Filecoin

Grade: D

Summary

Filecoin, introduced by Protocol Labs in 2020, is a decentralised network and global marketplace for file storage and retrieval. It seeks to address the challenges of traditional cloud storage systems by distributing data across nodes using blockchain technology.

The approach promises a more cost-effective and resilient alternative to traditional cloud systems. The primary goal is to allow users to securely buy and sell unused storage space, outside of the purview of a centralised entity, evoking an open and censorship-resistant system.

Filecoin holds a niche as the leading decentralised storage provider. Recent technical developments prime it to support economic activity, promising greater utility than just archival storage. However, we observe a downtrend through 2024 in the number of miners, number of deals and quantity of storage space in its ecosystem. Filecoin faces a huge task to capture market share from centralised behemoths and, in its current state, does not offer enough utility to do so.

| Pillar | Grade |

|---|---|

| Financial Prospects of the Network | D |

| Network and Usage | C |

| Comparison with Traditional Finance Alternatives | D |

| Future Utility | D |

| Weighted Grade | D |

I. Financial Prospects of the Network

Tokenomics

Each blockchain has a native currency that supports transactions and governance. Filecoin’s – FIL – is paid by users for storage services. The infrastructure carries data anywhere, as global providers are incentivised to contribute storage with rewards of FIL. Additionally, storage providers must pledge FIL as collateral, economically tying them into providing secure solutions.

At the time, Filecoin’s Initial Coin Offering (ICO) in 2017 was one the largest token sales in history, raising US$257mm. US$186mm was raised within the first hour! However, the ICO was only open to accredited investors so, though 30% of all possible FIL was disbursed at the genesis block, 15% went to the development team to support project growth and 10% went to investors. The other 5% was reserved for the Filecoin Foundation.

Distribution remains lopsided. The top 100 largest wallets own 79.10% of all FIL in circulation, degrading network decentralisation. Alarmingly, 69.04% of tokens are held by the top 10 users and this has not changed materially over the last year (71.15% in July 2023). Consolidation of tokens consolidates participation rights, ultimately damaging Filecoin’s utility, as large holders have greater ability to afford or supply storage space and exert greater control. It also increases risk for small investors as FIL is susceptible to unpredictable price moves if a large holder trades.

To dispel the remaining 70%, Filecoin releases 330 million tokens on a 6-year half-life, so 97% of all FIL will be distributed within 30 years. Releases reward miners for current block production, though 300 million will be held in reserve to incentivise mining beyond the final distribution. Rewards undergo a vesting schedule to encourage long-term support: 75% of rewards vest linearly over 180 days and 25% are immediately available to improve miner cash flow.

Filecoin’s protocol mediates inflation. Every transaction incurs a fee, part of which is ‘burned’ to permanently remove it from supply. Indirectly, burning makes existing tokens more valuable, since burn rate increases with platform use. Logically, increased use of Filecoin should appreciate the long-term value of FIL. This mechanism is critical since Filecoin’s maximum supply is fixed, meaning minting will one day stop and Filecoin’s market capitalisation would only fluctuate if buyers and sellers bid for FIL. Burning applies deflationary pressure, making FIL attractive for users as costs are unlikely to spiral.

Filecoin is governed by a decentralised autonomous organisation (DAO), which allows token holders to vote on decisions. Proposals determine network direction and bring ideas from a diverse group, making Filecoin a democratic alternative to traditional cloud solutions. Many blockchains encourage this to achieve true decentralisation. Filecoin’s long-term utility is in users’ hands.

Revenue Streams

Filecoin has a market capitalisation of US$2,551,411,363, making it the 35th most valuable protocol. With daily fees of US$58,000, Filecoin’s annualised fees stand at US$21.06mm, of which US$20.90mm is booked as revenue. This derives a price-to-fee (PF) ratio of 121, meaning the fair value of FIL is currently 121x higher than the economic value captured by the network. Fees are a critical driver of value in blockchain as they indicate the propensity for a network to sustain itself once all tokens are in circulation. Filecoin’s PF ratio is high – Solana’s currently stands at 96.5x – though it is far lower than Ethereum‘s at 211x, which suggests Layer-1 protocols are valued at significant multiples of the fees they generate. However, Filecoin books 99.19% as revenue, suggesting the protocol is profiting rather than reinvesting into development. Long-term, this may be at the detriment of users.

Fees work as follows:

- Messages consume computation and storage resources on the network. Gas measures these resources, directly affecting the cost paid by a message sender to submit that message to the blockchain.

- Gas is, essentially, fuel, consumed as users perform activities.

- Since every node on Filecoin must spend resource to validate each message and maintain a consistent network state, some gas is burned to spread this cost among all users, rather than weighting it disproportionately.

- BaseFee * gas for a message is burned, dynamically adjusting based on demand for Filecoin’s bandwidth at a given time. Burn rate increases in times of congestion and users who cause congestion internalise the cost by paying a higher fee.

- Additionally, users may include a priority fee – GasPremium – to compensate miners for their work.

Filecoin’s charges are difficult to calculate, with no existing interface to track current, or average, fees in real-time. Research finds Filecoin the cheapest of decentralised and centralised solutions, offering 1 terabyte (TB) of data storage at US$0.19 per month. This is 9.5% of the next cheapest decentralised provider (Sia – US$2.00) and 0.83% of the most expensive centralised provider (Amazon S3 – US$23.00). Filecoin is efficient and positioned competitively for users. Note, however, this data was published in 2023. Increased cost transparency would benefit users.

| System | Solution | 1TB per month (USD) |

|---|---|---|

| Decentralised | Filecoin | $0.19 |

| Decentralised | Sia | $2.00 |

| Decentralised | Arweave | $2.13 |

| Decentralised | BitTorrent | $2.24 |

| Decentralised | Storj | $4.00 |

| Centralised | Google Drive | $4.16 |

| Centralised | iCloud | $5.00 |

| Centralised | One Drive | $5.00 |

| Centralised | Dropbox | $5.00 |

| Centralised | Amazon Photos | $6.99 |

| Centralised | Google Cloud | $20.00 |

| Centralised | Amazon S3 | $23.00 |

Source: CoinGecko

Fees indicate how much users will pay to interact with the chain and we can compare competitors to estimate value. Filecoin generates low fees, perhaps reflecting its efficient charging model. However, other networks also support low fees – Solana, for example, charges around US$0.02275 per transaction – so Filecoin’s fees indicate a small user base. Though fees and revenues have grown 50% across the month, there is a problem. People use Filecoin, possibly at an increasing rate, and it holds a niche (whilst other networks compete to be the leading platform for decentralised finance (DeFi) applications). But it faces stiff competition from well-established centralised providers. Currently, this appears to cap its user base. Given the supply of FIL is limited, low fees may harm long-term prospects as Filecoin may not generate enough to operate sustainably once all tokens are released. Filecoin must find a way to increase its user base and fees, to develop the network and capture market share before its token supply expires.

| Network | Fees (L30D, USD) | Fees (annualised, USD), 30d% Change | Revenue (annualised, USD), 30d% Change |

|---|---|---|---|

| Algorand | $50.06k | $609.09k (-2.9%) | $609.09k (-2.9%) |

| BNB Chain | $13.25mm | $161.23mm (-18%) | $16.48mm (-17%) |

| Ethereum | $156.51mm | $1.9bn (+11.4%) | $1.31bn (+2%) |

| Filecoin | $1.73mm | $21.03mm (+50.7%) | $20.86mm (+52%) |

| Solana | $54.32mm | $660.93mm (+24.9%) | $330.46mm (+24.9%) |

| Tron | $138.32mm | $1.68bn (+6.8%) | $1.68bn (+6.8%) |

Date: 28 June 2024

Source: token terminal

Financial Metrics

565,583,221 FIL are in circulation, just 28.85% of Filecoin’s maximum supply (1,960,165,211). Typically, the higher the circulating total, the more decentralised token distribution is. FIL tokens are consolidated with a small number of users, to the network’s detriment.

Total Value Locked (TVL) on Filecoin stands at US$65.22mm, 49th highest of all protocols and significantly lower than other Layer-1 networks. Algorand, for example, sits at US$76.54mm; Tron at US$7.7bn. TVL is a crucial metric, revealing the sum of capital inflow into protocols, and higher sums indicate greater trust in a protocol. It is correlated strongly with both value and utility, but Filecoin’s market cap is 39x greater than the value locked on its network. A ratio of 1.0 is considered healthy: it is currently overvalued.

Notably, however, Filecoin’s TVL has increased 7.56% across the last 30 days. In many instances, Layer-1 protocols have seen significant decreases. Growth suggests users are increasingly engaging with the ecosystem, so recognition of its utility may be on an upward trend. This aligns with the increase in fees discussed above.

The chart below maps the historical price, volume and volatility of FIL across the last 90 days. High standard deviation is driven by the sharp price drop across April, from US$10 to US$6.24. On average, 8.12 million FIL are traded each day and an important metric to consider is the value traded (volume * price). US$50.67mm in value is traded each day, substantially lower than other tokens (consider Bitcoin and Ethereum at US$970mm and US$1.41bn, respectively). The token is less popular with users and investors, indicative of a product lagging in utility.

Date: 27 June 2024

Source: Investing.com

II. Network and Usage

Network Metrics

Filecoin uses an Expected Consensus (EC) algorithm, electing a miner from a group in proportion to the weighted storage power they contribute. This is probabilistic and Byzantine fault-tolerant. EC runs a secret, fair and verifiable leader election at every 30-second epoch, during which a set number of miners become eligible to submit a block. Each block pitches available storage space and each epoch potentially has multiple leaders. The winner is randomly selected from the weighted set of participants. A producer can be verified by any participant, but their identity is anonymous until the producer releases their block to protect the leader from being targeted by malicious agents prior to proposal.

Elected providers who successfully contribute storage space are rewarded with FIL and can also charge other users fees to include their messages in a block. Storage providers (miners) are then set requirements to prove they store data honestly. At a new block, each must submit a Proof-of-Storage to show they fulfil the pledged storage contribution, and Proof-of-Spacetime makes a provider prove that they continue to store a unique copy of data. Additionally, when proposing storage space, miners must also pledge a stake to the network. The stake, denominated in FIL, is proportional to the size of storage offered and is intended to keep miners honest, since failure to provide proof results in slashing and removal from consensus.

The requirement for staking improves security but also create a capital efficiency problem. It is expensive to obtain FIL but, the more storage space a miner provides, the more FIL they must pledge. This problem is unique to Filecoin and miners on its network suffer as a result.

User Adoption

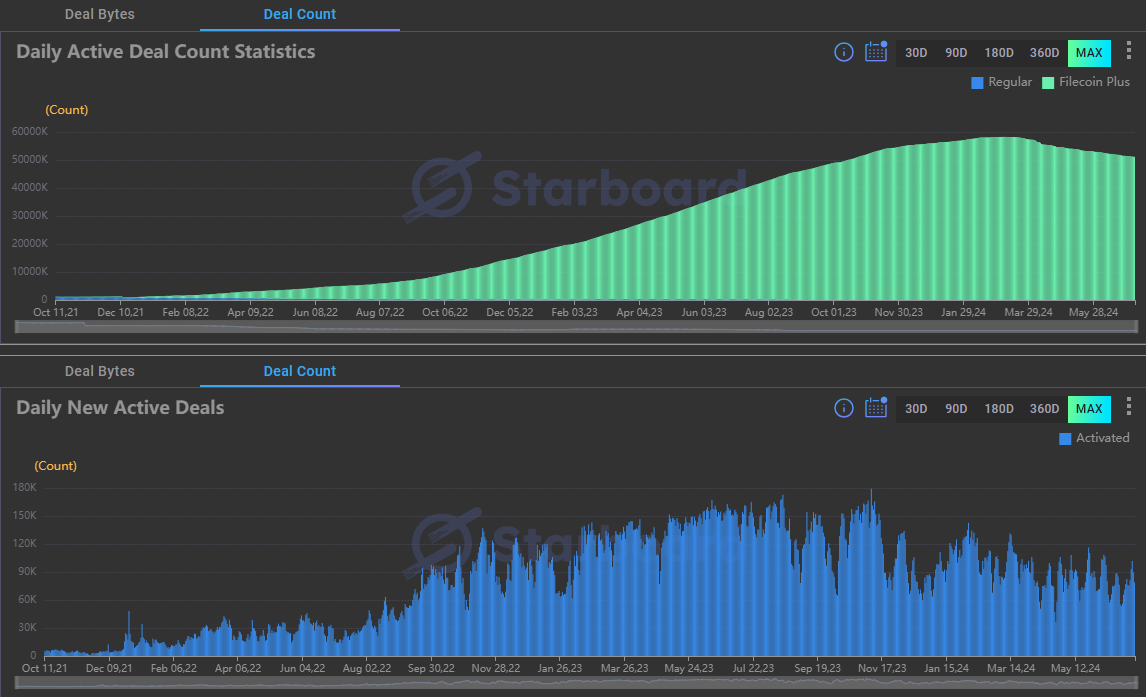

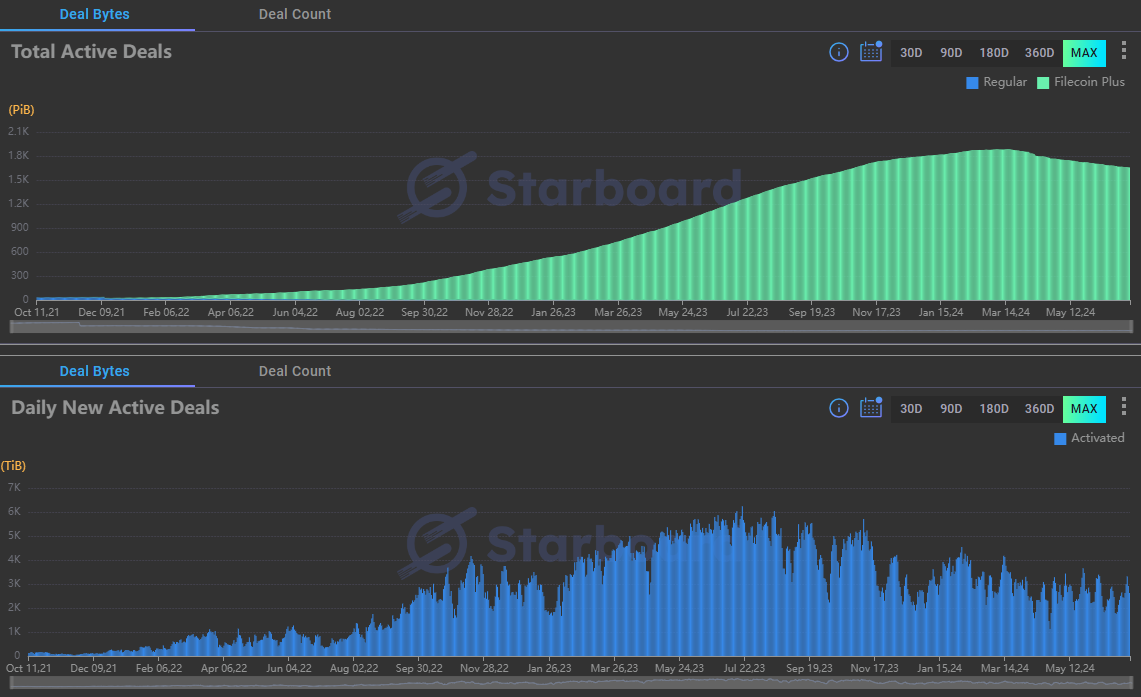

The charts below show daily active deal count and size, providing a proxy for demand.

The number of deals rose across 2023, along with deal size. This is explainable: since late 2021, deals have transitioned from Regular (unverified data) to predominantly Filecoin+ (verified data). Fil+ was introduced to increase the amount of useful data stored by clients by appointing allocators to vet clients and mark them as trusted parties. This transition stimulated a rampant upturn in Fil+ deals, which currently represent 99.96% of total active deals. The change suggests users find utility in the Fil+ mechanism and it successfully leverages storage.

Filecoin has 1,837 clients, with institutions such as The University of Utah and University of California, Berkeley using their service. More recently, however, we observe a downtrend in deals. Peaking at 142,585 in February 2024, the number of daily deals now sits at 78,828 – a 44.72% decrease. This is no blip: deals have dropped each month, as low as 36,256 on 24th April, and the amount of data (in bytes) has decreased too.

The cause is difficult to determine. It may indicate a slowing rate of new clients; that existing clients are not uploading as much data; or that clients are withdrawing. In any case, slowing activity affects the profitability of storage providers, which ultimately hurts network prospects. Considering competitiveness against peers, Filecoin must find a way to reverse this trend to capture more fees and boost development. Otherwise, it risks its long-term utility.

We turn to the number of developers building on Filecoin. Across 2023, Filecoin attracted the 19th most developers (1,016). This is some way off first place – just 6.1% of Ethereum – but, promisingly, almost doubles that of well-known Layer-1 protocols such as Cardano. The more developers writing code for an ecosystem, the more attractive it is likely to be, since there is greater opportunity for economically valuable applications. Filecoin is the 35th most valuable protocol yet attracts the 19th most developers. There is promise that Filecoin can improve long-term utility, boosting user base, fees and value.

Additionally, Filecoin’s interactions with developers greatly exceed decentralised storage competitors. Arweave, BitTorrent and Safe Network all focus on upending data storage but do not feature on the list. Filecoin also offers a more cost-effective solution. Of decentralised storage protocols, Filecoin is market leader.

Smart Contracts and dApps

Filecoin supports deal customisation, supporting various durations so users need only pay for the data availability that they need. Filecoin has also improved customisability by launching the Filecoin Virtual Machine (FVM). The FVM is discussed in Section IV but, at a high level, supports smart contracts. Termed Actors on Filecoin, these small, self-executing blocks manage, query and update the network and allow users to enact outcomes that they want.

Filecoin has two types of actors:

- Built-in actors: hardcoded programs written in advance by network engineers to manage key subprocesses in the network.

- User actors: code implemented by any developer that interacts with the FVM.

Built-in actors manage the global state of Filecoin, meaning the agreed state of a set of blocks at any given time. User actors encourage developers from anywhere in the world to contribute to Filecoin. For added functionality, the FVM supports Solidity – the language in which smart contracts are written on Ethereum. This supports interoperability between Ethereum and Filecoin, unlocking utility for users who can transfer contracts, assets and applications between the two. It also opens Filecoin to contributions from a broad range of developers, again supporting long-term utility.

Accordingly, Filecoin has a growing ecosystem of decentralised applications (dApps). Many pitch DeFi use cases, such as lending markets, decentralised exchanges and automated market makers. We list examples below:

| Project | Summary | Problem | Solution |

|---|---|---|---|

| FILLiquid | A liquidity pool that creates an open source, decentralised and algorithmic lending market. Allows FIL holders to deposit tokens into secure liquidity pools to earn interest. | Borrowers (storage providers) can obtain FIL loans from the platform and pay interest to lenders but must stake FIL to do so. Increasing requirements for staking to partake creates a bottleneck, as it increases the financial requirements on storage providers. | A lending marketplace that does not require borrowers to post collateral. Instead, providers can post their beneficiary addresses as collateral, to obtain FIL for the sole purpose of scaling their storage solution. Long-term, this should increase storage capacity across the network. |

| Glif | A liquid leasing protocol that enables FIL token holders and storage providers to earn rewards by depositing tokens. | Storage Providers must pledge FIL to prove their integrity, but acquiring FIL is the expensive. The more storage space miners provide, the more tokens they must pledge. | FIL holders can lend tokens and earn rewards, whilst benefiting Storage Providers who can borrow that FIL and use it to store more data. |

| NFT.Storage | Free, permanent storage for NFTs, helping users secure their digital assets. | As assets become digitalised, new methods to secure them are needed. Users need security on and across blockchain networks in an interoperable fashion. | Uses Filecoin to store NFT content and metadata, storing many copies of uploaded data on the public IPFS network. More than 91 million NFTs are currently stored on the service. |

| Saturn | Fast content delivery network to support websites and dApps serve billions of users. | Content delivery networks support the Internet (Web2.0) by allowing websites and applications to quickly retrieve information. A solution is needed to support similar in Web3.0. | Creates an efficient CDN on Filecoin with a dense network of permissionless nodes, ensuring users are always close to a node to retrieve data with minimal latency. |

To its detriment, the FVM is a relatively new functionality, so Filecoin has not supported dApp development for as long as other Layer-1 protocols. We might expect improved utility, but this is no certainty. The FVM makes Filecoin more competitive and attractive but talk of future platforms (e.g., data marketplaces, DAOs built with AI) is just that. Users can currently find working applications on alternative protocols, so Filecoin lacks value compared to other Layer-1s. It must work quickly to entice users.

III. Comparison with Traditional Finance Alternatives

Cost-Benefit Analysis

Filecoin supersedes decentralised peers, but what about centralised competitors? Filecoin aligns closely with Dropbox, given their market shares. Key areas for comparison are cost and speed.

Fees, covered above, reveal Filecoin to be more cost effective. US$0.19 per 1TB of data stored per month is 3.8% the cost of Dropbox. However, Filecoin is less accessible. It can take five-to-ten minutes for a 1.1MB file to fully upload and, once a deal is on-chain, storage providers must provide Proof-of-Replication. This can take over one hour depending on file size and hardware used. Retrieval can also be slow and is dependent on whether the provider holds an unsealed copy of the data or a sealed copy as well. Retrieving a sealed copy involves decoding the data and unsealing can take nearly three hours, again subject to file size and hardware. Meanwhile, Dropbox allows file upload in a few seconds up to 20 minutes.

As a thought experiment, Dropbox has a market capitalisation of US$7.37bn, at a price-per-share of US$22.33. Around 346,171,070 shares are in circulation. Filecoin, with a market capitalisation of US$2.55bn and price of US$6.24, has 565,583,221 tokens in circulation. Exchanging their respective share and token count, FIL appreciates 18.11% to US$7.37 and Dropbox depreciates 41.65% to US$13.03. Alternatively, Filecoin must appreciate 108.8% to reach Dropbox’s valuation. Inherently, Filecoin is not nearly as valuable as Dropbox and requires a seismic shift to get there. It currently offers less utility. However, if significant development is achieved, this may give a glimpse of possible upside for investors.

Security and Trust

Per Section II, Filecoin demands collateral from miners to offer storage space. Collateral is slashed when a miner fails to act with integrity and any revenues earned from providing storage are likely forfeit. This incentivises adherence to network rules and disincentivises malicious behaviour. Additionally, Proof-of-Storage and Proof-of-Spacetime protocols audit the network.

As of today, Filecoin has never been hacked.

Accessibility and Inclusivity

When a computer accesses a website, it retrieves files stored on a storage network. Cloud infrastructure is crucial, both storing and disseminating data to users. So, when cloud providers are concentrated – consider that Amazon Web Service, Microsoft Azure and Google Cloud together hold 67% of the market – it risks a single point of failure. An outage at a market leader may impact hundreds of popular services and cause data loss. For example, an outage at AWS in 2021 brought down Disney+ and Vice and impacted Reddit and Amazon, among others.

The risk of a single point of failure is emblematic of centralised systems. In addition, a lack of options reduces the competitiveness of products, pricing and terms. It is also hard to systematically verify the integrity of stored data. Ultimately, clients suffer.

Upending the incumbent model, Protocol Labs developed the InterPlanetary File System (IPFS), a peer-to-peer hypermedia protocol and distributed storage layer. Files are stored across participating nodes and accessed via unique cryptographic hash identifiers instead of traditional web addresses. So, a file remains on the Internet as long as there is a node in that stores the file in its cache. An IPFS node can be run by anyone, keeping the network open and secure and letting anyone with space earn revenue.

But IPFS has a shortfall: it does not incentivise nodes to store data for others, so there is no guarantee that data will be secure or consistently available. Essentially, IPFS does not force a trustless environment, instead relying on users to be honest of their own accord. So, Protocol Labs developed Filecoin. Filecoin is complementary to IPFS and powers data storage with a built-in cryptographic economic model, ensuring data is verifiably and securely stored and retrievable over time. The economic model is valuable for users of Web3 infrastructure because it challenges centralised business models and offers cloud storage at a more efficient rate.

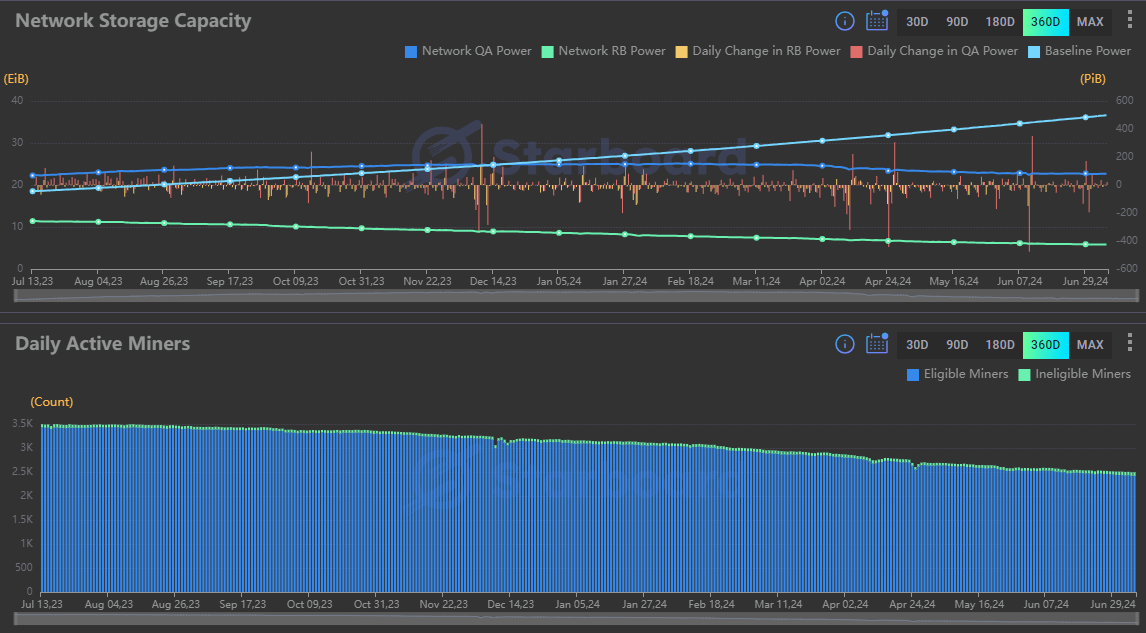

Filecoin has nearly 2,500 miners distributed globally. However, a 28.57% decrease across the last year, in line with the decrease in deal size and capacity, reaffirms a worrying trend: Filecoin’s utility is decreasing. The network must find a way to reverse this to remain competitive.

IV. Future Utility

Roadmap and Development

Filecoin grew across 2022-23, increasing capacity and access. With it, demand for collateral also increased, so Filecoin launched the FVM to accommodate. The FVM interprets user inputs and executes associated programs, providing a platform for building DeFi applications and smart contracts. It was intended to support dApps that alleviate capital constraints and specific applications are solving this problem (see Section II).

The FVM also supports interoperability between Filecoin and Ethereum. Ethereum’s Virtual Machine (EVM) can run on top of Filecoin – forming the FEVM – allowing developers to port programs between the two. Reliance on Ethereum is a drawback, since it is slower and more expensive. However, interoperability provides utility for developers who can leverage existing code. With rising demand for cloud storage, developers can build dApps for four categories: NFT and Web3 storage; permanent storage and Web2 datasets; metaverse and gaming; and audio and video.

| Item | FVM | FEVM |

|---|---|---|

| Pros | Native execution speed and performance on Filecoin, meaning less gas cost per unit of code executed. | Interoperability capitalises on current EVM tooling to quickly port or write programs. |

| Cons | Tooling is not yet as mature as EVM tooling. | Higher gas fees and lower performance due to overhead of the FEVM. |

It was only introduced in 2023, so Filecoin has yet to realise the full benefits, but the FVM has unlocked liquidity protocols to alleviate the financial strain on storage providers. Ultimately, this has been the most useful deployment in Filecoin’s recent history.

However, beyond enhancing the FVM, Filecoin’s roadmap is limited. We view this negatively; expectation that the FVM will, on its own, ensure Filecoin can compete with the largest cloud storage providers is naive. The roadmaps of Ethereum, Cardano and Algorand all extend into the future and focus on scalability, despite each already supporting dApps and interoperability. Reflected in the downtrend in storage provision, our analysis suggests Filecoin is not doing enough to improve utility.

Risks and Mitigations

Filecoin faces challenges. Early miners who hold substantial sums of FIL need to recoup their investments, which has led to selling pressure and likely suppressed its price when the market performs well. Additionally, Filecoin’s technology needs significant development to improve performance before it can rival traditional cloud storage services and attract large enterprises. A limited roadmap harms its competitiveness and is a major flaw – Filecoin must focus on actively developing its ecosystem to attract users. This includes developing wallets, decentralised exchanges (DEXs), games, as well focusing on mining, interoperability and custody. Some developments are underway, but more are needed to secure Filecoin’s long-term success. Ultimately, without progressive development, it will come up short.

Relevance

There are major concerns over the centralisation of data storage. A small number of centralised cloud storage operators hold huge market shares, allowing them to dictate terms and fees. Users are forced to buckle to their requirements given the lack of alternatives.

Filecoin attempts to solve this issue and is the market leader in decentralised storage. Its service is becoming increasingly relevant with an approach that gives it an early competitive advantage against decentralised peers. The FVM is a major upgrade, promising greater utility than simply archival storage. New applications and smart contracts should support innovations and efficiencies if Filecoin can continue to attract developers.

However, our analysis has revealed a sustained downtrend in both the number of miners and quantity of storage space. Deal count has decreased across 2024 as a result. With Filecoin’s need for fees to operate sustainably, this is a risk. Filecoin is hyper reliant on strong development to win clients or will remain in the shadow of centralised providers. For investors, though Filecoin holds a niche in decentralised markets, in its current state it does not offer enough utility to capture market share from centralised entities. This damages its long-term prospects.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Readers are encouraged to conduct their own research and seek professional advice before making investment decisions.

The author has held a stake in Filecoin since 2023.

References

Filecoin. (2023). Actors. Available at: Filecoin Docs (Accessed: 06 July 2024).

Filecoin. (2023). Consensus. Available at: Filecoin Docs (Accessed: 28 June 2024).

Filecoin. (2023). Crypto-economics. Available at: Filecoin Docs (Accessed: 28 June 2024).

Filecoin. (2023). Filecoin EVM runtime. Available at: Filecoin Docs (Accessed: 29 June 2024).

FLSD. (2023). What You Might Not Know: Filecoin LSD. Available at: Medium (Accessed: 29 June 2024).

GLIF. (2023). Why staking Filecoin benefits the whole ecosystem. Available at: Medium (Accessed: 06 July 2024).

Grigore, M. (2024). State of Filecoin Q4 2023. Available at: Messari (Accessed: 06 July 2024).

Hamilton, D. (2024). Investing in Filecoin (FIL) – Everything You Need to Know. Available at: Securities.io (Accessed: 05 July 2024).

Kok, N. (2024). Hot Data Availability on Cold Storage: Building Cost-Effective DA on Filecoin. Available at: Filecoin TL;DR (Accessed: 06 July 2024).

Metelski, D., & Sobieraj, J. (2022). Valuations of decentralised finance (DeFi) protocols: a panel data study investigating DeFi’s key performance indicators. XXIX International Conference of AEDEM, Santo Domingo.

Qian, L. Y. (2023). Centralized vs Decentralized Storage Cost (2023). Available at: CoinGecko (07 July 2024).

Richter, F. (2024). Amazon Maintains Cloud Lead as Microsoft Edges Closer. Available at: Statista (Accessed: 05 July 2024).

Roddy, M. (2023). Filecoin in 2023: Expectations, milestones and opportunities. Available at: Holon Investments (Accessed: 28 June 2024).

Sharomi, U. (2023). A Simplified Economic Analysis On Filecoin Tokenomics. Available at: Medium (Accessed: 29 June 2024).

Sheldon, R., & Posey, B. (2023). 7 decentralized data storage networks compared. Available at: TechTarget (Accessed: 29 June 2024).

Shen, M. (2024). 2023 Crypto Developer Report. Available at: Electric Capital (Accessed: 06 April 2024).

Zhang, A. (2023). Filecoin has quickly become the world’s largest decentralized storage network. Available at: Medium (Accessed: 05 July 2024).

Leave a comment