Ethereum

Grade: A

Summary

Ethereum, a Layer-1 blockchain launched in 2015, focuses on programmability and decentralised computing. Unlike its predecessor, Bitcoin, Ethereum was specifically designed as a versatile platform beyond simple peer-to-peer transactions. The impetus for its creation was to establish a decentralised infrastructure for smart contracts: self-executing agreements coded with predefined conditions. By introducing its own scripting language, Ethereum enables developers to build an array of decentralised applications (dApps), distinguishing it as a comprehensive blockchain offering trust, security and transparency to users.

Financial prospects and network usage typically go hand-in-hand and Ethereum performs extremely well financially, reaping the benefits of broad adoption. It leads all networks on revenues, total value locked and developer activity. There is a question around how regulation in the US may impact its prospects, whilst Ethereum must also be wary of competitors deploying faster and more efficient protocols. However, our analysis suggests that Ethereum is currently the most valuable blockchain.

| Pillar | Grade |

|---|---|

| Financial Prospects of the Network | A |

| Network and Usage | A |

| Comparison with Traditional Finance Alternatives | A |

| Future Utility | A |

| Weighted Grade | A |

I. Financial Prospects of the Network

Tokenomics

Ethereum, inherently, is a platform providing a secure environment for digital commerce. Participants engage in trading, transfers, app development, art exchange, gaming and more. Software sets the structure and rules, whilst computers that run Ethereum are called validators. Validators ensure the rules are followed and maintain a ledger of all economic activity within the ecosystem. Software is hosted by validators world-wide, creating a decentralised ecosystem that allows users to trade globally.

Validators are randomly selected to propose a block of transactions and are rewarded for their work. Newly minted Ether (ETH), Ethereum’s native token, is issued in small amounts and validators also receive fees remitted by users of Ethereum. If you or I wanted to trade with counterparties, we must pay fees. Equally, to perform work, validators must post ETH as collateral against their honesty and, if they cheat, the ETH is seized. Since ETH is used to pay validators, who sell ETH to cover costs, demand is married with supply and this equilibrium obviates the need for centralised control.

This mechanism also creates value. To do anything on Ethereum, a user must use ETH, making it a commodity. To make Ethereum most effective, ETH must be used by many, otherwise large holders could gain outsized power. Ethereum claims to be decentralised but, at the time of writing, the richest six wallets hold 38.11% of all ETH, extending to 51.32% concentrated in the top 105. This is slightly below the average of all blockchains analysed (54.92%) but, notably, over half of tokens are held by a small subset of users. This may expose investors to unpredictable swings in price and liquidity and reduces decentralisation.

Many blockchains limit the maximum supply of tokens to combat inflation, but Ethereum deploys a different mechanism. There is no maximum supply of ETH so, theoretically, it could be minted forever. However, Ethereum applies deflationary pressure through its EIP-1559 upgrade. Launched in August 2021, EIP-1559 adapted Ethereum’s economics by changing how transaction fees are calculated. Using ETH to pay fees removes ETH from the supply by burning a base fee which can adjust up to 12.5%, depending on demand. To date, over 4.3m ETH has been burned – US$14,630,364,160 at the time of writing. As Ethereum becomes more active, burning will apply deflationary pressure, so holders share in an increasingly valuable network as supply declines.

Revenue Streams

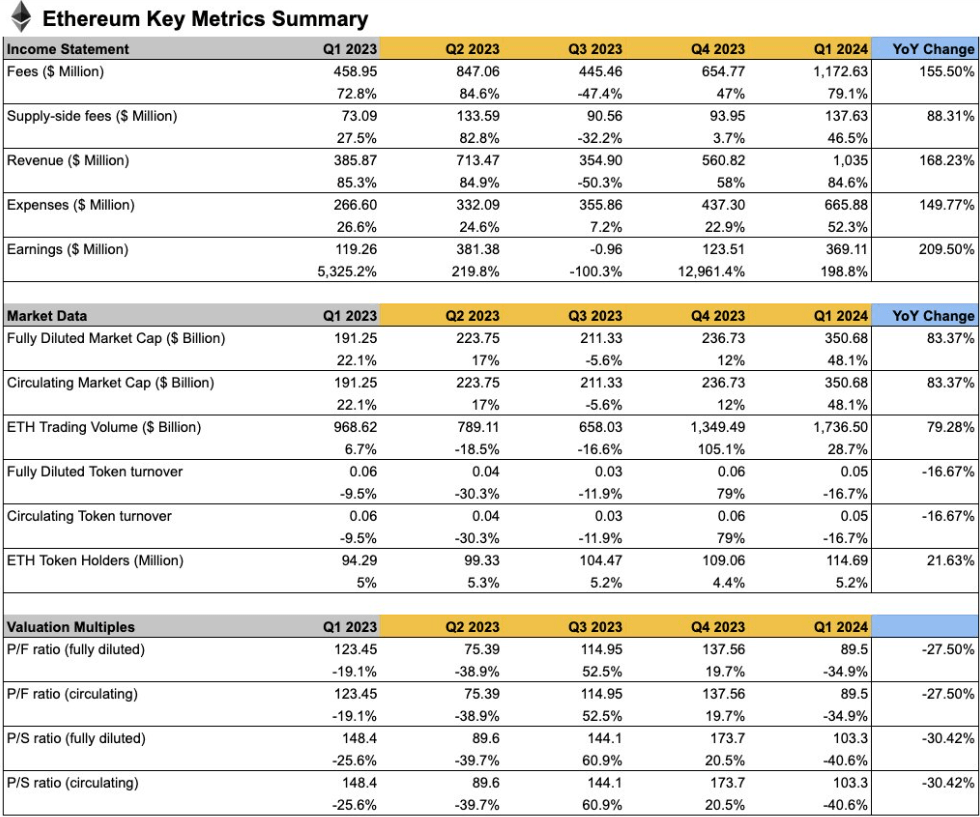

Ethereum’s financial landscape, though not as clear cut as that of centralised businesses, presents opportunities. Coin98 Analytics recently published data showing that Ethereum’s earnings tripled in Q1 2024, reaching US$369mm. This represents a 210% increase year-on-year, up from US$119mm in 2023. Fees increased 79%, with US$1.2bn from transaction fees in Q1 2024, and total revenues reached US$1bn in Q1 2024, a 186% increase on US$385mm in Q1 2023. Annualised revenues stand at US$4.50bn.

Date: 07 April 2024

Source: Coin98 Analytics

The price of ETH surged in February 2024 in tandem with a wider market bull run. However, the catch with Ethereum is, as price and popularity rise, so do fees. Some users reported paying fees over US$100 in ETH at peak times and averaged US$79 per transaction.

Fees are relative to the demand for, and intensity of, computation. Users pay both the costs of hosting Ethereum and the costs of computational validation. Given Ethereum coordinates services between suppliers and consumers, the higher the demand for participating, the higher the fees and amount of ETH removed from circulation.

Also termed gas, fees contribute significantly to Ethereum’s revenue. Gas is a derivative of ETH designed to mitigate malicious attacks on the network and efficiently allocate computational resources, since transactions require users to pay ETH and validators to post ETH. Transactions must have some cost to perform, otherwise malicious participants could manipulate the network for free.

Transaction fees = Gas Units Used * Price per Gas Unit

Users pay different amounts of gas depending on the type of transactions they execute. More complex transactions require more gas. During 2020-21, Ethereum’s fees soared as it struggled to cope with demand, particularly as more complex tasks, such as minting non-fungible tokens (NFTs), became commonplace. Average price for one unit of gas reached 709.71 gwei (1 gwei = 1 billionth of an ETH) on 11 June 2020, 538.01 gwei on 17 September 2020 and hovered between 100-200 gwei throughout 2021.

As of 4 April 2024, Ethereum’s gas price stands at 32 gwei. Fees remain far higher on Ethereum than other networks, weakening its utility.

Financial Metrics

With 120,070,288 ETH in circulation, Ethereum has a market capitalisation of US$422,327,035,509. Ethereum is regarded highly as the second largest cryptocurrency and remains the primary currency for decentralised finance (DeFi). Total Value Locked (TVL) in DeFi applications on Ethereum stands at US$50bn outsizing all other networks (Solana, for example, has US$4.74bn staked: 4th highest). Reports suggest between 25-37% of circulating ETH is locked in smart contracts, meaning one third of users are holding ETH rather than selling or engaging on exchanges. This is positive for Ethereum, as widespread voluntary support indicates growing use of its technology beyond currency speculation.

Given a market capitalisation of US$422bn and annualised revenues of US$4.50bn, Ethereum’s price-to-sales ratio is 93.7, meaning the fair value of ETH is currently 94 times higher than the economic value captured by the network. This seems high but is relatively conservative compared to other networks: Solana sits at 155x and Algorand at 2,000x.

The chart below tracks Ether’s price, volume and volatility across the last 90 days. The price has been volatile – a standard deviation of 561 – but trending upwards, in line with the market upturn of late February. Note that the average daily volume traded at 469,000 ETH is lower than most blockchains in the top 20. However, this is attributable to price of ETH. The average daily value traded (price * volume) is extremely large at US$1,411,690,000.

Date: 08 April 2024

Source: Investing.com

II. Network and Usage

Network Metrics

At any given time, network participants agree on the exact number and history of blocks in a chain and bundle current transactions into the next block. Blocks, therefore, are batches of transactions linked to the previous block, made possible by cryptographically deriving hashes from the previous block’s data. A key question for Ethereum is how efficient this process can be:

- Real-time TPS: 13

- Maximum recorded TPS: 62

- Theoretical maximum TPS: 119

- Block sizes: 1-2MB

- Block time: 12 seconds

Ethereum’s transactions per second statistics lag other networks, such as Solana and Avalanche. Block times and sizes are also less efficient, reflecting Ethereum’s historical prioritisation of decentralisation and security rather than scalability. As discussed in Section I, Ethereum faces scalability challenges, causing congestion and increased gas which, ultimately, may degrade user experience. To tackle scalability issues, Ethereum completed The Merge: a huge upgrade in 2022 which shifted consensus protocol from Proof-of-Work (PoW) to Proof-of-Stake (PoS). PoS achieves consensus through the following mechanism:

- Validating nodes stake 32 ETH as collateral. This helps protect the network because dishonest activity leads to some, or all, of that stake being destroyed (slashing).

- In every slot (spaced twelve seconds apart) a validator is randomly selected to propose the block. Validators bundle transactions together, execute them, wrap this data into a block and distribute it to other validators.

- Other validators who receive the new block re-execute the transactions to ensure they agree with the proposed changes. Assuming the block is valid, they add it to their own database.

- If a validator hears about two conflicting blocks for the same slot, they use their fork-choice algorithm to pick the one supported by the most staked ETH.

The Merge redeployed Ethereum on a more sustainable, efficient and scalable path, reducing costs by approximately 90% and achieving a markedly more efficient consensus model that consumes 99.95% less energy. It is also the foundation for scalability upgrades in future. There is little doubt PoS offers substantially more utility than Ethereum’s former mechanism.

User Adoption

VanEck – an investment firm that recently launched a bitcoin Exchange-traded Fund (ETF) – applies Metcalfe’s law when valuing blockchain networks, suggesting that a network is theoretically more valuable if each user is able to interact with a growing number of users. Ethereum boasts a massive user base, with over 110 million addresses holding ETH and 566,000 active. This gives Ethereum an active address ratio of 0.56% – substantially lower than Bitcoin. Though half as many wallets hold bitcoin (BTC), 965,000 are active, suggesting BTC currently has more utility as a means of transaction. However, in Q1 of 2024, Ethereum recorded over 107 million transactions and onboarded over 9 million new wallet addresses: a vast increase in adoption. The transition to Ethereum 2.0 through the Merge also introduced staking, allowing token holders to secure the network and a substantial amount of ETH is now locked. But beyond this, the large user base suggests recognition of value. Ethereum provides utility as a place for developers, entrepreneurs, buyers and sellers to operate, convene and transact.

By example, Curve, Sushiswap and Aave launched on Polygon – a layer-2 chain that runs alongside Ethereum – between April and May 2021. Derivative networks like Polygon’s PoS Sidechain provide a scalable foundation for a growing number of users that were, in turn, contributing economics back to Ethereum (the parent chain). Today, over 750 applications operate on Ethereum, 322 of which hold over US$1m in TVL. By Metcalfe’s Law, we can determine that the active user base of scaling networks contribute significant value back to Ethereum.

Smart Contracts and dApps

Solidity is a programming language created by developers from the Ethereum Foundation. For developers, Solidity became the language for crafting dApps and its integration with Ethereum contributed to prolific growth in both the platform and the language itself. It serves as another contributing factor to Ethereum’s dominance and its utility as a blockchain network.

Ethereum is a Turing-complete system, meaning a machine that can handle any task, of any complexity, provided it has the time, memory and correct instructions. Ethereum can theoretically handle any program and is, inherently, a playground for developers to build dApps based on smart contracts in a decentralised and permissionless manner. dApps, such as NFT marketplaces (OpenSea, NFTrade, LooksRare and Gem) and DeFi platforms, have proliferated in Ethereum’s ecosystem.

DeFi is attractive because of its goal to remove financial intermediaries and central authorities, and Ethereum is the leading environment for DeFi experimentation. Consider dApps like MakerDao, a financial system for decentralised, collateralised loans; money market protocols like Compound, lending tools like Aave, decentralised exchanges like Uniswap, yield aggregators like Yearn and derivative products like dYdX. Ethereum is the foundation for these projects – providing critical utility.

The ecosystem is characterised by a diverse dApp universe spanning various industries. However, collaboration with traditional finance (TradFi) entities are limited and Ethereum faces competition from blockchains offering more tailored solutions to traditional market participants. Partnerships between DeFi and traditional banks capitalise on the advantages of both models, increasing customer reach, facilitating knowledge sharing and promising safer and more regulated services. For example, the Marshall Islands have adopted Algorand to power its national digital currency; Franklin Templeton’s OnChain U.S. Government Money Fund (FOBXX) maintains records of share ownership using the Stellar blockchain; and bitcoin has been purchased by El Salvador as a treasury asset. Such use cases may not all be powerful or enduring, but they are direct, strategic implementations of decentralised technology with traditional business models; something to consider when assessing long-term utility. Ethereum has formed the Enterprise Ethereum Alliance alongside Accenture, EY, J.P. Morgan, Microsoft and Santander, which promote the ecosystem for business use. But Ethereum is less focused on TradFi collaborations, turning instead to decentralised projects.

III. Comparison with Traditional Finance Alternatives

Cost-Benefit Analysis

With reference back to its size and user base, Ethereum holds a pivotal position in DeFi and is poised for growth. Layer-2 networks are progressively driving demand for blockspace, fuelling both the price and liquidity of ETH. Rather than diverting users, these layers contribute to Ethereum’s network and enhance revenue generation. This is mainly due to Layer-2 networks using ETH to pay for blockspace, so fees accrued translate into demand for Ethereum.

Smart contracts built on Ethereum streamline processes by executing predefined actions when certain conditions are met. These self-executing contracts eliminate intermediaries, reducing costs and ensuring transparency and security. The intention is to provide efficient and cost-effective cross-border transactions ahead of other TradFi and DeFi platforms.

The trickier element to this, though, is how reliable services are. Ethereum cannot protect users of Layer-2 products from financial loss, for example. Whereas in TradFi, in which regulated products are usually protected by compensation schemes, assets on Ethereum’s network remain outside the scope of regulation. In addition, staking introduces potential risks as governance decisions may favour major stakeholders, potentially compromising decentralisation.

Ethereum’s prospects are robust, driven by smart contract deployment and active development. But it is important to remain vigilant to navigate the uncertainties and risks posed by projects on its ecosystem.

Security and Trust

The growth of DeFi on Ethereum has led to concerns about systemic risks, smart contract vulnerabilities and regulatory crackdowns. Since smart contracts handle assets of considerable value, besides their correct execution it is also crucial that their implementation is secure against attacks.

The largest hack on Ethereum was The DAO Attack. The DAO (decentralised autonomous organisation) was a contract for global crowdfunding and raised US$150 million before an attack in June 2016. This drained US$60 million of ETH and led to a coordinated hard fork: the most controversial change Ethereum has implemented. The fork took money back from the hacker (not all) by rewriting Ethereum’s ledger, but this challenged the immutability inherent to blockchain technology. Fears that such a fork could become a precedent introduced flavours of centralisation to a purportedly decentralised environment.

Hacks of crypto projects and exchanges are common. But Ethereum shifted focus to security following The DAO attack. Ethereum itself expresses recognition that improvements can still be made to the protocol, listing view-merge, distributed validator technology and secret leader election as solutions. This is a double-edged sword – an absence of enhanced security but a recognition and plan to implement it – but, by and large, Ethereum does prioritise security. This was a factor in PoS implementation and Ethereum’s requirement for validator staking.

Accessibility and Inclusivity

Ethereum’s open nature allows anyone with an internet connection to participate in its ecosystem, democratising access to financial tools. For validators, the shift from energy-intensive PoW to PoS has opened the door in regions with prohibitive electricity costs (business electricity rates, March 2023: US$455/MWh in Germany, US$207/MWh in Finland, US$437/MWh in the United Kingdom; US$84/MWh in Russia, US$63/MWh in Kazakhstan and US$87/MWh in China).

However, this has led to geographical consolidation of node placement: of the 11,000 globally, 33% reside in the in US, 18% in Germany and 4% in the UK. In addition, reports suggest 65% of nodes are housed in centralised data centres. Of this, Amazon Web Services (AWS) host 52.1%, Hetzner Online GmbH host 16.9% and OVH SAS host 4.1%. Oracle Cloud, Alibaba and Google Cloud also host 4.1%, 3.9% and 3.5% of nodes, respectively. This can expose Ethereum to central points of failure and raises a risk if dominant centralised web providers can manipulate Ethereum.

Separately, the Ethereum Foundation Fellowship Program is an initiative to address gaps in representation across cultures and class. It is estimated that 60.25% of the world’s population own mobile phones and, of the 1.7 billion unbanked, 1.1 billion have phones. Other estimates suggest that as much as 35% of total economic activity in developing markets happens in the “informal economy”; equal to trillions of dollars operating outside formal financial services. DeFi is well positioned to be the technology that enables the unbanked to access previously unavailable services, displacing TradFi in the process.

Ethereum, as market leader, is in pole position to capture this value and the Foundation’s work aligns with this. Ethereum contributes to financial inclusion by providing methods of exchange – for NFTs, currency and person-to-person transfers – to unbanked populations. Ethereum also attracts a diverse community of developers. 16,747 new developers wrote code for Ethereum in 2023, outstripping other networks by at least 2.7x (Polygon, in second, attracted 6,208). In addition, 71% of new contract code is initially deployed on Ethereum, meaning it disproportionately captures innovation in blockchain development (BNB Chain is second with 19.1%). In total, 40% of global developers work on Ethereum or Bitcoin. It is the most attractive network to work on.

But, as previously presented, high use contributes to congestion and high fees. This restricts inclusion efforts, limiting access in economically disadvantaged regions, and Ethereum’s main challenge to adoption stems directly from scalability problems. Blockchains conceived after Ethereum have focused on high-transaction-throughput and scalability, for example, Algorand and Solana. Ethereum, meanwhile, is working through several upgrades to scale the network without compromising decentralisation or security, but this is a complicated workstream that has progressed slower than anticipated and failed to alleviate expensive transaction fees. If Ethereum cannot find a solution quickly, it risks users migrating to more efficient platforms.

IV. Future Utility

Roadmap and Development

Ethereum is a market leader and observed closely. It is one of the longest serving networks, launching in 2015, and has proved mightily ambitious, delivering on an extensive roadmap that continues to look forward. As discussed in Section II, it is also the foundation for several subsequent blockchain projects.

But, for all Ethereum’s success, it has shortcomings. Notably, the network suffers from slow transaction speeds and high fees during times of congestion. If Ethereum achieved mainstream adoption in its current state, it would likely be prohibitively slow and expensive which could impact its market dominance in the long-term.

Ethereum’s future hinges on successfully addressing scalability to accommodate more users at peak times while still performing well. Tackling scalability introduces the blockchain trilemma: the concept that a blockchain can only optimise two of three key elements (decentralisation, scalability and security). Ethereum has focused on decentralisation and security, but its roadmap now pursues an optimal balance of all three.

| Scalability | Security |

|---|---|

| Danksharding: plan to make transactions much cheaper and faster by enabling the network to process bundled transactions from layer-2 without having to store the data permanently. Single-Slot Finality (SSF): an Ethereum block currently takes 15 minutes to finalise, but SSF aims to make validation more efficient, allowing proposition and finality in the same slot. Verkle Trees: a data structure that introduces nodes who need only a small amount of storage space to verify new blocks. | Proposer-Builder Separation (PBS): splits block-building and proposal among different validators. Block builders create blocks and present them to a block proposer, who can choose the most profitable block without seeing the contents. The proposer also pays a fee to the block builder before sending the block onwards. This prevents transaction censorship, establishes fairer consensus and facilitates the Danksharding upgrade. |

Of course, the risk remains that rival blockchains could chip away at Ethereum’s market share as its roadmap is implemented. Solana and Cardano, for example, focus heavily on scalability and have learned from Ethereum’s life cycle.

Risks and Mitigations

Regulatory uncertainties pose a risk to all blockchain projects, threatening legal challenges and restrictions on operations. The Securities and Exchange Commission (SEC) insists that many cryptocurrencies are unregistered securities and, as such, are not covered under investor protection schemes. However, the SEC has recently focused directly on Ethereum, requesting information from companies about dealings with the Foundation. The inquiry may determine that ETH falls under the purview of the SEC due to features of the software (PoS may resemble investment contracts) and the directive of the Foundation. If ETH is confirmed a security, Ethereum would be hit with compliance and investor protection rules alongside more stringent requirements on how ETH is bought and sold.

Despite reticence to classify cryptoassets as securities, the SEC recently approved BTC spot ETFs, enabling investors to trade BTC like a share. Investors expecting similar treatment of the second largest cryptocurrency will be disappointed. As of April 2024, ETH ETFs have not been approved by the SEC. With the regulator investigating Ethereum’s classification, the waiting game is likely to go on.

Relevance

We are just beginning to scratch the surface of how to appropriately value native assets of blockchains. But reviewing utility is a useful method to keep informed of the appropriate technologies to support. Perhaps the element which speaks most highly to Ethereum’s utility is its basis as a platform for Layer-2 and its endurance throughout the proliferation of other projects.

Ethereum’s foundational principles seek to address the limitations of earlier models and the real innovation is its ability to act as a global, immutable ledger; not just for transactions but also for a spectrum of dApps. With more than a third of ETH locked, support for Ethereum’s technology suggests widespread recognition of utility. Though Ethereum faces agile challengers focusing on scalability, Ethereum continues to innovate and holds promise that its roadmap can deliver a secure, scalable and decentralised ecosystem.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Readers are encouraged to conduct their own research and seek professional advice before making investment decisions.

The author has held a stake in Ether since 2020.

References

Atzei, N., Bartoletti, M., and Cimoli, T. (2017). A survey of attacks on Ethereum smart contracts. The Post.

Bruell, L., Smalley, C., & Fields, R. (2023). Network Analysis Series Part 1: Examining the Ethereum Network — Introduction. Available at: Medium (Accessed: 07 April 2024).

Chainalysis. (2023). The 2023 Geography of Cryptocurrency Report. Available at: Chainalysis (Accessed: 03 March 2024).

Deka, C. (2024). Ethereum’s Q1 2024 Revenue Soars to $1.2 Billion, Marking 155% YoY Increase. Available at: CryptoPotato (Accessed: 07 April 2024).

Harland, L. (2023). On Ethereum’s Valuation. Available at: RxR Research (Accessed: 04 March 2024).

Huffman, E., & Ullman, S. (2024). Ethereum Gas Fees. Available at: Milk Road (Accessed: 06 April 2024).

International Monetary Fund. Five Things to Know about the Informal Economy. (2021). Available at: IMF (Accessed: 06 April 2024).

IntoTheBlock. Holdings Distribution. Available at: IntoTheBlock (Accessed: 07 April 2024).

Lindrea, B. (2022). 3 cloud providers accounting for over two-thirds of Ethereum nodes: Data. Available at: Cointelegraph (Accessed: 07 April 2024).

Morris, D. Z. (2023). CoinDesk Turns 10: 2016 – How The DAO Hack Changed Ethereum and Crypto. Available at: CoinDesk (Accessed: 06 April 2024).

Motepalli, S., and Jacobsen, H. (2023). Analyzing Geospatial Distribution in Blockchains. Department of Electrical and Computer Engineering.

Neumüller, A. (2023). Ethereum’s climate impact: a contemporary and historical perspective. Cambridge Centre for Alternative Finance.

Ngetich, D. (2024). Over 37% Of All ETH Is Locked In Smart Contracts: Will Ethereum Prices Roar Above $4,000? Available at: 99Bitcoins (Accessed: 06 April 2024).

Partz, H. (2024). Ethereum earnings tripled in Q1 2024, reaching $370M. Available at: CoinDesk (Accessed: 07 April 2024).

Roy, G. (2024). What Is the Ethereum Roadmap: Upgrades in 2024 and Beyond. Available at: Ledger Academy (Accessed: 07 April 2024).

Shen, M. (2024). 2023 Crypto Developer Report. Available at: Electric Capital (Accessed: 06 April 2024).

Sigel, M. (2023). A Potential Valuation Methodology for Ethereum. Available at: VanEck (Accessed: 10 February 2024).

Tan, G., Versprille, A., & Kharif, O. (2024). Ethereum Foundation Gets SEC Scrutiny in Latest Crypto Crackdown. Available at: Bloomberg (Accessed: 20 March 2024).

Turner, A. (2024). NUMBER OF MOBILE PHONE & SMARTPHONE USERS. Available at: bankmycell (Accessed: 06 April 2024).

Leave a comment