Cardano

Grade: C

Summary

Cardano was launched in 2017 by Ethereum co-founder Charles Hoskinson. Established to address shortcomings of existing blockchains, Cardano emphasises research-driven development and is recognised its scientific rigor.

The platform is designed to facilitate a more inclusive and sustainable global financial system. It uses a Proof-of-Stake consensus, called Ouroboros, which aims to be efficient and secure. Cardano also has a treasury system that allows the community to propose and vote on protocol upgrades, fostering a more decentralised governance model.

Cardano invests in Africa and the Middle East to encourage blockchain adoption. However, it is let down significantly by failure to generate substantial fees, likely caused by low adoption rates. Rigorous scientific testing has made a safer and technologically advanced network, but also caused slower delivery and Cardano has fallen behind several competitors. Our analysis suggests Cardano’s long-term value proposition is weaker than its peers.

| Pillar | Grade |

|---|---|

| Financial Prospects of the Network | D |

| Network and Usage | B |

| Comparison with Traditional Finance Alternatives | A |

| Future Utility | C |

| Weighted Grade | C |

I. Financial Prospects of the Network

Tokenomics

The purpose of Cardano’s native currency, ADA, is a) to send and receive payments, b) for staking, and c) to pay transaction fees. ADA holders can act as validators, earning rewards and contributing to consensus by pledging their token stake. As with other cryptoassets, ADA can also be an investment.

The top 100 wallets hold roughly 19% of all tokens in circulation and 52.17% are held in wallets of size 1mm-100mm ADA: a dollar value of US$510,000-51,000,000. Though this falls outside the ballpark of retail ownership, ADA distribution is reasonably decentralised. The majority of addresses – 2.36mm – hold 1-100 ADA (below US$51 at current price) and 20.1% hold less than US$50,000. Though this cannot be confirmed as retail, wallets of this size are unlikely to be institutional. We conclude that ownership is more decentralised than other cryptoassets analysed.

Revenue Streams

Cardano is a Layer-1 network that deploys a Proof-of-Stake (PoS) consensus model, placing it among a highly competitive peer group including Ethereum, Solana, Avalanche and BNB Chain. Its minimum transaction fee is US$0.074 and averages US$0.17, making it far more affordable than Ethereum. Users can also prioritise transactions by paying extra fees to validators.

Validator nodes are commonly called Stake Pools and are run by Stake Pool Operators (SPO). To be a validator you must run a server and register it by depositing 500 ADA: a far lower barrier to entry than Ethereum (32ETH). Cardano directly incentivises validator participation with fees and rewards. At launch, ADA had an expected annual inflation rate of 7% and released rewards every five days. Currently, rewards stand at 3% of staked value, bringing more supply into circulation at every five-day epoch.

Fees reveal how much users are willing to pay to interact with the chain and we can compare competitors to estimate value generation. Fees are also important for network sustainability since they provide economic security as the issuance of new tokens diminishes. Cardano generated US$317,210 over the last 30 days, annualised at US$3.86 million. This pales in comparison to competitors.

| Network | Fees (L30D, USD) | Fees (annualised, USD), 30d% Change |

|---|---|---|

| Avalanche | $2.26m | $27.46m (+5.3%) |

| BNB Chain | $24.68m | $300m (+31.6%) |

| Cardano | $317k | $3.86m (-13.1%) |

| Ethereum | $276m | $3.36bn (-12.6%) |

| Solana | $62.57m | $761.3m (+220.4%) |

| Tron | $126.7m | $1.54bn (-3.4%) |

Date: 25 April 2024

Source: token terminal

Low fees indicate a significantly smaller user base than competitors, with reduced activity. This is explored in Section II, but immediately suggests that Cardano currently offers lower value to users. Hammering this home is a 13.1% month-on-month decrease. Meanwhile, competitors are growing.

Financial Metrics

78.47% of all ADA tokens are in circulation: 35,310,891,231 of the maximum 45bn. Noting a current price of US$0.51 per ADA, Cardano’s market capitalisation is US$18,016,530,839, making it the 10th most valuable blockchain. Total Value Locked (TVL) in decentralised finance (DeFi) applications on Cardano stands at US$334.51 million: 19th largest. Compared to Ethereum (US$53.227 billion) and Solana (US$3.989 billion), two of its closest competitors, Cardano is weak. Fewer users and fewer funds indicate less recognised utility than Ethereum’s and Solana’s technology.

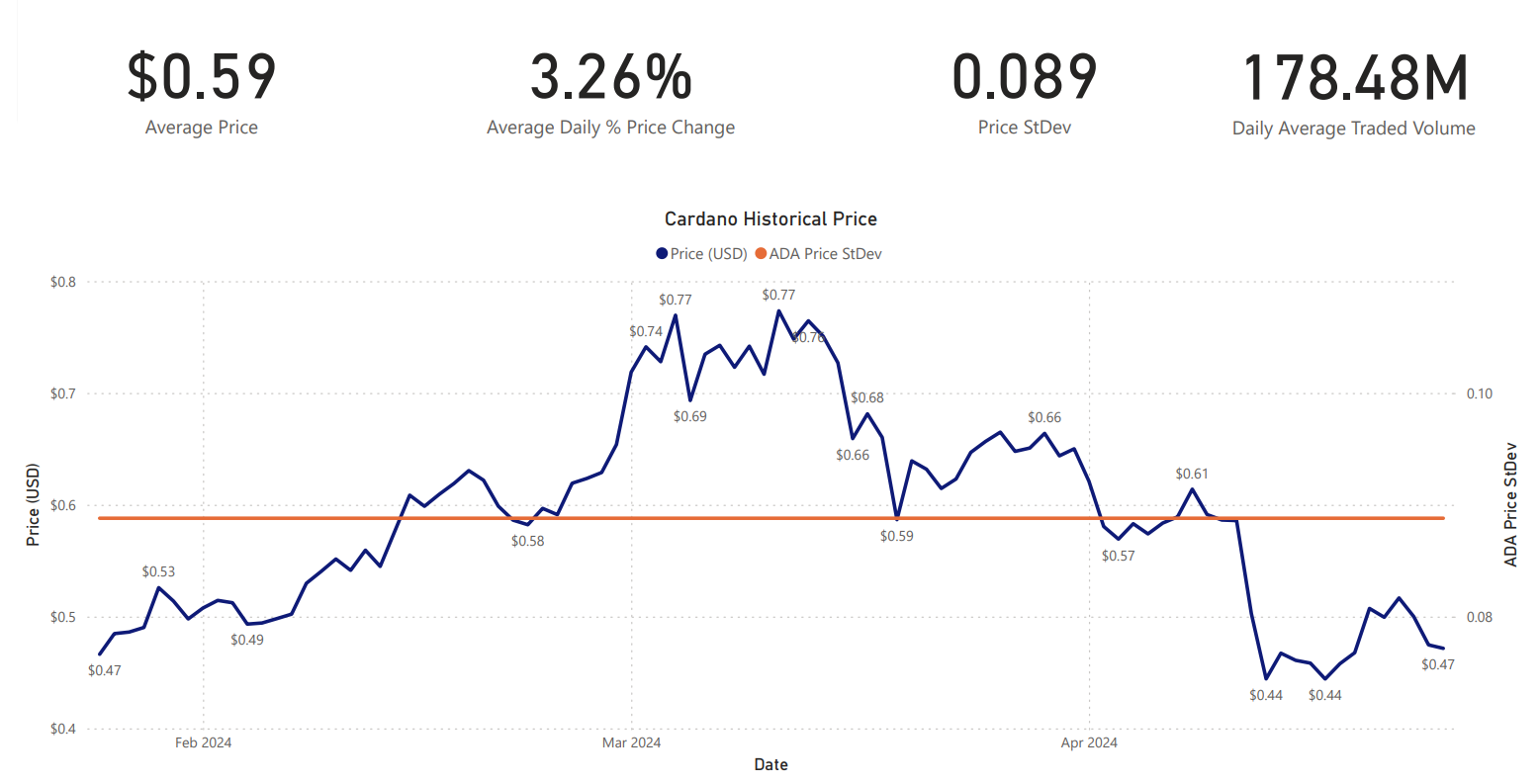

The chart below tracks ADA’s price, traded volume and volatility across the last 90 days. Price has been less volatile than other cryptoassets, with an average daily change of 3.26% and standard deviation of 0.089. The average daily volume traded of 178.48 million tokens is high and ADA is one of the most actively traded cryptoassets. The average value traded (price * volume) exceeds US$100m per day – US$105,303,200 – though note this is just 8% of the value traded daily in Ethereum.

Date: 25 April 2024

Source: Investing.com

II. Network and Usage

Network Metrics

Cardano aims to tackle the scaling problems of earlier blockchain projects. Bitcoin and Ethereum both show poor efficiency, meaning fees increase dramatically when transaction volumes increase. Cardano implements its algorithm Ouroboros to solve this.

Ouroboros uses a PoS consensus to reduce energy costs and enable faster transaction processing. Instead of storing a full copy of data on each node, the algorithm nominates lead nodes – slot leaders – who are responsible for validating transactions and subsequently sending them to the network. A stakeholder’s chance of being selected depends on how much ADA they have staked and Ouroboros also uses a verifiable random function (VRF) to make slot leaders unpredictable, improving security by defending against forks and attacks.

Has Ouroboros successfully achieved its purpose?

- Real-time TPS: 80

- Maximum recorded TPS: 386

- Theoretical maximum TPS: 1000

- Block sizes: 1MB

- Block time: 20 seconds

Cardano mints new blocks every 20s, slower than Ethereum (12s), with a typical transaction size of 300 bytes. Maximum block size of 1MB is relatively small; Bitcoin, for example, doubles this. However, Cardano can process many more transactions per second than either Bitcoin or Ethereum, achieving an aspect of scalability it set out to tackle. This is attractive, offering utility to users who want to record many transactions of small size.

Cardano’s two-tiered architecture is designed to process many transactions per second:

- Cardano Settlement Layer (CSL): manages ADA transfers and retains the ledger of balances, with transactions validated by Ouroboros.

- Cardano Computational Layer (CCL): the layer in which smart contracts operate to run applications on the blockchain.

Increasing Cardano’s transaction processing limit requires Input Endorsers which make use of the empty space between block creation. The process is too technical for this analysis but summarised neatly here. At a high-level, Input Endorsers enable users to pre-validate and pre-build blocks before they reach consensus, making the system faster since validation and creation can happen in parallel, while blocks are still chained in sequential order.

However, despite achieving faster transaction processing speeds than Bitcoin and Ethereum, Cardano is slower than other competitors, such as Solana and Algorand. This presents a conundrum. With a smaller market capitalisation and lacking first mover advantage, Cardano must differentiate itself. Tackling scalability was a tactic, but Cardano has been exceeded. So where does it offer value?

User Adoption

Cardano has nearly 6000 relay nodes which contribute to decentralisation. Increasing the number of nodes increases security of the network, as a more users participate in decision-making. Stakers are globally represented but highly concentrated in the USA (1,800) and Germany (1,400). Beyond this, pool operators use select cloud operators to run their nodes, and Amazon (21%), DigitalOcean (11%), Hetzner (8%) and Google (6%) are key to Cardano’s infrastructure. This is a risk: if a provider terminated their service, Cardano’s network would be temporarily compromised as a sizeable percentage of validators would be cut off. It also increases centralisation as the network is overly dependent on a few infrastructure providers. However, Cardano is not alone: Bitcoin and Ethereum both centralise hosting providers, to a greater extent. The number of nodes exceeds many competitors – we conclude Cardano is one of the most decentralised blockchains.

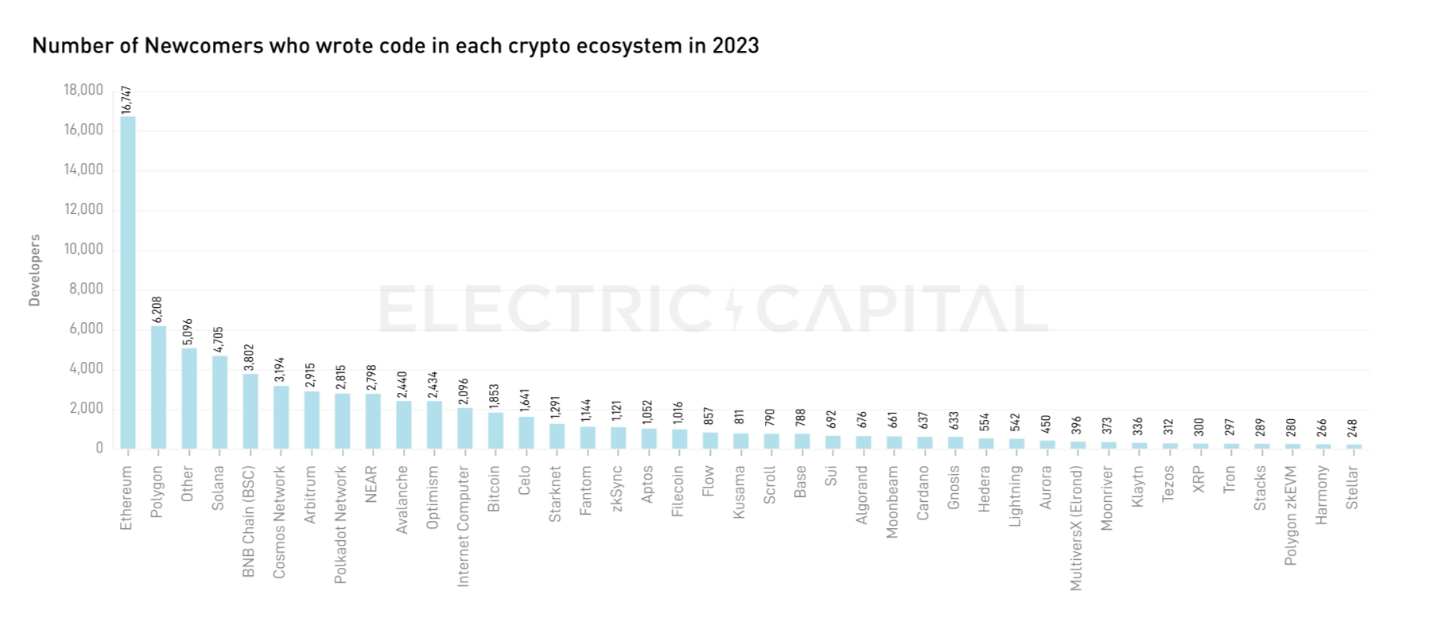

Developers are indicative of network utility. Developers are encouraged to work on blockchain infrastructure, with many ecosystems urging open-source participation and publishing code online. But open-source developers do not appear attracted to Cardano. Electric Capital’s 2023 Crypto Developer Report identified that 47,876 newcomers contributed to the crypto ecosystem across 2023, but only 637 (1.33%) worked on Cardano. This places it 27th of 41 networks surveyed and Cardano attracted just 3.80% and 13.54% of the number of newcomers that Ethereum and Solana did, respectively.

Source: Electric Capital

Source: Electric Capital

Interestingly, developers working on Cardano do not work on other chains. This is unusual; developers on Ethereum, Polygon, Arbitrum and Optimism also contribute to several other projects. Developers are a leading indicator of value creation, building decentralised applications (dApps) that deliver value to users. Cardano appears isolated, which suggests it may offer lower utility to developers and lower value to users. Currently, Cardano is not used prolifically for smart contracts, DeFi or transactions, more resembling a circular economy of staking. Unless more practical use cases are realised, Cardano will struggle to keep pace with competition.

This is highlighted by the number of wallets using Cardano daily. As of 15 April 2024, 39,560 active wallets use Cardano, a 30.03% decrease since 15 April 2023 (56,580). This is far fewer than the number of active wallets using Ethereum (605,260, +5.91% y/y) and Tron (2.2 million, -1.35% y/y) and is decreasing. In addition, the data highlights that Layer-2 solutions attract more developers than Cardano. Polygon, a Layer-2 solution on Ethereum, attracted 6,208 developers in 2023. Optimism, also compatible with Ethereum, attracted 2,434. These chains oversee 2,120 and 10,930 active wallets daily. Though not level with Cardano, greater development on Layer-2s combined with reduced daily activity on Cardano pose a risk that Cardano could be overlooked.

Smart Contracts and dApps

Cardano’s main programming language, Haskell, is a functional language that helps developers write more secure smart contracts. But Cardano also has its own smart contract language called Plutus. It is based on Haskell and lets developers write both on-chain and off-chain code.

And Cardano has a Layer-2 scalability solution. Hydra allows developers to run scripts and perform complex transactions off-chain while maintaining security and functionality. Replicating the security of Cardano creates an efficient solution for scaling DeFi protocols – for example, dApps optimised for micropayments, subscription-based content or in-app purchases – without increasing traffic or fees on the parent chain. Hydra is customisable, so developers can run ‘Hydra Heads’ tailored to their dApps’ requirements. A decentralised exchange can operate independently of another on a distinct Hydra Head, for example. For more information on how this works, see this review by CoinBureau.

The advent of CCL confirms Cardano is designed for smart contract execution. The layer can support self-executing agreements without oversight, so any user can input a condition which, when met, will be automatically executed. Smart contracts support dApps, ultimately contributing to Cardano’s goal of serving traditional finance (TradFi) users in a more inclusive, decentralised manner.

Cardano’s ecosystem currently has more than 1,315 projects on its platform, with 155 launched. Some key dApps include:

- NMKR: Enables the minting and trading of non-fungible tokens (NFTs).

- Minswap Labs: A decentralised exchange.

- Maestro: Supports dApp development and assists businesses with integrating products with Cardano.

- zkFold: Uses zero-knowledge smart contracts to make Cardano transactions faster.

- Indigo Labs: Allows users to create fully collateralised synthetic assets.

- Iagon: A cloud storage provider offering privacy, security and operational sovereignty for consumers over their data.

- Djed Stablecoin: Cardano’s first native stablecoin, pegged to the US dollar.

All offer utility to users. Djed, for example, is an exciting development since stablecoins improve transaction security by reducing price volatility.

III. Comparison with Traditional Finance Alternatives

Cost-Benefit Analysis

Cardano is made up of four entities, each with a distinct role:

- Cardano Foundation: A Swiss non-profit that works with governments, regulatory bodies and enterprises to support usage.

- IOHK (Input Output Hong Kong): An engineering company dedicated to peer-to-peer technologies and contracted to design, build and maintain the platform.

- EMURGO: Formed to integrate, develop and support businesses that want to use Cardano.

- Input Output Global: A US-based technology company that engineers blockchain structures.

Cardano differs from other blockchains because it is based on scientific research and peer review, rather than copying the principles of preceding networks. IOHK is primarily the research arm, collaborating with academics to identify optimal development. All specifications are openly published, and rigorous peer review reinforces the roadmap by reducing live experimentation and ensuring releases are thorough.

This is distinct from many crypto projects. We do not highlight any specifically, but a huge number have failed, fallen foul of hacks or turned out to be rug pulls/Ponzis. Cardano is different. Scientific and financial minds stringently theorise and test methods to handle funds and create a safe ecosystem. Though this increases time to deployment, it provides utility to users since they should be able to trust the ecosystem more so than other networks.

Security and Trust

Cardano is extremely secure, specifically developing its Extended Unspent Transaction Outputs (eUTXO) model. The model makes it easy to check the steps a transaction needs to be successful. Given a validator has a predictable number of inputs and can only produce a set number of outputs, one can follow a validator’s logic to approve the desirable or suggest a correction. Smart contracts can be easily mapped, so transactions are deterministic (in other networks, transactions are usually non-deterministic, so outcomes cannot be exactly predicted, and uncertain states are always possible).

Secondly, Cardano treats all assets as native. Essentially, NFTs or tokens can be transferred as easily as ADA.

Cardano is extremely resistant to hacks. However, when two blockchains are made interoperable, vulnerabilities can appear at the point of interconnection. In 2022, Cardano users were affected by a hack on the Nomad bridge.

Bridges connect two or more blockchains, making it possible to use tokens of one on another by locking them in a smart contract on Chain A and reissuing them “wrapped” on Chain B. For example, a smart contract can lock 100 ETH on in Ethereum, then issue 100 wrapped ETH on Cardano. On Ethereum, the ETH are still locked but wrapped ETH can be used freely on Cardano.

Nomad facilitated this for users across Avalanche, Ethereum and, indirectly, Cardano. A hacker attacked a smart contract on the Nomad bridge and drained almost all locked tokens, meaning the wrapped tokens had no backing. The total loss was almost US$200 million.

The bug was not on Cardano, but the ecosystem was hurt. Bridges are a weak point of decentralisation but necessary for interoperability. Once Cardano connects to another network, neither the development team nor participants have full control. However, native stablecoin tokens offer more security in interoperability and this is a key reason for excitement around Djed. It offers utility by securely supporting token interoperability.

Accessibility and Inclusivity

Cardano is governed by a non-profit organisation in Switzerland called the Cardano Foundation. It launched its network in 2017 after raising US$62.24 million in an Initial Coin Offering (ICO). However, a for-profit entity, EMURGO, works to develop projects that interact with Cardano.

EMURGO has a venture capital and investment arm – EMURGO Ventures – which made over 60 investments in 2023 into blockchain projects building on Cardano. A significant number focused on DeFi: investment into NMKR aims to drive real-world asset tokenisation; partnership with Cactus Custody looks to provide regulated, institutional-grade custody solutions for native assets; and collaboration with Bitkub, Thailand’s number one crypto exchange, wants to raise awareness of Cardano in Thailand through community-building and educational initiatives. In addition, EMURGO Ventures hosted a blockchain hackathon, with a US$2mm funding prize pot. Over 100 submissions proposed work on derivatives, aggregators and zero-knowledge projects.

A branch of the entity, EMURGO MEA, is focused on adoption of Web3 technology in the Middle East and Africa, investing in startups. They made a strategic investment in Fig Finance, for example, which allows any B2B business to automate lending to trusted SME customers. EMURGO MEA also backed Fonbnk to support payments through SIM cards and invested US$250,000 into Changeblock, which allows companies to offset carbon excesses by trading carbon credits.

Source: The Global Findex Database 2021

Source: World Bank Group, 2019

It could be an astute move. Just 35 percent of people aged 15+ in 28 countries in Sub-Saharan Africa had formal bank accounts in 2021. Additionally, there are high barriers to lending for small and medium-sized entities (SMEs). Providing the infrastructure to serve the unbanked and facilitate financial inclusion in Africa could be extremely profitable and allow Cardano to sidestep traditional finance players that have so far been unable to provide requisite functionality. It could also swell Cardano’s user base and adoption.

Accessibility and inclusivity are areas of strength. Cardano, through various means, provides value to businesses operating in DeFi. Being a trusted partner of even a handful of successful projects could pay dividends.

IV. Future Utility

Roadmap and Development

Cardano sets out several upgrades, each named after a scientific figure. The Byron, Shelley and Goguen upgrades have been applied. Goguen has enabled users from both technical and non-technical backgrounds to create and execute functional smart contracts on the network. Encouraging non-technical users is important as financial workers with no previous technical knowledge can create smart contracts, supporting the integration of Cardano with TradFi enterprises. Plutus, a smart contract development language and execution platform, and Marlowe, a domain-specific language for financial contracts, are key to this. Marlowe comes with Marlowe Playground, an application-building platform for non-programmers to simplify smart contract creation. Reducing the need for programming skills offers value as it is more user-friendly, which should also support utility as a more diverse set of users are encouraged to contribute.

The current upgrade – Basho – is underway and focused on meeting the demands of an increasing number of users, turning from decentralisation to scalability. A key development is the introduction of sidechains which can a) take work away from the main chain to increase network capacity, and b) be used for experimentation without affecting the security of Cardano. Hydra, the Layer-2 chain, was introduced during Basho. The intention is to build infrastructure that can scale sustainably with new functions and dApps that do not risk network operation.

Lastly, Cardano has planned Voltaire: the final stage of its roadmap. Voltaire will introduce a voting and treasury system, so network participants can use their stake to influence future development. This would achieve a truly decentralised set up, with network maintenance and improvement handled by all users. The treasury system will retain a fraction of transaction fees to fund developments approved in voting. Voltaire intends to move away from the management of IOHK to full decentralisation, with the community driving Cardano.

Risks and Mitigations

A key risk is maintaining relevance. How does Cardano keep up and catch up with more established competitors? Compared to Solana and Ethereum, it has a weak market capitalisation. This does not necessarily mean it is not useful. But consider Avalanche and Tron (two Layer-1 networks using PoS): both have smaller market capitalisations than Cardano, however, attract far more in fees, far more TVL and generally oversee more activity. Cardano appears to lag, perhaps symptomatic of the deliberate and methodical approach to development. Though trying to create a better version of blockchain is valiant, competitors have capitalised with earlier deployment to engage more developers. This is a critical risk to Cardano’s long-term utility; as discussed in Section II, less developer activity means fewer dApps under development and likely less value creation.

Regulatory uncertainties pose a significant risk to all cryptoassets since they could manifest as legal challenges and restrictions. Cardano has found itself under the scrutiny of the Securities and Exchanges Commission (SEC) which, when initiating legal action against cryptocurrency exchanges Binance and Coinbase, listed ADA as an unregistered security. The legal precedent for classifying cryptoassets as securities is still evolving but, if deemed a security, Cardano would be subject to a raft of new legislation and could even be subject to retrospective action if in violation of securities laws.

If confirmed as a security, investors could face price volatility, be hit with taxes or see investment opportunities restricted. In addition, Cardano could be delisted from certain exchanges, reducing liquidity.

Lastly, the rise of Layer-2 blockchains is shifting users away from lower-cost Layer-1s like Cardano. Not to the extent that they have become redundant but, given Ethereum (Layer-1) supports Layer-2 protocols that are already gaining more traction than Cardano (Polygon and Optimism, for example), the project must work urgently to find its niche or else be left behind.

Relevance

Cardano launched with the goal of improving on the functionality Ethereum initially lacked. The team’s research-driven strategy distinguishes it from other projects, perhaps aligning it with Algorand which has also taken deliberate efforts to balance security, decentralisation and scalability. This method is calculated to oversee a more robust and scalable platform.

Cardano initially flourished, with hype over the founding team and methodology leading to it being labelled an “Ethereum Killer”. ADA reached an all-time high of US$2.96 in March 2021, but has since fallen and failed to breach US$1 since 17 April 2022. Many investors holding ADA prior to this date will likely be in the red, so we ought to consider Cardano’s challenge to Ethereum.

Both deploy a PoS consensus, but Ethereum is more efficient with higher transactional throughput. Cardano had the advantage of developing after Ethereum, learning from Ethereum’s initial mistakes (such as Proof-of-Work deployment), and positioning itself as uniquely efficient. But Ethereum’s Merge in 2022 has enabled it to achieve slightly better efficiency and the advent of Layer-2 blockchain solutions on Ethereum has likely contributed to Cardano’s struggles to gain significant levels of adoption. Ethereum does lag Cardano’s accessible fee schedule but, with other networks also offering much lower fees than Ethereum, this is not a significant catalyst for adoption.

The Cardano project has focused on technologically advanced infrastructure, programming languages and multi-chain solutions, with a promising and ambitious roadmap. However, our analysis suggests Cardano’s methodical approach has hindered uptake. Technological advancement in DeFi is extremely rapid and other projects have clearly captured investment, developers and dApps at Cardano’s expense. The platform is working on scalability solutions, like Hydra, which should enhance transaction speed and throughput, but currently does not do enough to distinguish itself. It does not offer enough value to draw users away from other networks or encourage first-time users to its platform.

Unless investment into the Middle East and Africa can encourage a significant increase in adoption, Cardano may be found wanting.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Readers are encouraged to conduct their own research and seek professional advice before making investment decisions.

References

Arthur, V. (2024). Cardano vs Solana (2024): Is Cardano or Solana better? Available at: CoinWire (Accessed: 21 April 2024).

Cardaniansio. (2023). What is the future of Cardano scalability? Available at: CeExplorer (Accessed: 27 April 2024).

Cardaniansio. (2023). Cardano network infrastructure. Available at: CeExplorer (Accessed: 27 April 2024).

CryptoEQ Fundamentals Team. (2023). Cardano CORE Report (Abridged). Available at: CryptoEQ (Accessed: 21 April 2024).

Emurgo. (2024). 6 Cardano Projects to Keep an Eye on in 2024. Available at: LinkedIn (Accessed: 27 April 2024).

Gilani, K. (2024). Is Cardano a Security and Why Should It Matter to Investors? Available at: AMBCrypto (Accessed: 27 April 2024).

Jawaid, J. (2023). Cardano Review 2024: Updates You Don’t Want to Miss! Available at: CoinBureau (Accessed: 21 April 2024).

Kofa, D. (2023). Proof-of-Stake on Ethereum and Cardano: Running a Validator Node. Available at: Lido Nation (Accessed: 27 April 2024).

Kondo, M., & Valerie, N. M. (2024). EMURGO Africa 2023 Annual Report: EMURGO Africa’s 2023 Key Contributions in Carbon Offset Trade, Lending, and Crypto On/Off Ramping. Available at: EMURGO Africa (Accessed: 28 April 2024).

Lewandowski, M. (2024). Cardano’s Price Volatility Suggests Mixed Sentiment in the Market. Available at: Bit Perfect Solutions (Accessed: 25 April 2024).

Macchiavelli, L. (2023). Cardano’s Input Endorsers: An Explainer. Available at: Cardano Spot (Accessed: 27 April 2024).

McGimpsey, P. (2024). Cardano Price Prediction: Will The Wildcard Prevail? Available at: Forbes (Accessed: 27 April 2024).

Miller, F. (2024). Cardano Roadmap: What Next for ADA? Available at: DailyCoin (Accessed: 28 April 2024).

Shen, M. (2024). 2023 Crypto Developer Report. Available at: Electric Capital (Accessed: 06 April 2024).

Tsouros, E. (2024). Unlocking Financial Inclusion: Banking the Unbanked in Africa. Available at: Cambridge Management Consulting (Accessed: 28 April 2024).

Vermaak, W. (2022). A Deep Dive Into Cardano [Updated]. Available at: CoinMarketCap (Accessed: 25 April 2024).

Leave a comment