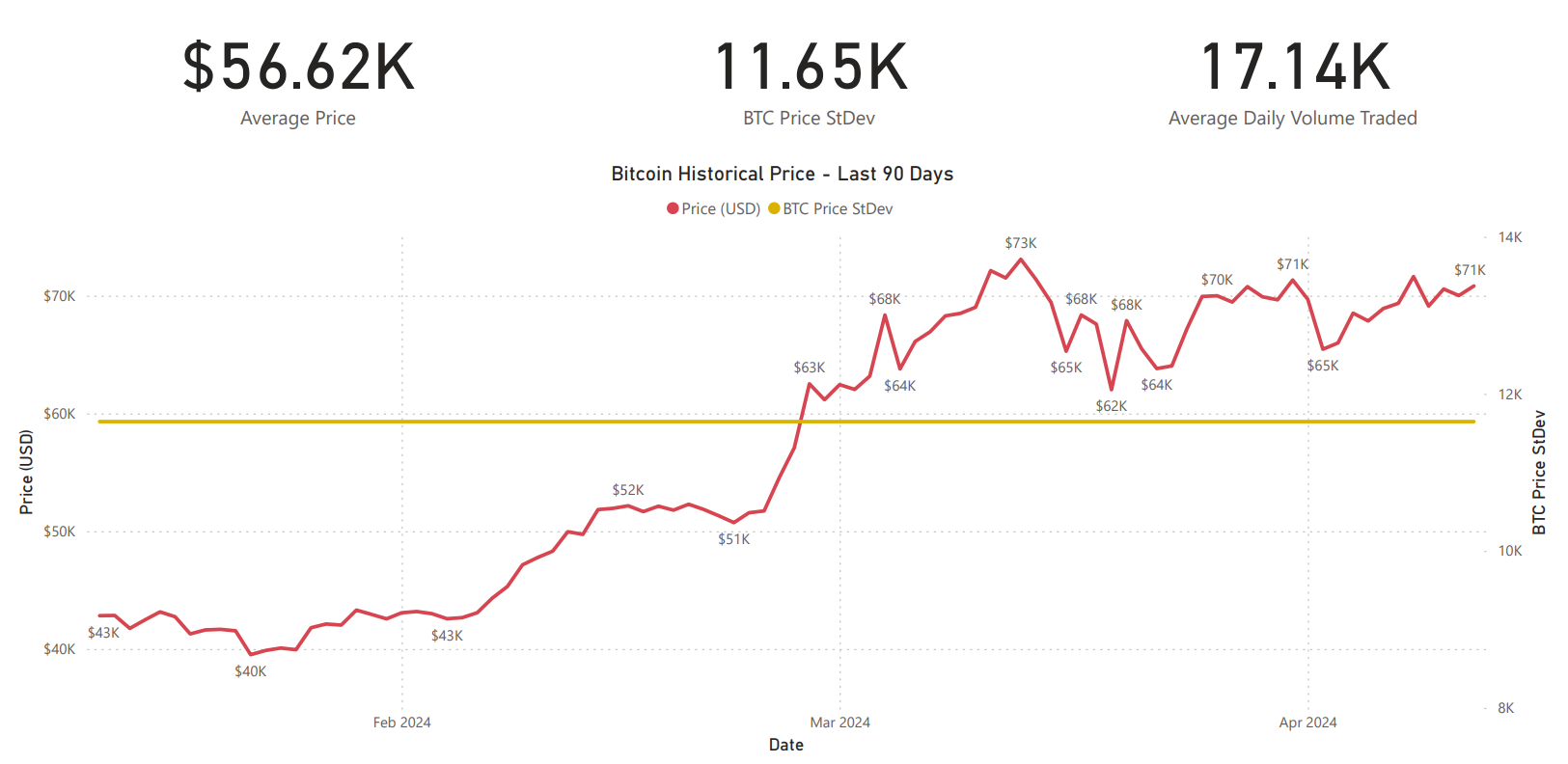

Over the last 90 days, BTC’s price has been relatively volatile, with a standard deviation of 11,650, but is trending upwards, perhaps in anticipation of the halving. Average daily volume traded of 17,140 BTC is very low compared to other cryptoassets, however, is attributable to the average price of one BTC: US$56,620. Average daily value traded (price * volume) is extremely large at US$970,466,800. Though, interestingly, this is 26.64% less than that of Ethereum at time of writing: US$1,322,873,500.

Date: 13 April 2024

Source: Investing.com

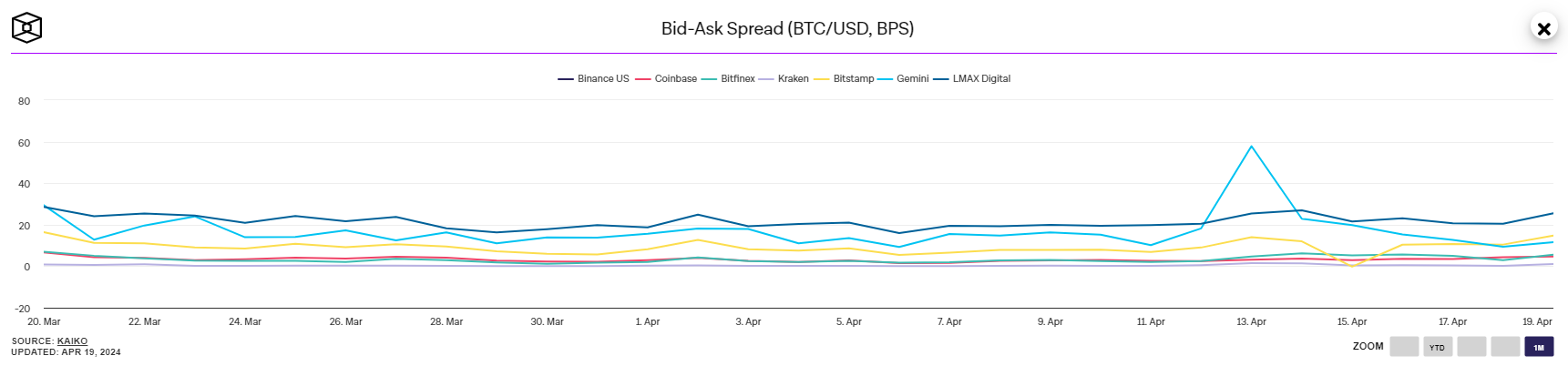

Liquidity is important to institutions when assessing asset allocation. Measured by BTC-US dollar bid-ask spreads, spreads at the largest trading venues globally are between 0.0001% (Kraken) and 0.019% (Coinbase), implying very strong liquidity for BTC. By comparison, the largest and most liquid ETF in the world – SPDR S&P 500 ETF Trust – has a mean spread of 0.0032% and the average of the 2,900 ETPs listed on US markets is 0.52%.

Date: 19 April 2024

Source: Kaiko

II. Network and Usage

Network Metrics

Bitcoin deploys a PoW consensus mechanism to verify the validity of new transactions and add data to the blockchain, which works as follows: network participants – miners – compete to solve arbitrary mathematical puzzles and are rewarded with BTC when they accurately and honestly validate data. Winning miners only receive their reward after other participants verify that data is valid, and blocks are only regarded as valid if they draw a certain amount of computational power to produce. This prevents malicious individuals from gaming the system whilst allowing anonymous entities to transact in the absence of trust. PoW distinguishes Bitcoin from Ethereum, which restructured to a Proof-of-Stake (PoS) mechanism to improve efficiency. And, certainly, Bitcoin’s process is substantially less efficient than Ethereum’s.

- Real-time TPS: 5

- Maximum recorded TPS: 11

- Theoretical maximum TPS: 119

- Block sizes: 1-2MB

- Block time: 9 minutes

Bitcoin has limited capacity to handle many transactions in a short time. Blocks are limited in size and frequency, jointly constraining throughput. PoW may have hamstrung Bitcoin’s transaction processing capacity, increasing fees and delaying processing when the network has high traffic.

Increasing Bitcoin’s transaction processing limit requires software changes in a process known as a fork. In 2017, developers disagreed on how to increase Bitcoin’s TPS and undertook a fork to create Bitcoin Cash (BCH). BCH increased the maximum block size, so Bitcoin split into two separate chains: one maintained in accordance with rules for Bitcoin and with rules for BCH. They are distinct and trade independently, with BCH valued substantially lower (price: US$454.48; market capitalisation: US$515,685,553).

Bitcoin’s efficiency has come under increasing scrutiny, challenging its long-term value proposition. Competitors have benefitted from observing Bitcoin’s rise and a major challenge it faces is ensuring utility when other networks can host more data and validate faster. Many view PoW as essential to Bitcoin’s identity and a shift to PoS unlikely. The mechanism reflects different ideologies and priorities to Ethereum which, through The Merge, redeployed a more sustainable and scalable path. The Merge shifted Ethereum to PoS, reducing the costs of securing its network by approximately 90% and consuming 99.95% less energy. Bitcoin, conversely, is estimated to use 167 TWh per annum, more than the use of 179 individual countries. In addition, US miners had an annual indirect water footprint of 84.9 GL in 2023, up from 70.9 GL in 2021 and 12.9 GL in 2020. So, total water footprint of US Bitcoin miners, after adding their direct water consumption, could be equivalent to the cumulative annual water consumption of 300,000 US households.

Looking further afield, the data is harrowing. Consider, for example, Kazakhstan. The estimated water footprint of Bitcoin mining in Kazakhstan alone was 997.9 GL in 2021, while the nation’s capital could face a water shortage of 75 GL per year by 2030. The impact of mining must be viewed with global warming and water scarcity in mind. The scrutiny Bitcoin faces around its efficiency will reoccur unless it can find a serious resolution, and quickly. Its technology satisfies security and decentralisation well, but falters heavily on scalability, to the detriment of our climate.

User Adoption

Bitcoin is an open ledger, so we can observe activity within its ecosystem. Ownership has never been higher – on 10 March 2024, 51.74 million addresses held BTC, up from 44.93 million one year ago (+15.16%). Of those, 965,000 are active, giving Bitcoin an active address ratio of 1.88%. This is substantially higher than Ethereum’s which, despite 110 million addresses holding Ether (ETH), has 566,000 daily active addresses. Ethereum’s ratio of 0.56% indicates that users find BTC more useful for daily transactions. However, exploring this further reveals that Bitcoin hosts 455,820 transactions per day (7-day average) compared to Ethereum’s 1.19 million. We deduce that, despite fewer active users, those who use Ethereum transact more frequently than those who use Bitcoin. Perhaps this is indicative of utility, but price, transaction costs and other factors may contribute. In any event, both are among the top networks for DeFi transactions and empower users to transact in decentralised ecosystems.

It is important to briefly distinguish miners and nodes. A Bitcoin miner is a subset of a full node, but not all full nodes are mining nodes. A full node maintains a complete copy of the blockchain and validates blocks. Mining nodes perform these actions but also participate in mining.

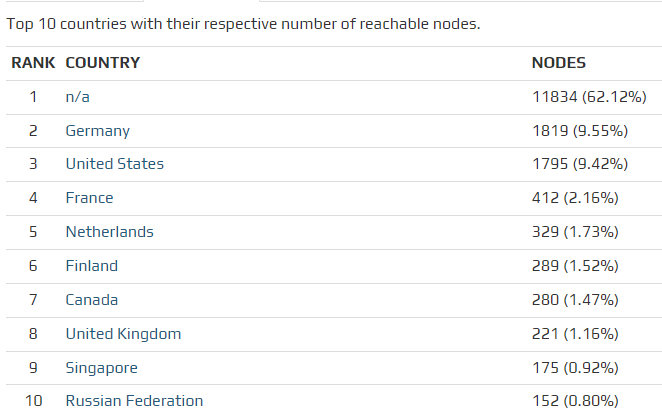

Active nodes (those currently reachable) are distributed globally, with Germany holding the largest single proportion. However, closer viewing reveals that a substantial number are consolidated in a small group. Hetzner Online GmbH hosts 5.49%, Contabo GmbH 2.60%…even Amazon hosts 1.34%. Are nodes susceptible to control by powerful, centralised entities?

Source: Bitnodes

Source: Bitnodes

Source: Bitnodes

Data on miners tells more. Global hash rate distribution shows that 53.82% of blocks are produced by just two mining pools: Foundry USA and Antpool. Since April 2023, these pools have mined 29.595% and 24.226% of all Bitcoin blocks, respectively. In the last ten days, Foundry USA mined 7,698 blocks (reward: US$2.9 billion), while Antpool mined 6,770 blocks (reward: US$2.6 billion). CryptoSlate provide a thorough review of each pool to reveal extreme centralisation, since a small number of interconnected companies control over half of Bitcoin’s network. To summarise, Foundry is owned by Digital Currency Group (DCG) – one of the most powerful venture capital firms in DeFi – whose portfolio includes some of the largest companies in the space (Blockchain.com, Chainalysis, Coinbase, Genesis, Grayscale, Kraken, Lightning Network and Ripple, to name a few). Founded in 2014, Antpool is one of the oldest mining pools in operation. It is owned by Bitmain, the world’s largest mining hardware manufacturer, so has been consistently supplied with premium mining technology.

Centralisation is a serious problem that severely undermines the utility of a decentralised network, but this issue is not localised to Bitcoin. Antpool has pools for Litecoin (LTC), ZCash (ZEC), Bitcoin Cash (BCH), Ethereum Classic (ETC) and Dash (DASH). Foundry offers enterprise staking support for Ethereum (ETH), Solana (SOL), Polkadot (DOT), Avalanche (AVAX) and Cosmos (ATOM). It is blatant that mining is becoming centralised to corporate behemoths: a significant risk for both investors and users. It is the antithesis of decentralisation.

Smart Contracts and dApps

As a Layer-1 blockchain, Bitcoin uses its own computing language. Script delivers instructions with each transaction to record how the next person wanting to spend bitcoins transferred to them can access them. The script for a transfer encumbers future spending of the transferred bitcoins with two things:

- The spender must provide a public key that, when hashed, yields the destination address embedded in the script; and

- A signature to prove ownership of the private key corresponding to the public key.

This logic deploys a lock-and-key system to execute smart contracts. The sender sets a condition for the transaction to be processed (the lock) and the recipient must provide a matching “key” to fulfil the condition.

Bitcoin smart contracts are limited and, per above, transaction validation and throughput is inefficient. However, Layer-2 blockchains built on Bitcoin allow developers to code more complicated contracts. For example, the Lightning Network facilitates fast and low-cost transactions by conducting most transactions off-chain and enables more complex smart contracts for micropayments, instant swaps and streaming payments. It is also home to Discreet Log Contracts (DLCs): contracts that allow two parties to engage in bets that use an oracle to verify real-life events, initiating immediate settlement.

Another chain, Stacks, enables developers to build smart contracts and decentralised applications (dApps) on Bitcoin. Developers can create a range of applications, from DeFi platforms to non-fungible tokens (NFTs). It facilitates a more expansive ecosystem while maintaining the security of Bitcoin as the base layer.

Roughly 100 dApps operate on Bitcoin, far lower than BNB Chain and Ethereum which each host over 4000. This matters for long-term utility: dApps imply greater economic productivity, since increased development should a) encourage more innovation, b) spawn more useful applications, and c) invite more users to the network. Lagging competitors is a weakness.

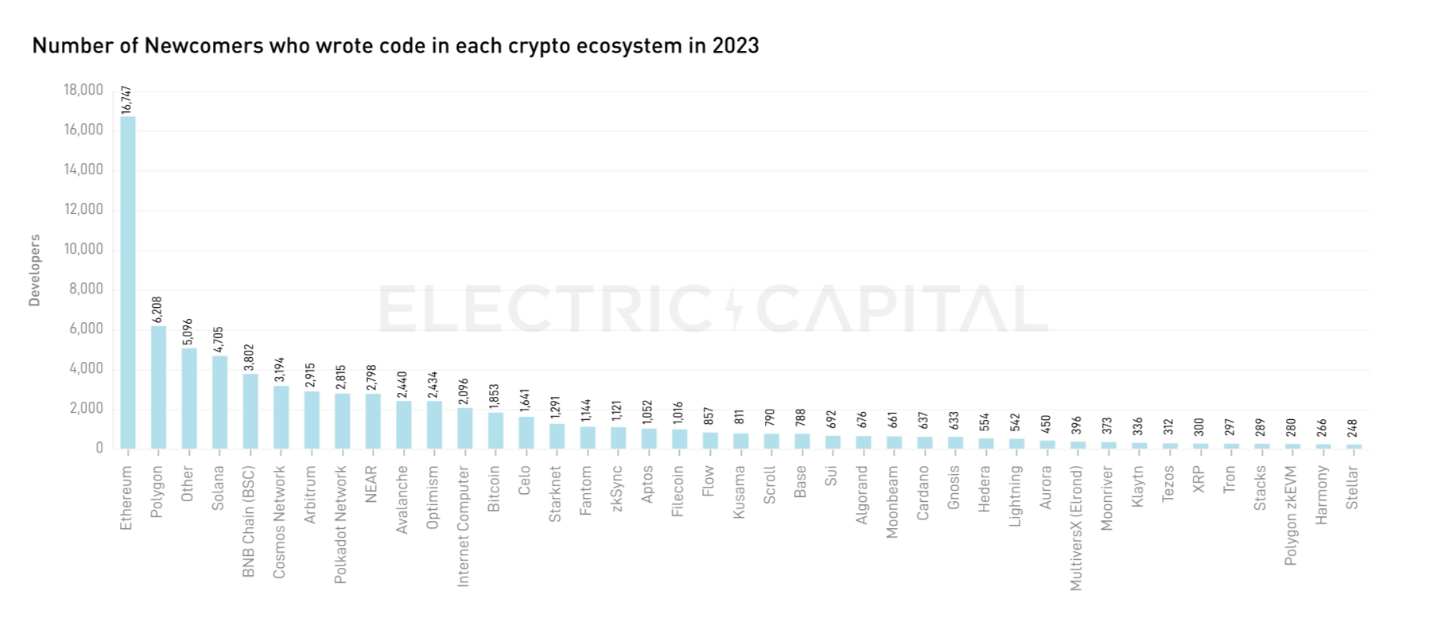

This is reflected in developer numbers. Electric Capital find that Bitcoin welcomed 1,853 new developers in 2023: substantially lower than several competitors and 9x fewer than Ethereum. That said, developers across Bitcoin and Ethereum account for 40% of all crypto developers and this has been consistent since 2015. 1,071 active developers support Bitcoin monthly and 40% are focused on scaling solutions. In all, Bitcoin continues to attract, and work is underway to improve efficiency. However, we may see Bitcoin start to lose some of its appeal and give way to more scalable and innovative solutions. Lower developer numbers, though not yet an issue, may impact Bitcoin’s utility long-term.

Source: Electric Capital

III. Comparison with Traditional Finance Alternatives

Cost-Benefit Analysis

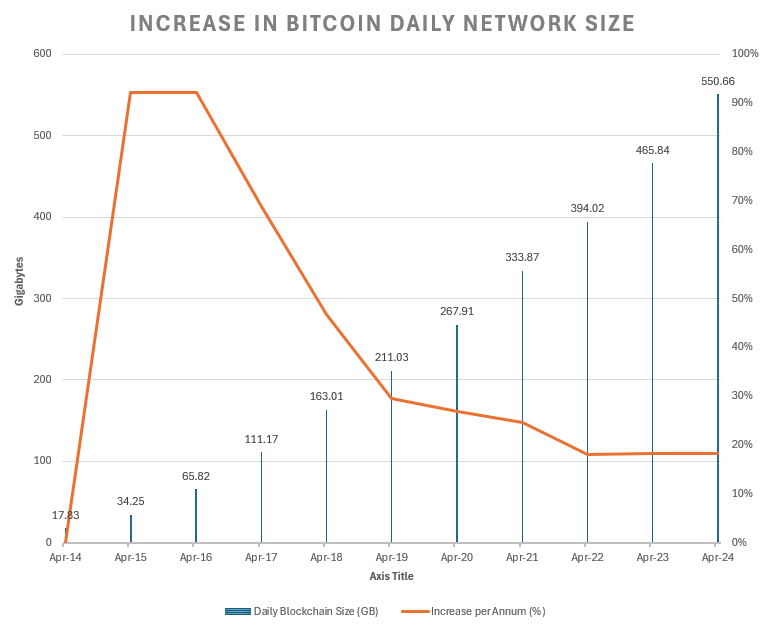

In the absence of cash flows, we require different strategies to estimate Bitcoin’s value. Network growth is one indicator: Metcalfe’s law states that the financial value of a network is proportional to the square of the number of connected users, growing exponentially with each new user. A 2018 paper showed a correlation above 80% between Bitcoin’s price and its network growth over the long-term; NYDIG found that the number of Bitcoin addresses squared explains 93.8% of the variation in Bitcoin’s market capitalisation. Bitcoin’s daily network size of 550GB with 965,000 active wallets per day indicates substantial value. It’s network of transactions is extremely large and over the last 10 years has grown 43.35% per annum on average, up from 17.83GB in April 2014. For comparison, Ethereum’s network amasses double that of Bitcoin – 1071.37GB daily – with 566,000 active users. Bitcoin serves nearly one million users globally per day, fulfilling its purpose as a permissionless network for transactions.

History suggests that an asset accrues value as the demand for it increases relative to the supply. Demand is a function of an asset’s ability to serve three roles of money: a store of value, a unit of account and a medium of exchange. Though gold has maintained status as a store of value, its divisibility is limited (e.g., £1) and expenditure has shifted digitally. Bitcoin is scarce, digital, durable, divisible, portable, transferable and protects against centralisation. A theme has emerged touting BTC as digital gold.

| Year | Daily Blockchain Size (GB) | Increase Per Annum (%) |

|---|---|---|

| Apr-14 | 17.83 | – |

| Apr-15 | 34.25 | 92.09% |

| Apr-16 | 65.82 | 92.18% |

| Apr-17 | 111.17 | 68.90% |

| Apr-18 | 163.01 | 46.63% |

| Apr-19 | 211.03 | 29.46% |

| Apr-20 | 267.91 | 26.95% |

| Apr-21 | 333.87 | 24.62% |

| Apr-22 | 394.02 | 18.02% |

| Apr-23 | 465.84 | 18.23% |

| Apr-24 | 550.66 | 18.21% |

Source: Statista

Gold supply grows roughly 1–2% per year, but Bitcoin goes further, setting a predetermined supply schedule which is insensitive to changes in demand (see Section I). All coins will be mined by 2140. If gold is comparable, the global value of which is estimated at US$15.8 trillion, price per Bitcoin could rise to US$790,000 when fully mined.

“As an amusing thought experiment, imagine that Bitcoin is successful and becomes the dominant payment system in use throughout the world. Then the total value of the currency should be equal to the total value of all the wealth in the world. Current estimates of total worldwide household wealth that I have found range from $100 trillion to $300 trillion. With 20 million coins, that gives each coin a value of about $10 million.”

Hal Finney, early Bitcoin contributor

A comparable market analysis lays out possibilities, but the chosen market will never truly align. Gold has had long-term historical utility as a tangible store of value and in daily use. Bitcoin is not accepted as currency in developed countries and cannot be physically materialised. In addition, challenging Finney’s statement, Bitcoin cannot handle the transactional throughput required to become the dominant global payment system. 5 TPS pales in comparison to VISA (1,600, though, theoretically, 24,000).

Stock-to-flow models are popular, measuring the rate of production against existing supply. A higher stock-to-flow ratio typically corresponds to a higher value and Bitcoin’s currently sits at 115,021. But this can be criticised, since a) it takes for granted that scarcity alone leads to higher valuations, and b) as block rewards move to zero, the model posits that BTC’s price will converge on infinity.

Bitcoin’s financial landscape does not offer a clear picture compared to centralised businesses and current valuation methodologies need refinement. However, rough assessments reveal value and investors are realising opportunities to profit from BTC, associated instruments and mining businesses.

Security and Trust

PoW and network longevity have their benefits. Bitcoin is the most secure network, corroborated by over 19,000 nodes to yield a high degree of decentralisation. Miners, who ensure transactions are verified and irreversible, support Bitcoin’s security, and rising hash rate levels increase network security. The following data is slightly skewed, noting that the halving is imminent, but miners have ramped up the hash rate from 350 million terahashes per second in April 2023 to 650 million.

In theory, an attacker controlling 51% of nodes could override decentralisation, but this is impractical as the number of nodes has proliferated. To control over half of a network’s power, an attacker would need hardware at costs running into the millions, and this does not consider electricity and maintenance. In addition, Bitcoin uses the SHA-256 hashing algorithm to encrypt data, meaning each block is coded into a 256-bit (78-digit) hexadecimal number that also contains the hash from the previous block. The algorithm operates one-way, so the input cannot be reverse engineered, and miners cannot submit fake solutions since other nodes can easily check the hash. Security is undoubtedly valuable for users of Bitcoin’s ledger.

Hacks and attacks have been frequent but have targeted exchanges (centralised businesses) rather than Bitcoin. In February 2014, after BTC exceeded US$1,000, security lapses at the exchange Mt. Gox led to the loss of 850,000 BTC: more than 6% of circulating supply at the time. This sparked a bear market, driving BTC below US$200 in January 2015 and it did not reclaim US$1,000 until 2017. Several other high-profile hacks exist. More recently, exchanges with a stronger focus on governance and security have emerged – Coinbase, Bitfinex and Huobi, for example – though in 2022 the FTX exchange collapsed due to fraudulent management and operational failures.

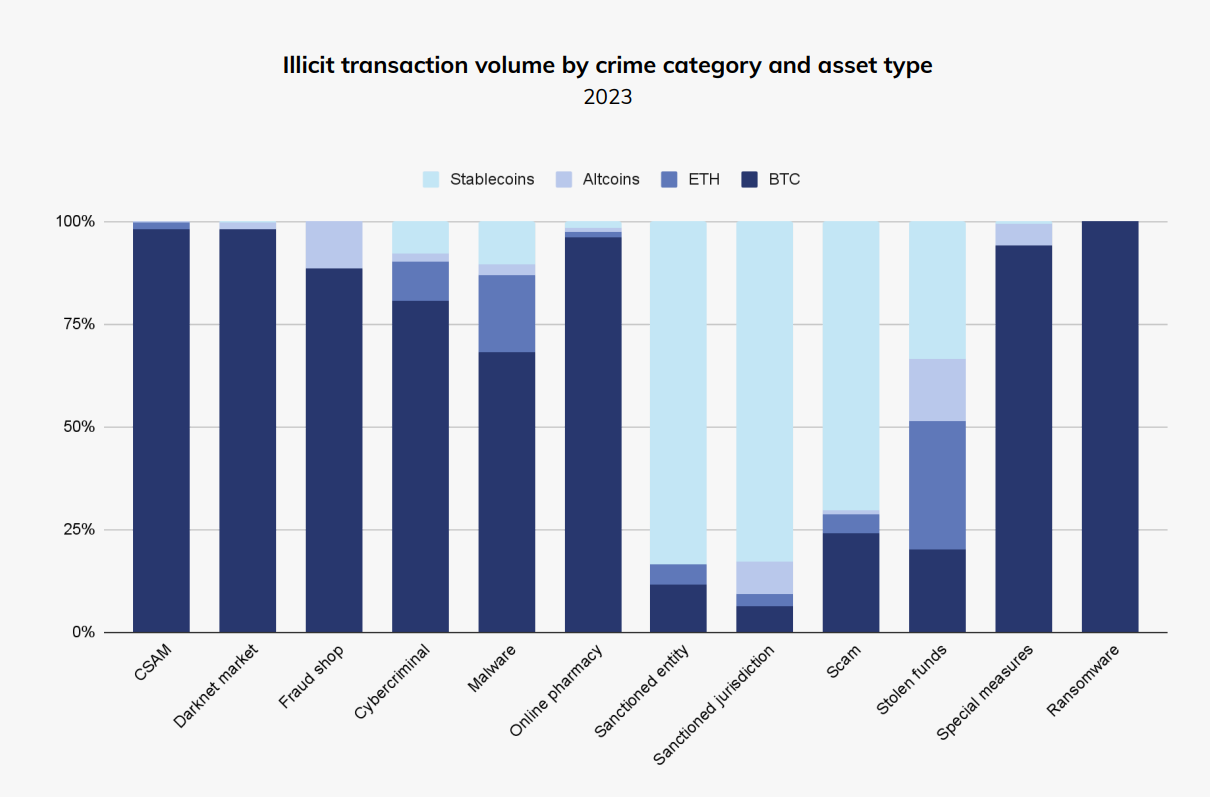

Attacks are not localised to BTC, with venues being drained of Ethereum, Solana and Tether also. In 2021, Bitcoin was the cryptoasset of choice among cybercriminals, but this has shifted and stablecoins now account for significant volumes of illicit transactions.

Attacks can be viewed in two ways. Firstly, the juvenile nature of start-up, centralised companies in DeFi is a clear short-term risk to investors. A hack on an exchange resulting in the loss of BTC could initiate a slump and hurt token holders. However, Bitcoin’s network security indicates excellent utility for validating transactions and storing an immutable, decentralised ledger of information. To date, there are no known events where BTC has been stolen by altering information on the blockchain. It satisfies the utility of a secure, immutable ledger.

Accessibility and Inclusivity

Bitcoin’s network achieves global reach and cannot censor transactions, nor can BTC be inflated by central banks. Decentralised consensus obviates the need for third parties and Bitcoin can settle high value transactions irreversibly within hours. Bitcoin also enables personal sovereignty; crucial in jurisdictions where property is exposed to seizure or hyperinflation. Resistant to inflation, easily and globally transferrable and highly divisible, BTC offers currency demonetisation and has been trialled in emerging markets. El Salvador adopted Bitcoin as legal tender in 2021 and 10% of Venezuelans (population: 30 million) use BTC to support value remittance and fight devaluation of the bolívar. Though not yet ready to support an entire economy, demand in emerging markets could increase as Bitcoin’s infrastructure evolves. Analysis by ARK Invest in 2020 suggested that if Bitcoin were to capture 5% of the global monetary base (outside of the US dollar, yen, yuan and euro), its market capitalisation could increase by US$1tn to roughly US$1.2tn. In hindsight, Bitcoin achieved this valuation without even coming close to 5% of the global monetary base.

Source: CoinMarketCap

IV. Future Utility

Roadmap and Development

On 10 January, 2024, the Securities and Exchange Commission (SEC) approved 11 new spot BTC exchange-traded funds (ETFs). These securities track the underlying spot price of BTC and provide an easy way for investors to gain exposure, making BTC accessible through common brokers rather than DeFi wallets.

US BTC ETFs have proved immensely popular in their early months of trading, bringing US$9.6bn in net fund flows and averaging 2.8% of total US ETF trading volume as of 13 March 2024. Approval is seen as a major milestone for Bitcoin, potentially unlocking mainstream investment and marking a shift in how regulators treat cryptoassets. Short-term, it has led to BTC appreciation through February and March, followed by signs of heavy profit taking which has induced short-term volatility. Long-term, however, ETFs could support stable value appreciation as markets adjust to Bitcoin’s integration though efficient vehicles. Institutional investors can easily invest in BTC without necessary custody measures; 401(k) and pensions can diversify into alternative assets; indices can integrate BTC with traditional securities; and we could see further cryptoasset ETFs approved, all of which should improve demand. Note though, for now, the SEC has rejected calls for ETH ETFs.

The halving will reduce mining rewards, slowing the rate of new BTC. Scarcity is likely to drive Bitcoin’s price, especially in a market that’s increasingly sensitive to supply dynamics. But Bitcoin still faces significant scalability challenges. Protocol limits maintained by its community prevent Bitcoin from handling more than seven transactions per second, averaging 5. Attempts to reduce fees and confirmation times have largely been conducted by third parties designing second-layer solutions, such as the Lightning Network, but siphoning transactions off the network reduces Bitcoin’s decentralisation and security. Without extensive and productive work on scalability, Bitcoin will retain a severe impediment to its utility.

Risks and Mitigations

Bitcoin is exposed to several risks that challenge its utility. Custody is different to traditional assets, since a key element of Bitcoin’s genesis related to ownership out of the reach of centralised authorities. Cryptography enforces this: the possession of digital private keys confirms ownership. But self-managed custody poses a risk. There is no way to reverse engineer, so the loss of one’s private keys locks a wallet forever. Though this is emblematic of Bitcoin’s utility as a secure network, it also degrades its utility as an easily accessible currency. Many will be familiar with the case of James Howells, who lost the drive on which his private BTC wallet was stored, or Stefan Thomas, who has two guesses left at his private key before it locks forever. Estimates suggest roughly 20% of total BTC supply is in dead wallets – US$245bn. Retail and institutional investors exposed to BTC must consider custody and insurance solutions, else mismanagement will cost millions.

Regulatory uncertainties pose a risk, potentially leading to legal challenges and restrictions. One of Bitcoin’s primary value propositions is the ability to exchange and store value outside of centralised control. Regulators are focused on how to regulate it but global accessibility means each jurisdiction can treat Bitcoin differently. Countries like Bolivia, China and Qatar have banned it; others, like Malta, El Salvador and Venezuela, have created national strategies to promote it. In the US, the Commodity Futures Trading Commission (CFTC) denotes Bitcoin a commodity that falls under its enforcement authority, whilst the SEC focuses on taxation, money laundering requirements and ownership policies applicable to Bitcoin and the cryptoasset market. The European Union is implementing its Markets in Crypto Assets regulation (MiCA), marking tailored rules to regulate cryptoassets and stablecoin services. The risk is not regulation itself; the collapse of FTX demonstrates that regulation is needed to protect users of DeFi services. Rather, over-regulation risks healthy innovation by stopping entrepreneurs mid-project, squandering economic resource. However, if implemented the right way, regulation can drive value for Bitcoin, encouraging developers, entrepreneurs and users to its ecosystem.

Institutional adoption also poses a risk. Specifically, Bitcoin users and investors could fall prey to the custody of assets by third parties, contrary to three of Bitcoin’s principles: inclusion, self-custody and decentralisation. If institutions are forced to custody BTC with third party services, a custodial “banking” layer could result in just a few trusted parties dominating transactions. In addition, as discussed in Section III, mining pools are consolidated, indicating centralisation of Bitcoin – counterintuitive to Bitcoin’s existence.

Bitcoin was created in the wake of the Global Financial Crisis with altruistic goals in mind. It’s full suite of principles cover:

- 21 million coins

- No censorship

- Open-Source

- Permissionless

- Pseudonymous

- Fungible

- Irreversible Transactions

However, those who do not see a use for Bitcoin have lambasted it for its volatility and likened it to the Dutch Tulip mania (1634-37). Bitcoin has not been helped by rogue agents that damage the credibility of its vision. Scandals such as the fall of FTX, the hack of Mt. Gox…even its initial use on Silk Road have led to Bitcoin being branded a tool for criminals. Though not a direct detriment to Bitcoin’s utility, scandals can a) impact the short-term price, hurting investors, and b) discourage users from the network. This may slow uptake or encourage more stringent regulation that suffocates innovation.

Relevance

Investors are searching for alternative ways to invest their money and Bitcoin’s uniqueness makes it popular. But one-of-a-kind innovation and rising popularity do not necessarily equate to value and mainstream media has consistently cast doubt on Bitcoin’s viability.

Many are sceptical given regulatory concerns, which remain a major impediment. The majority of exposure Bitcoin gets is usually in response to scandals, market drop-offs or comparisons with now defunct instruments. To encourage more users, Bitcoin must directly challenge these views. And, looking at scalability specifically, Bitcoin is weaker than competitors, partly due to being the original blockchain and partly due to fierce loyalty to PoW. There is a genuine risk that Bitcoin’s relevance will fade if it cannot upgrade its solution, which will do little to change the minds of those who doubt its validity.

Yet, what if Bitcoin’s primary value lies not in blockchain performance, but rather in being a game? Strip back all the talk of technological advancement and you are left with a speculative tool. A gamble.

Gaming is legitimate economic activity. Global sports betting accounted for US$83.65bn in 2022; the global video game market US$217bn. The market for Contracts for Difference (CFDs) (betting on the direction of an asset’s price) is expected to reach US$7.65bn by 2030. However, whereas casinos and financial markets are regulated, Bitcoin exposes users to zero-sum outcomes, bad actors and rigged rules without any protection. It is therefore easy, looking on from the outside, to determine that Bitcoin is a fool’s game.

But this view ignores the fact that many traditional financial assets trade in ways reminiscent of gambling; it is not unique to cryptoassets. Value is derived by players that play the game well, buying Bitcoin because they anticipate that others will also, driving up the price. Of course, to win, you need to sell right before there are more sellers than buyers and never let on that it is time to sell. And if you do hold on too long, the best play is to remain enthusiastic to convince others back in.

This description fits well, but our review suggests there are genuine technological fundamentals with Bitcoin. Even if it were all just a game, there is an opportunity cost associated with ignoring it as an asset. Though trickier to value, we suggest BTC deserves a small allocation in well diversified investment portfolios, offering a compelling risk-reward profile given its unrivalled growth over the last ten years. ETF approval also implies a shift in regulator mood and unlocks exposure for traditional portfolios, such as ISAs and 401(k), which should further its popularity.

This review has attempted to dissect Bitcoin’s utility, discussing its relevance as a store of value and its potential as a foundation for transparent finance. Bitcoin fits well to the description of both digital gold and a gamble, but we find that the protocol has genuinely unlocked global value transfer, immutability, transparency and security, and laid the groundwork for subsequent decentralised projects. Though it faces a fight to retain relevance, we believe Bitcoin currently offers significant value to investors.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Readers are encouraged to conduct their own research and seek professional advice before making investment decisions.

References

Atzei, N., Bartoletti, M., and Cimoli, T. (2017). A survey of attacks on Ethereum smart contracts. The Post.

Bartosz, B. (2023). 51% Attack: The Concept, Risks & Prevention. Available at: Hacken (Accessed: 13 April 2024).

Chainalysis. (2024). The 2024 Crypto Crime Report. Available at: Chainalysis (Accessed: 10 February 2024).

Chaturvedi, V. (2024). The big Bitcoin ‘halving’ event is almost here. We’ve got answers to all your questions. Available at: Quartz (Accessed: 15 April 2024).

Davis, K. (2024). How Spot Bitcooin ETFs are Performing Across Exchanges. Available at: Cboe (Accessed: 20 April 2024).

de Vries, A. (2024). Bitcoin’s growing water footprint. Cell Reports Sustainability, 1.

Dewey, J. N. & Patel, S. (2024). Blockchain & Cryptocurrency Laws and Regulations 2024 | USA. Available at: Global Legal Insights (Accessed: 18 April 2024).

Elmandjra, Y. (2020). Bitcoin As An Investment: Part 2. Available at: Ark Invest (Accessed: 13 April 2024).

Ferrer, E. (2024). Venezuela’s Crypto Rebirth: Interview With Enrique De Los Reyes. Available at: Forbes (Accessed: 16 April 2024).

Grand View Research. (2022). Video Game Market Size, Share & Trends Analysis Report By Device (Console, Mobile, Computer), By Type (Online, Offline), By Region (Asia Pacific, North America, Europe), And Segment Forecasts, 2023 – 2030. Available at: GVR (Accessed: 22 April 2024).

The Investopedia Team. (2024). What is Bitcoin? How to Mine, Buy, and Use It. Available at: Investopedia (Accessed: 13 April 2024).

Kaur, G. (2024). Bitcoin nodes vs. miners: Key differences explained. Available at: Cointelegraph (Accessed: 17 April 2024).

Nevil, S. (2024). What Are the Safest Ways to Store Bitcoin? Available at: Investopedia (Accessed: 16 April 2024).

Pan, D. (2024). Bitcoin ‘halving’ will cost crypto miners $10 billion a year in lost revenue and ‘could well determine who comes out ahead and who gets left behind’. Available at: Fortune (Accessed: 14 April 2024).

Peterson, T. (2017). Metcalfe’s Law as a Model for Bitcoin’s Value. Alternative Investment Analyst Review, 7(2), 9-18.

Radmilac, A. (2023). The centralisation of Bitcoin: Behind the two mining polls controlling 51% of the global hash rate. Available at: CryptoSlate (Accessed: 18 April 2024).

Roy, S. (2022). ETFs With The Highest & Lowest Trading Spreads. Available at: Yahoo!Finance (Accessed: 13 April 2024).

Shen, M. (2024). 2023 Crypto Developer Report. Available at: Electric Capital (Accessed: 06 April 2024).

Simone, N. (2023). The Unbreakable Link. Available at: Medium (Accessed: 13 April 2024).

Tidy, J. (2024). As banks buy up bitcoins, who else are the ‘Bitcoin whales’?. Available at: BBC News (Accessed: 04 March 2024).

VanEck. (2024). 3 Reasons Advisors Should Consider Bitcoin. Available at: VanEck (Accessed: 13 April 2024).

Wade, J., & Adams, M. (2024). Spot Bitcoin ETFs: What Are They, And How Do They Work? Available at: Forbes (Accessed: 16 April 2024).

Xu, D., Gao, J., Zhu, L., Gao, F., & Zhao, J. (2023). Statistical and clustering analysis of attributes of Bitcoin backbone nodes. PLOS One, 18(11).

Zenipulsar. (2023). BNB Chain (BNB): The World’s Top Blockchain by the Number of DApps. Available at: LinkedIn (Accessed: 20 April 2024).

Leave a comment