Solana

Grade: A

Summary

Solana is a Layer-1 blockchain designed to address the scalability challenges faced by blockchain networks. It combines a Proof-of-Stake (PoS) consensus mechanism with Proof-of-History to deliver fast and cost-effective infrastructure, and emphasis on scalability, speed and low transaction costs has positioned it as a popular choice for developers seeking to build high-performance decentralised applications (dApps) across decentralised finance (DeFi) and Web 3.0.

The success of this focus is clear. Solana can process 92x as many transactions per second as Ethereum but charges users 1% of the fees of Ethereum. Developers have flocked to the ecosystem, contributing to strong and increasing revenues since 2022. And, over the last year, Solana has shown considerable strength in DeFi, given its aptitude for small and high transactional throughput. It is the market leader for decentralised exchanges and meme coin trading.

Solana is a valuable, leading blockchain. Should it continue to support the development of innovative applications spanning DeFi, gaming and more, we expect Solana to seriously rival Ethereum in the near future.

| Pillar | Grade |

|---|---|

| Financial Prospects of the Network | A |

| Network and Usage | A |

| Comparison with Traditional Finance Alternatives | B |

| Future Utility | A |

| Weighted Grade | A |

I. Financial Prospects of the Network

Tokenomics

Solana aims to compete directly with Ethereum, the market leading Layer-1 smart contract platform. As with all blockchains, the native currency plays a critical role in incentivising good network behaviour. By holding SOL, one can participate in consensus to propose and vote on new blocks, pay transaction fees or serve as minimum balance deposits to store data and build on the blockchain.

Solana launched with an initial supply of 500 million tokens, of which the founding team kept 12.79%, 10.46% went to the Solana Foundation, 12.92% was allocated to a founding sale and 16.23% to an initial seed sale. The rest went to public and private sales: Solana Labs raised US$25.66mm in the initial coin offering (ICO) and received a further US$314mm from a private sale to leading venture firms Andreessen Horowitz and ParaFi Capital.

Today, 9,154,449 wallets hold SOL. The top 100 own 22.76% of the total supply, which stands at 591.47 million SOL. The top 10 own 6.58% and the largest wallet owns 5,178,991 SOL, 1.01% of the total supply. Distribution is more equitable than other Layer-1 blockchains, notably Algorand and Cardano, which benefits smaller investors. It suggests the network is more decentralised and reduces possible volatility should a large holder trade.

Solana does not have a maximum supply. Instead, the founding team applied an initial inflation rate of 8%, reducing by 15% each year until 2031 when it will remain stable at 1.5%. The current rate of 5% means Solana emits 5% of its value as tokens to validators per annum. This incentivises validators to secure the network and, though it will decrease in the coming years, an indefinite rate of 1.5% will reward validators who remain with the network long-term. Additionally, half of the base fees earned by Solana are burnt, benefiting all holders since burning shifts the supply-and-demand balance to increase SOL’s value. The remainder are paid to validators for their work.

Revenue Streams

To achieve widespread adoption, a network should be developed with mass appeal and utility. Fee volatility can deter first-time users and developers, which has been a reoccurring complaint during Ethereum’s lifespan. Solana is one of the most consistent, cost-efficient and high-performing networks available, with a single transaction typically costing around 0.00015 SOL (US$0.032). This fee structure is equal to 1% of Ethereum’s median (US$3), offering exceptional utility for developers.

Fees indicate how much users are willing to pay to interact with the chain and are indicative of utility. Despite charging very low fees per transaction, Solana generates high daily fees of US$3,846,000 and places third amongst leading PoS solutions. It has a price-to-fees ratio of 74x, better than Ethereum at 182x. Tron exhibits strength with a ratio of just 6.13x, suggesting Solana may be overvalued, however, fees are a clear strength for Solana and a key reason for its competitiveness against Ethereum. The network appears to attract many users and hosts high transactional throughput, a sign of utility, and retains long-term value as it can sustainably reinvest fees back into the network.

| Network | Fees (L30D, USD) | Fees (annualised, USD), 30d% Change |

|---|---|---|

| Algorand | $60.79k | $739.65k (+52.2%) |

| Avalanche | $1.31mm | $15.97mm (+82.9%) |

| BNB Chain | $17.42mm | $211.90mm (+49.7%) |

| Ethereum | $197.36mm | $2.4bn (+34.6%) |

| Solana | $115.38mm | $1.40bn (+13.7%) |

| Tron | $312.57mm | $3.80bn (+42.7%) |

Date: 04 January 2025

Source: token terminal

Financial Metrics

Solana has a circulating supply of 482.9mm tokens and market capitalisation of US$103.48bn, making it the 5th most valuable blockchain. With annualised revenues of US$702mm, the fair value of SOL (price-to-revenues ratio) is currently 147x higher than the economic value captured by the network. Ethereum’s ratio of 224x suggests Solana may be undervalued in this context. Solana also collects the third highest revenues of all networks (to be expected, given its fees).

| Network | Revenues (L30D, USD) | Revenues (annualised, USD), 30d% Change |

|---|---|---|

| Algorand | $60.79k | $739.65k (+52.2%) |

| Avalanche | $1.31mm | $15.97mm (+82.9%) |

| BNB Chain | $1.75mm | $21.23mm (+46.8%) |

| Ethereum | $160.63mm | $1.95bn (+42.6%) |

| Solana | $57.69mm | $701.91bn (+13.7%) |

| Tron | $312.57mm | $3.80bn (+42.7%) |

Date: 04 January 2025

Source: token terminal

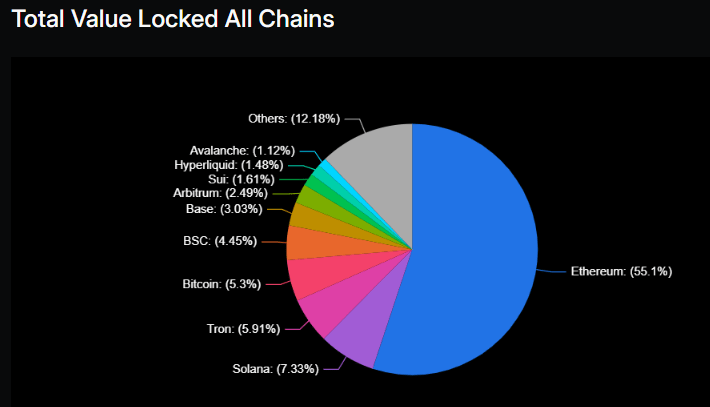

US$9.47bn in total value is locked on Solana (TVL), second highest of all protocols. This is just 13.47% of the TVL on Ethereum, perhaps attributable to the 189 protocols hosted on Solana – 15% of Ethereum’s 1,264. However, on a like-for-like basis, protocols on Solana and Ethereum have US$500mm and US$550mm pledged to them, respectively, indicating that users find protocols comparably useful on both networks.

That said, Solana’s market capitalisation/TVL ratio of 10.93x is higher than Ethereum’s (6.13x). A ratio of 1.0 suggests fair valuation, so Solana looks overvalued. To compete with Ethereum more directly, Solana must onboard more protocols, since applications attract users and investment and improve utility. We caution investors to consider how much upside is available – noting Solana’s PF and PS ratios, there appears room for appreciation, however, the market may currently overweight the value of protocols on Solana.

The below chart maps historic price, volume and volatility of SOL across the last 90 days. Solana reached its all-time high of US$264.18 in late November, but volatility has since gripped the market and Solana’s price shows a standard deviation of 33.47. 937k tokens are traded daily: lower than some blockchains. However, given an average price of US$196.92, US$184.46mm in value is traded each day, making Solana one of the most liquid tokens available.

Date: 04 January 2025

Source: Investing.com

II. Network and Usage

Network Metrics

Solana’s architecture is built around a unique mechanism called Proof-of-History (PoH), which proves that a message occurred before or after a known event, rather than relying on a timestamp. This leverages Bitcoin’s SHA-256 algorithm but additionally links actions to moments in time, creating a historical record of events that allows parallel transaction processing – key for quick transactions. In addition, Solana implements an innovation called Sealevel, which allows Solana to process thousands of smart contracts simultaneously to propagate data extremely quickly. And Solana combines PoH with Proof-of-Stake (PoS) in a hybrid consensus model to secures the network.

As a result, Solana is one of the fastest blockchain networks in existence, if not the fastest. Ethereum is considered the leading smart contract network but can only process 12.98 transactions per second (TPS). Data from Chainspect shows that Solana currently outstrips Ethereum’s real-time TPS by 92x and Ethereum’s maximum recorded TPS by 116x.

- Real-time TPS: 1,200

- Maximum recorded TPS: 7,229

- Theoretical maximum TPS: 65,000

- Block sizes: 128MB

- Block time: 0.41 seconds

Solana applies the Turbine protocol to optimise information propagation. Though Solana’s block size can reach 128MB, instead of transmitting the whole block at once, the protocol propagates each block. A lead validator breaks a given block into 64KB-sized packets, transmitting 2000 packets in total. Each packet is assigned to and transmitted by 2000 individual validators on the network. By breaking data into small chunks and disseminating it through a hierarchy of nodes, Turbine eases data transmission and boosts network throughput.

Lastly, Solana’s block time of 0.41s is 96.57% less than Ethereum’s, at 12.08s. The team’s focus on scalability has proved successful, providing users near unrivalled utility.

Date: 05 January 2025

Source: Chainspect

User Adoption

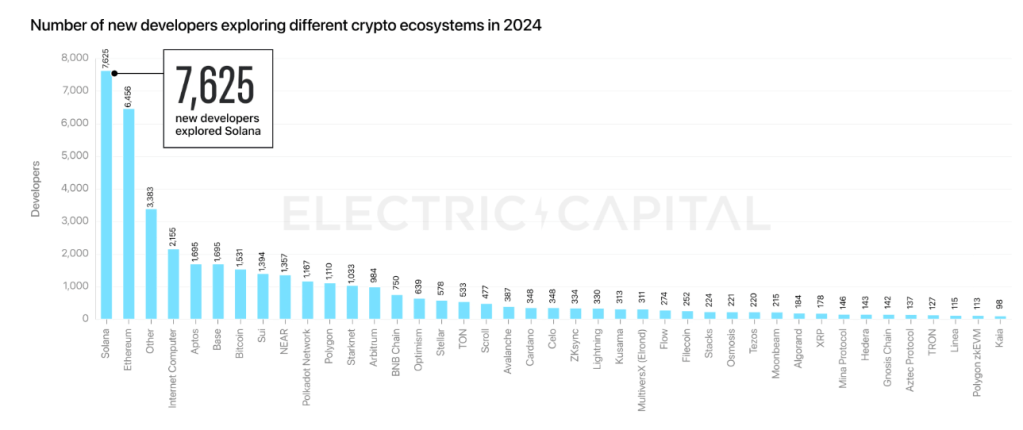

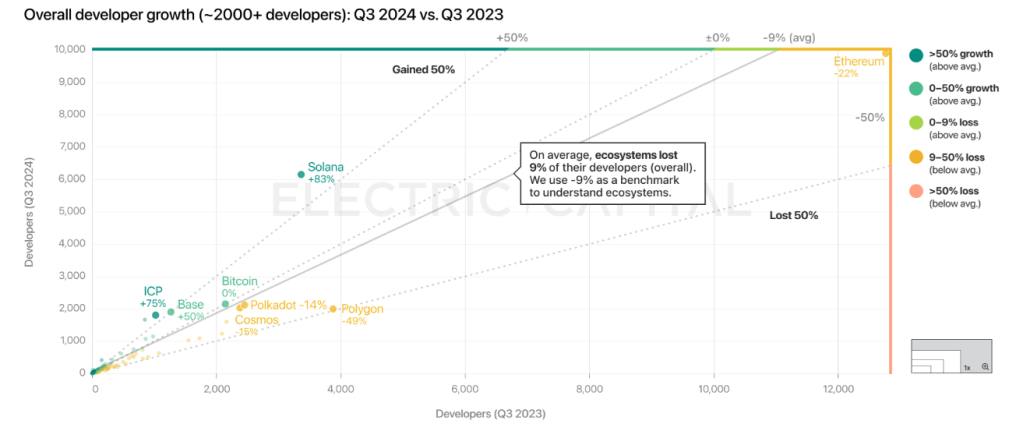

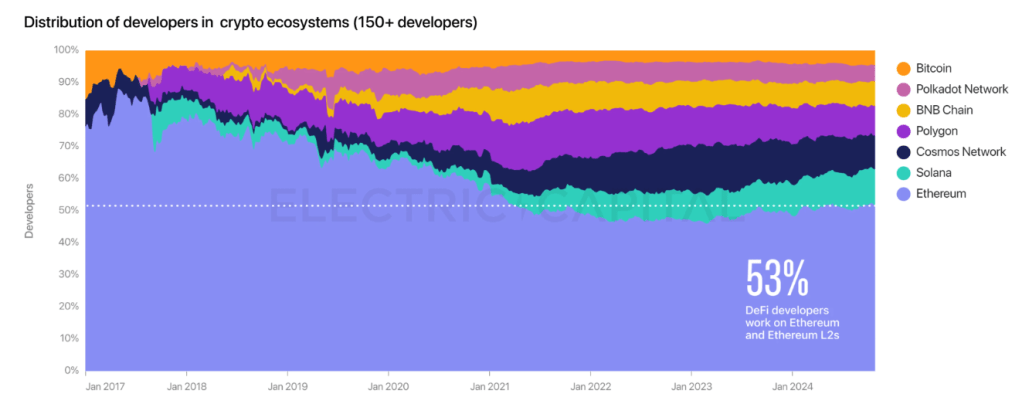

Solana was the second most attractive ecosystem globally for blockchain developers across 2024. However, it was the most popular ecosystem for new developers, and 2024 marked the first year since 2016 that any ecosystem attracted more new developers than Ethereum. Of 39,148 new developers entering crypto across the year, 7,625 explored Solana, 18% more than explored Ethereum. Total developer numbers on Solana grew 83%, the third fastest rate behind Aptos (96%) and EigenLayer (167%). Over the same period, Ethereum lost 22%.

This indicates current utility since developers are attracted to the network and suggests Solana will hold long-term value, as developers should contribute to more innovative and diverse applications.

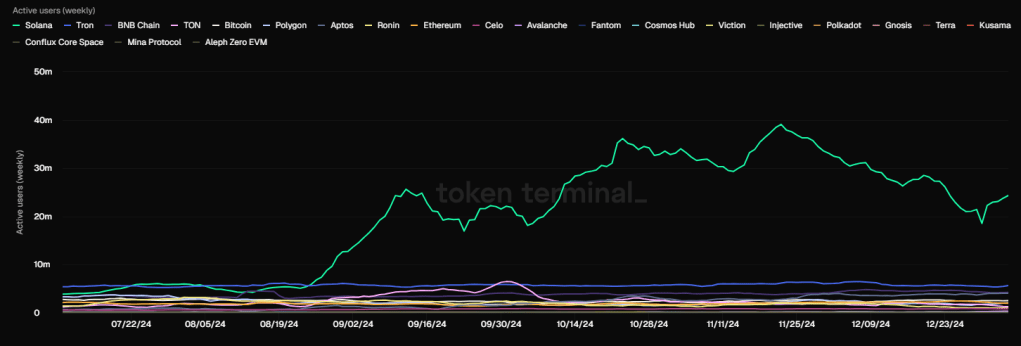

Developer activity appears to be attracting users. Solana’s monthly active address count exceeded 100 million in October, a huge jump from 509,000 recorded at the start of 2024. And, despite a drop across December, the user base remains very high compared with other networks.

Date: 05 January 2025

Source: token terminal

However, as discussed in Section I, only around 10m wallets hold SOL – 12.5% of the current 80m monthly user base. This has spurred criticism of the legitimacy of Solana’s metrics, with sceptics suggesting the network is flooded with bots that artificially inflate activity by interacting with each other. Interestingly, the Solana Foundation have admitted as much, agreeing that bots pay fees and, therefore, contribute to long-term inflation goals. However, for this analysis, only human users are relevant. At the start of January, Ethereum hosted 4.4 million active users per day; Solana around 3 million (assuming 87.5% are bots). Solana is competitive with Bitcoin, Polygon and BNB Chain, each hosting 2.1-3.5 million active users daily, but lags Ethereum and Tron.

Smart Contracts and dApps

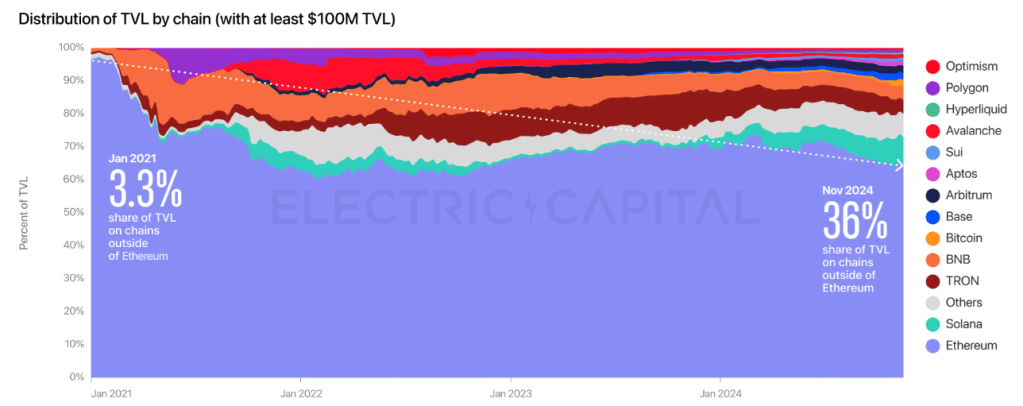

As discussed in Section I, Solana is the second largest blockchain for DeFi, with US$9.47bn TVL pledged to protocols on its network. And, though Ethereum retains significant dominance, Solana has been key to pushing Ethereum’s share of TVL down by almost 33% across the year. Evidence suggests that Solana has profited greatly and is now the most attractive hub for DeFi development.

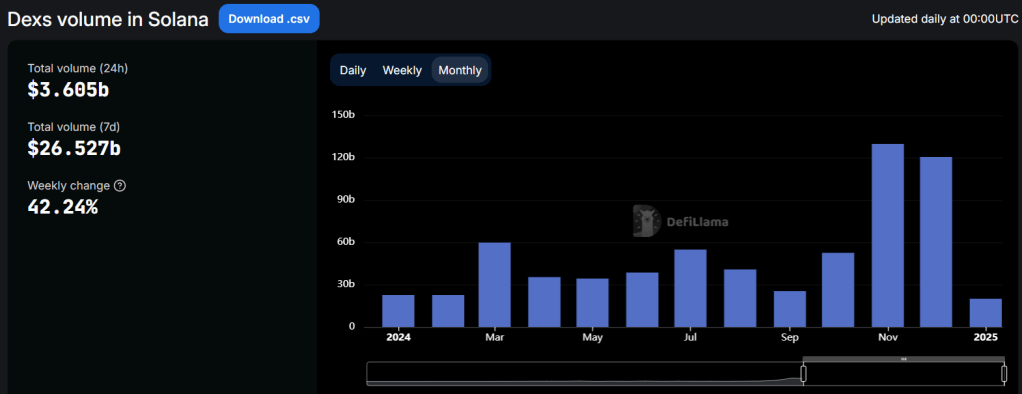

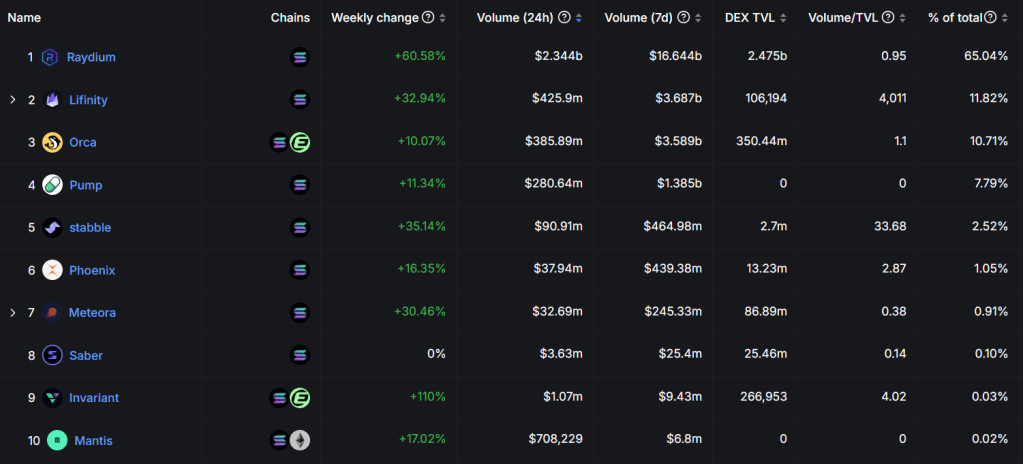

This may be expected, given the high speeds and low costs available. The network has successfully developed an ecosystem containing meaningful projects with strong user traction. Solana appears particularly well-suited to decentralised exchanges (DEXs): across 2024, DEXs on Solana settled US$574bn in volume, ahead of Ethereum with US$568bn. This also doubled the nearest competitor, BNB Chain. In addition, 81% of monthly DEX transactions are hosted on Solana, suggesting Solana is optimal for smaller transactions.

Volume growth has, to a large extent, been fuelled by meme coin trading on DEXs, and meme coin issuance has taken off since the launch of the pump.fun meme coin launch platform: one of the fastest growing crypto applications. The market capitalisation of meme coins on Solana today exceeds US$21.5bn, and examples include dogwifhat and Pudgy Penguin, each valued over US$2.5bn. And the combined 7-day volume on Solana’s largest DEXs – Raydium, Lifinity and Orca – at US$23.9bn, exceeds the top three on Ethereum by over US$10bn.

Solana has also emerged as a leading platform in blockchain payments, has captured significant market share in non-fungible tokens (NFTs) and is making headway into blockchain-based gaming, recently announcing the launch of the Play Solana portable gaming console. Due to its low costs and speed, Solana offers substantial value for users and developers alike.

III. Comparison with Traditional Finance Alternatives

Cost-Benefit Analysis

Research by ParaFi in mid-December suggests that Blockchain Gross Domestic Product (GDP) is a valuable framework for understanding economic activity in blockchain. It can be calculated by summing Protocol GDP – the base and priority fees Solana captures – and Application GDP – the revenues, imports and exports generated by dApps in the ecosystem.

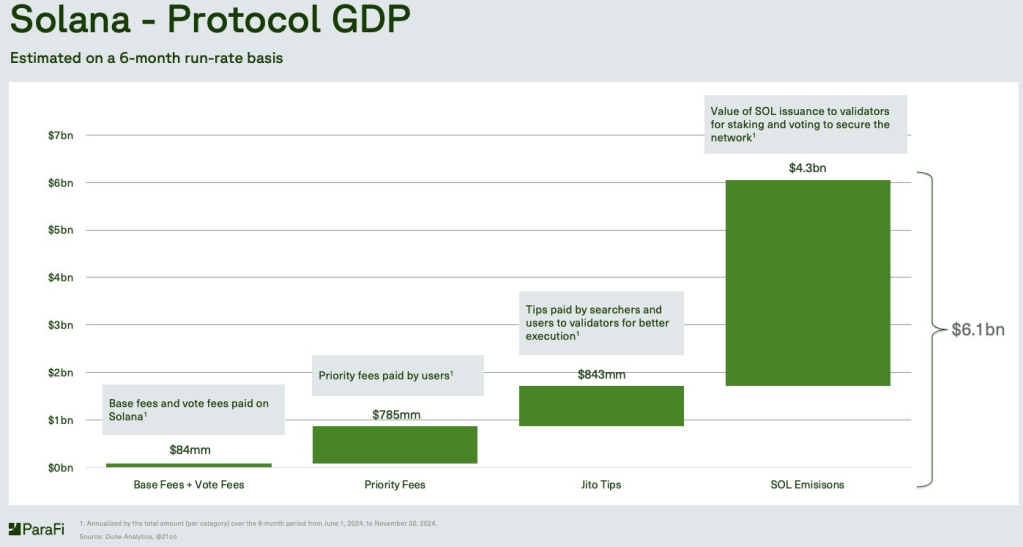

The first component, Protocol GDP, hit US$6.1bn in 2024. Applying a 5% emission schedule, Solana distributed US$4.3bn to validators for staking and securing the network. Validators also netted US$84mm in base fees, US$785mm in priority fees and US$843mm in tips paid by users for better execution (note that Solana burnt a near equivalent value across the year).

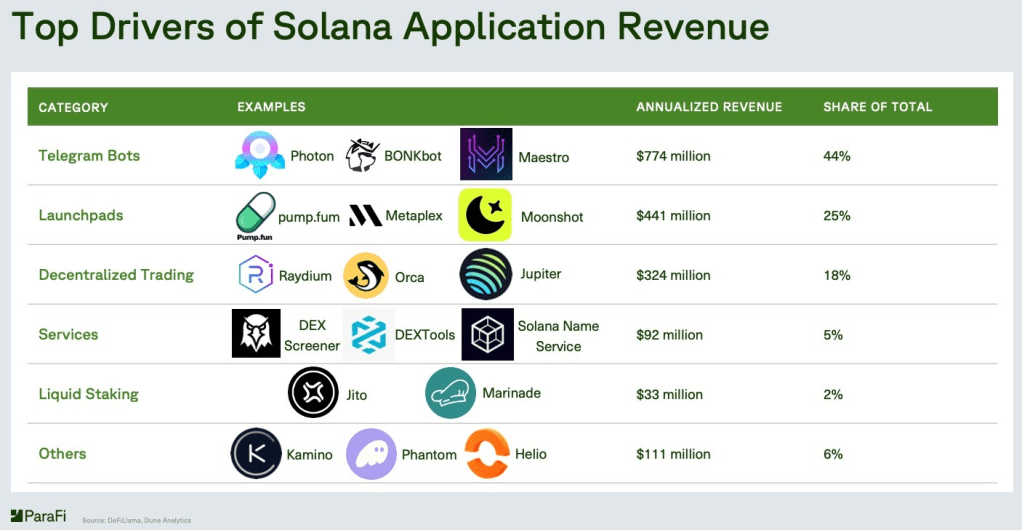

Application GDP was almost entirely driven by highly profitable dApps, including key DEXs Raydium, pump.fun and Orca. However, Telegram Bots were the largest contributors to annualised revenues, driving 44% of the US$1.8bn total. This confirms that meme coin creation and trading, in a large part initiated by bots, have been the primary drivers of economic activity on Solana. To be more competitive with Ethereum, the ecosystem must scale and diversify further into gaming, NFTs and other decentralised finance applications, and prioritise human users.

Security and Trust

Solana’s hybrid mechanism of PoH and PoS reflects an initial priority for scalability. But, as dictated by the blockchain trilemma, security and decentralisation have suffered.

Since 2020, Solana has experienced multiple network outages. Across 2022, 14 outages combined for a total downtime of 4.5 days; a major outage in February 2023 brough the system down for almost 19 hours; and a bug in Solana’s Just-in-Time (JIT) compilation cache caused a five-hour outage in February 2024. Since then, Solana has retained uptime consistently, however, the platform still faces scrutiny during periods of high demand.

Ethereum has promoted decentralisation by encouraging developers to create their own client implementations in various programming languages. Client software, for example, a cryptocurrency wallet, is needed to access a blockchain – it bridges a node’s computer and the network. Ethereum’s strategy ensures nodes have several options of client software (and, therefore, ways to bridge to the blockchain), reducing the network’s vulnerability to attacks and allowing developers to create applications using programming languages they are most comfortable with. Ethereum has also introduced penalties to dissuade nodes from all running the same client software, encouraging client software diversity.

Solana, however, has just three validator clients in operation, so is not as resilient to attacks as Ethereum. In addition, Solana nodes lack support for sharding, a technique essential for horizontal scalability, which will hinder Solana’s ability to efficiently expand with network growth. Long-term, this will impact Solana’s ability to handle increasing transaction volumes.

But Solana has strong links with Jump Crypto, which announced in 2022 that it would develop a new software for Solana called Firedancer. Launching in 2025, Firedancer is an independent validator client software to make Solana more decentralised and less prone to outages. It will introduce sharding support for horizontal scalability and resilience, reducing the likelihood that Solana experiences outages simultaneously across different validator clients. And it should increase the network’s transactions per second capacity. In a demo in 2022, it processed 1.2 million TPS.

Accessibility and Inclusivity

One of key reasons for Solana’s success has been its ability to enter strategic partnerships that expand its ecosystem and usage. Visa introduced settlement of USDC stablecoins over Solana; Solana nodes can be easily created and run on AWS via the Node Runner App; and Google integrated its BigQuery data warehouse with Solana to run analytics. This collaborative streak with traditional finance and centralised tech is key, since partnerships cement a project’s legitimacy and support real-world adoption. Creating nodes with little friction and supporting users to settle stablecoin transactions are real-world uses, driving Solana’s relevance and utility.

In addition, Solana runs a venture arm – Solana Ventures – to support projects building within its ecosystem. In all, the arm has invested in over 100 projects, most recently supporting lending platform Exponent‘s US$2.1mm raise and cross-chain wallet platform Infinex‘s US$67.7mm raise. Investments of this ilk expand Solana’s ecosystem and available services, strengthening its position as an interoperable and market-leading decentralised network.

IV. Future Utility

Roadmap and Development

Solana was founded by software engineer Anatoly Yakovenko, former colleagues Greg Fitzgerald and Stephan Akridge, and entrepreneur Raj Gokal. It has a for profit arm, Solana Labs, which developed the protocol and expands network capabilities, and a nonprofit Foundation that supports ecosystem growth through advocacy, partnerships and funding for projects.

Security is now a top priority. Firedancer, intended to prevent outages and support decentralisation, is key, but Solana also plans to introduce more rigorous security protocols, including third-party audits. In addition, Solana, like Ethereum, is focusing on interoperability to allow users and developers to seamlessly communicate, share data and transact across different blockchains. This is critical to the vision of a decentralised landscape, but Solana has largely been isolated. For users, this degrades utility, since one is likely to want to move assets across multiple blockchains to leverage different applications and services. Recently, however, Neon Labs has deployed a cross-chain network extension on Solana, supporting compatibility with the Ethereum Virtual Machine (EVM). This operates the EVM natively within Solana’s base layer and provides a pathway for Ethereum developers to deploy EVM dApps and smart contracts directly to Solana. This compatibility supports the exchange of applications, contracts and assets across the two chains.

Risks and Mitigations

Solana had significant financial ties with FTX. The Foundation had substantial holdings in FTX Trading Ltd shares and FTX Tokens, whilst FTX and Alameda Research held significant sums of Solana tokens, participating in the private token sale with Andreessen Horowitz and ParaFi Capital. In total, nearly 20% of projects on Solana received funding from FTX or Alameda. When FTX and Alameda collapsed in November 2022, Solana was seriously and negatively impacted, shedding 70% of its value in the aftermath. In addition, it lost the backing of key venture capitalists, an advantage it held over many Layer-1 protocols.

However, Solana has recovered well and is still viewed as Ethereum’s main competitor. At its lowest, SOL traded around US$9.7; it has since hit an all-time high and currently trades at US$214.24 – a 2096% increase. It has fought off competing Layer-1 networks such as Avalanche and BNB Chain to retain second place and is well-positioned for continued growth.

Unfortunately, investors must wait for Solana exchange-traded funds (ETFs). The U.S. Securities and Exchange Commission (SEC) has rejected two applications from U.S.-based asset managers to introduce the instruments, meaning Bitcoin and Ether remain the only cryptoassets available to trade on traditional financial markets.

Relevance

Solana hosts a diverse spectrum of projects, from DeFi protocols to GameFi (Gaming Finance) to NFTs, and now trades at 20x its post FTX lows. It is increasingly considered Ethereum’s main rival, and we reiterate that Solana has made strong competitive strides on transaction volumes in 2024 to tackle Ethereum head on. High throughput on DEXs and sustained revenues are driving Solana’s market capitalisation upwards.

Solana and Ethereum’s relative market shares may converge slightly in the near future. Solana’s market capitalisation is currently 74x higher than fees and 147x higher than revenues, whereas Ethereum is valued at 182x fees and 224x revenues. There appears room for Solana to appreciate or Ethereum to depreciate. However, a troubling metric is TVL. As highlighted in Section II, though Solana rivals Ethereum on transaction volume and active address metrics, the veracity of these statistics is questionable, with over 80% attributable to trading bots. The human user base on Ethereum is equal, if not greater, than Solana, so Ethereum still dwarfs the number of protocols and TVL on Solana. And Ethereum is valued more reasonably at 6.13x TVL, which may impact long-term price convergence.

Date: 06 January 2025

Source: DeFi Llama

Ultimately, for Solana to successfully rival Ethereum, it must attract more innovative decentralised applications. That will bring adoption, accompanied by growth in TVL and revenue. To give credit, Solana has worked on this strategy and successfully taken chunks out of Ethereum’s TVL across 2024. But there is work to do to increase from the 189 currently available to 1,264 on Ethereum.

In all, market sentiment since 2022 has looked favourably on Solana’s protocol. It is now one of the most popular and valuable blockchains due to its innovative consensus mechanism that supports exceptional scalability. Low transaction costs and efficient infrastructure make it attractive for developers and users alike, and its ecosystem is growing rapidly. Solana’s biggest challenge is eating away at Ethereum’s market share but, in our view, the technological foundations and rapid growth provide a springboard for future success. It is a valuable and useful blockchain.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Readers are encouraged to conduct their own research and seek professional advice before making investment decisions.

References

Chern, R. (2024). Turbine: Block Propagation on Solana. Available at: Helius (Accessed: 05 January 2025).

Kriptomat. (2024). What is cryptocurrency Solana (SOL) and how does it work? Available at: Kriptomat (Accessed: 04 January 2025).

Krupka, D. (2024). Solana Review: In-depth Analysis of the Scalable Blockchain. Available at: CoinBureau (Accessed: 06 January 2025).

Lovelyn, L. (2024). INTEROPERABILITY IS COMING TO SOLANA. Available at: Medium (Accessed: 06 January 2025).

McSweeney, M. (2024). Solana outage caused by a previously identified bug, devs say. Available at: Blockworks (Accessed: 06 January 2025).

ParaFi Capital. (2024). Solana’s Blockchain GDP. Available at: LinkedIn (Accessed: 05 January 2025).

Sheehan, C. (2024). How Many Solana Holders Are There? Available at: Spritz (Accessed: 04 January 2025).

Shen, M., et al. (2024). 2024 Crypto Developer Report. Available at: Electric Capital (Accessed: 05 January 2025).

Soon, M. (2024). Why Solana is one of the most popular cryptocurrencies of 2024? Available at: Northcrypto (Accessed: 06 January 20250).

Sygnum. (2024). Solana primer. Available at: Sygnum (Accessed: 05 January 2025).

Varshney, A. (2021). A Deep Dive Into Solana. Available at: CoinMarketCap (Accessed: 04 January 2025).

Yun, Y. (2024). Solana has 100M active wallets, but most are empty. Available at: Cointelegraph (Accessed: 05 January 2025).

Leave a comment