Unlocking Opportunities

The Approval of Crypto ETPs

Date of Publication

July 2024

Author

Charlie Kellaway

Reading Time

10 minutes

Introduction

Following US approval of spot bitcoin exchange-traded products (ETPs) in January 2024, investors are expectant that other cryptoasset products will soon be regulated, unlocking safer, more efficient trading [1]. However, the U. S. Securities and Exchange Commission (SEC), regulator of the largest market in the world, has so far had a firm and final say against additional listings.

With the popularity of BTC ETFs and the pace of growth in digital asset markets, how much longer can the SEC hold out? This piece discusses ETPs, the impact of approved bitcoin vehicles and what it means looking forward.

Exchange-Traded Products

Exchange-traded Products (ETPs) are a group of instruments that track underlying securities, indices or other financial products. They are similar to mutual funds, except ETPs trade throughout the day rather than at the end of trading hours. The product suite encompasses:

- Exchange-Traded Funds (ETFs) – a basket of investments that typically tracks an underlying index, but which can also follow an industry, sector or currency.

- Exchange-Traded Notes (ETNs) – generally track an underlying and trade like shares but are issued as bonds. They track unsecured debt instruments, paying the back the principal and any returns generated at maturity, but are dependent on the issuer’s creditworthiness.

- Exchange-Traded Commodities (ETCs) – structured as either ETFs or ETNs and offer exposure to commodity prices, spot or futures, without needing to physically hold the underlying.

ETPs trade continually on stock exchanges but rely on share creation and redemption by institutional traders to maintain the price of shares in line with assets in the pool. These Authorised Participants (APs) create shares by assembling the underlying securities in appropriate weightings and deliver them to an ETF sponsor [2]. In return, the sponsor bundles securities into the ETF wrapper and sends ETF shares back to the AP. These shares can then be introduced to the market.

When demand increases, more ETF shares can be created. When demand decreases, APs can redeem shares by reversing the process. Redemption units are collected and exchanged with the ETF sponsor for the underlying securities.

Investment in ETPs

This process allows investors to gain exposure to underlying assets without having to hold the assets themselves. A large portfolio of stocks, take the S&P 500, would cost investors considerably to build. But one share of an ETP captures the value of the basket and appreciates or depreciates in line with its constituents, saving investors the time and cost of building and adjusting a basket themselves.

Such accessibility unlocks diversity, as investors are exposed to indices and classes with a single trade. Commodities, debt, small- or large-cap stocks, sectors, volatility-linked instruments, leveraged instruments and more can all be accessed, making ETPs incredibly popular.

Globally, they attract huge investment. Fixed Income ETPs received US$25.1bn in Q2, up 5.02% on Q1 (US$23.9bn) [3]. US-listed ETFs captured US$37.4bn of investment, supporting total inflows of US$255.3bn into US equity ETFs through 2024 [4]. Leading providers hold assets under management (AUM) that increase at an astonishing rate. Leverage Shares, which started listing in 2017, surpassed $500mm AUM in 2023, and iShares, with 43 million investors, manages over US$2tn [5,6].

The London Stock Exchange (LSE) lists over 3,500 ETPs and has onboarded 231 so far in 2024 [7]. Meanwhile, the number of US ETPs grew 9.56% across 2023 to 3,368 products, totalling US$8.1tn AUM [8].

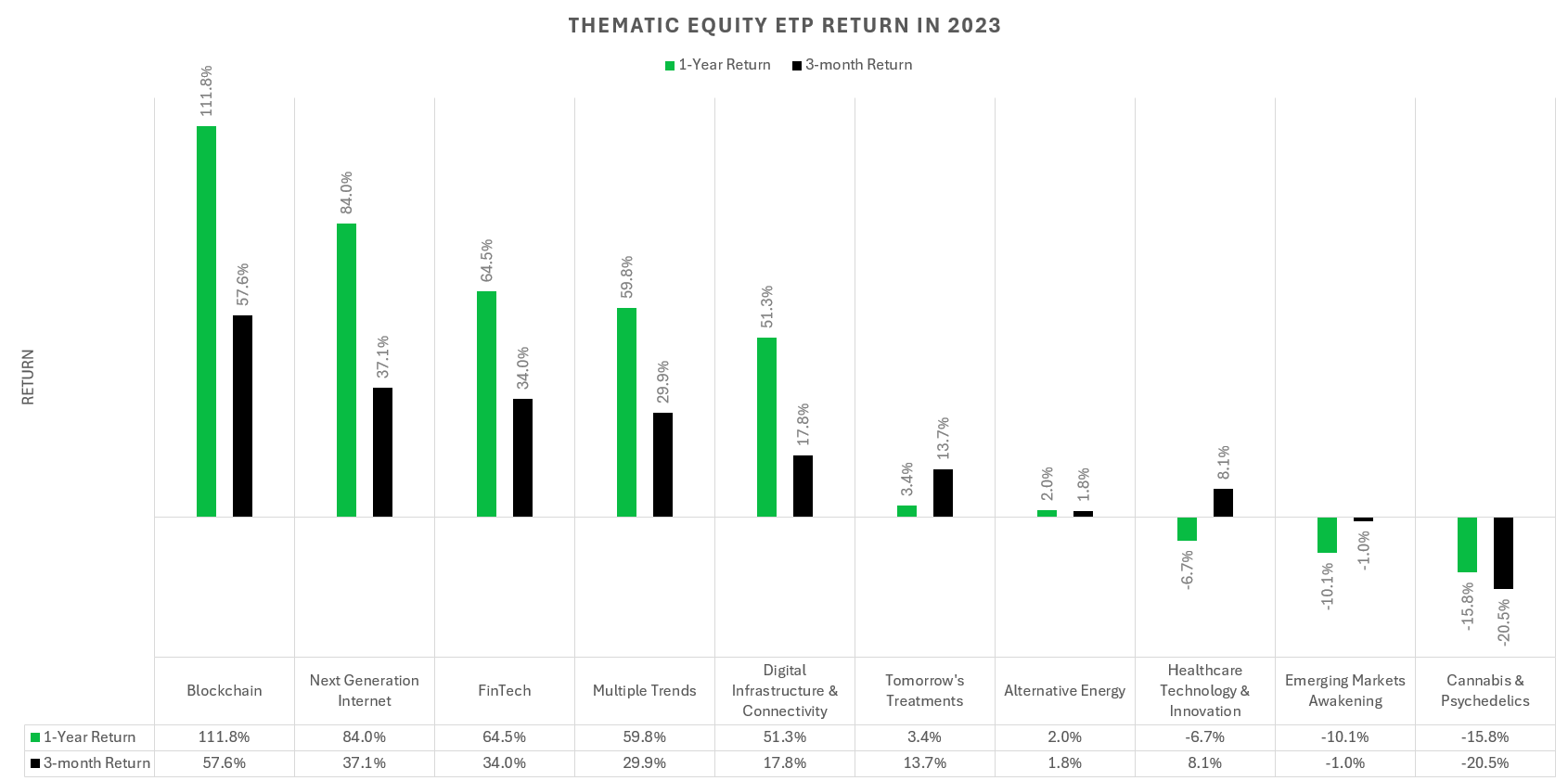

Investors use ETPs for diversified exposure and several themes have shown outsized strength in 2023. Blockchain, Next Generation Internet and Fin Tech all returned more than 60% for the year. Emerging financial technology has boomed.

Which brings us to cryptoassets.

Introducing Bitcoin ETPs

Bitcoin (BTC) is the first decentralised cryptocurrency and holds the largest market capitalisation of all blockchain native digital tokens. The SEC allowed the listing of BTC futures ETPs – instruments which invest in derivative contracts based on bitcoin prices – and ProShares launched the first in October 2021 [9]. However, they firmly rejected spot BTC ETPs, leading to near 10-year battles with would-be providers. By January 2024, the Commission had disapproved more than 20 exchange rule filings to list spot ETPs.

Spot ETPs differ from futures ETPs as they invest directly in BTC as the underlying asset. In rejection, the SEC cited industry immaturity and suggested that exchanges could not adequately prevent manipulative practices it deemed prevalent in the cryptocurrency market [10]. Frustratingly for providers, the first BTC and ETH (Ether – Ethereum’s native cryptocurrency) ETFs in North America were approved by Canada’s Ontario Securities Commission (OSC) in 2021 [11]. The US took almost three years to catch up.

In October 2022, Grayscale Investments, LLC, sponsor of a spot BTC ETP, filed a judicial challenge against the SEC, arguing that futures ETPs were “materially similar” to spot [12]. They reasoned that spot ETPs deserved similar treatment and further argued that the SEC’s treatment of BTC ETPs was inconsistent.

As to the futures ETPs, the Commission applied an exceedingly lax version of the test, essentially admitting that the test was not strictly satisfied but approving those ETPs anyway. But in disapproving the proposed spot bitcoin ETP here, the Commission applied an exceedingly stringent version of the test—going so far as to make findings that directly contradict findings that it made in its orders approving the bitcoin futures ETPs. That stark arbitrariness cannot be justified…The Commission has…failed to satisfy the APA’s requirement of reasoned decision making because it has not applied the test even-handedly to both categories of ETPs.

Brief of Petitioner, Grayscale Investments, LLC v. Securities and Exchange Commission

The US Court of Appeals for the District of Columbia agreed, ruling that the SEC had failed to adequately explain why it allowed BTC futures ETPs but not spot. Subsequently, on 10th January 2024, the SEC approved 11 spot BTC ETFs [13].

| Spot Bitcoin ETF | Ticker | Performance Since Inception | 3-month Performance |

|---|---|---|---|

| ARK 21Shares Bitcoin ETF | ARKB | 26.23% | -13.36% |

| Bitwise Bitcoin ETF | BITB | 26.29% | -13.34% |

| Fidelity Wise Origin Bitcoin Trust | FBTC | 26.53% | -13.40% |

| Franklin Bitcoin ETF | EZBC | 23.85% | -13.32% |

| Grayscale Bitcoin Trust | GBTC | 23.71% | -14.17% |

| Hashdex Bitcoin ETF | DEFI | 163.35% | -14.08% |

| Invesco Galaxy Bitcoin ETF | BTCO | 24.45% | -13.83% |

| iShares Bitcoin Trust | IBIT | 32.17% | -13.37% |

| Valkyrie Bitcoin Fund | BRRR | 26.27% | -13.37% |

| VanEck Bitcoin Trust | HODL | 31.10% | -13.31% |

| WisdomTree Bitcoin Fund | BTCW | 26.32% | -13.32% |

Source: LSEG Workspace

Approval has materially impacted the market. The UK’s Financial Conduct Authority (FCA) somewhat followed suit, allowing LSE to launch Crypto ETNs in May, though only for professional investors [14,15]. But US ETFs have quickly attracted activity. Within two months, the 11 instruments cumulatively captured US$9.6bn in net fund flows and contributed, on average, to 2.8% of total US ETF daily volume, peaking at 8.4% on 28th February [16]. Retail was heavily engaged, trading 19.9 million shares of IBIT, 10.8 million shares of GBTC and 9.9 million shares of FBTC across the period.

Though recently cooling off, noted by a drop in performance over the last three months, all instruments are up since inception and daily trading volumes remain high. Volume highlights the number of shares traded, whilst turnover reflects the cumulative value transacted (volume * price).

| Spot Bitcoin ETF | Market Price (USD) | Daily Volume | Turnover (USDmm) |

|---|---|---|---|

| ARK 21Shares Bitcoin ETF | 57.62 | 1,701,746 | 98.68 |

| Bitwise Bitcoin ETF | 31.42 | 2,135,743 | 67.54 |

| Fidelity Wise Origin Bitcoin Trust | 50.43 | 4,216,145 | 213.98 |

| Franklin Bitcoin ETF | 33.47 | 204,967 | 6.89 |

| Grayscale Bitcoin Trust | 51.54 | 2,903,952 | 149.48 |

| Hashdex Bitcoin ETF | 66.50 | 1,414 | 0.95 |

| Invesco Galaxy Bitcoin ETF | 57.64 | 311,273 | 18.08 |

| iShares Bitcoin Trust | 32.85 | 16,920,991 | 559.31 |

| Valkyrie Bitcoin Fund | 16.34 | 274,498 | 4.51 |

| VanEck Bitcoin Trust | 65.20 | 205,716 | 13.52 |

| WisdomTree Bitcoin Fund | 61.21 | 256,032 | 15.78 |

Source: LSEG Workspace

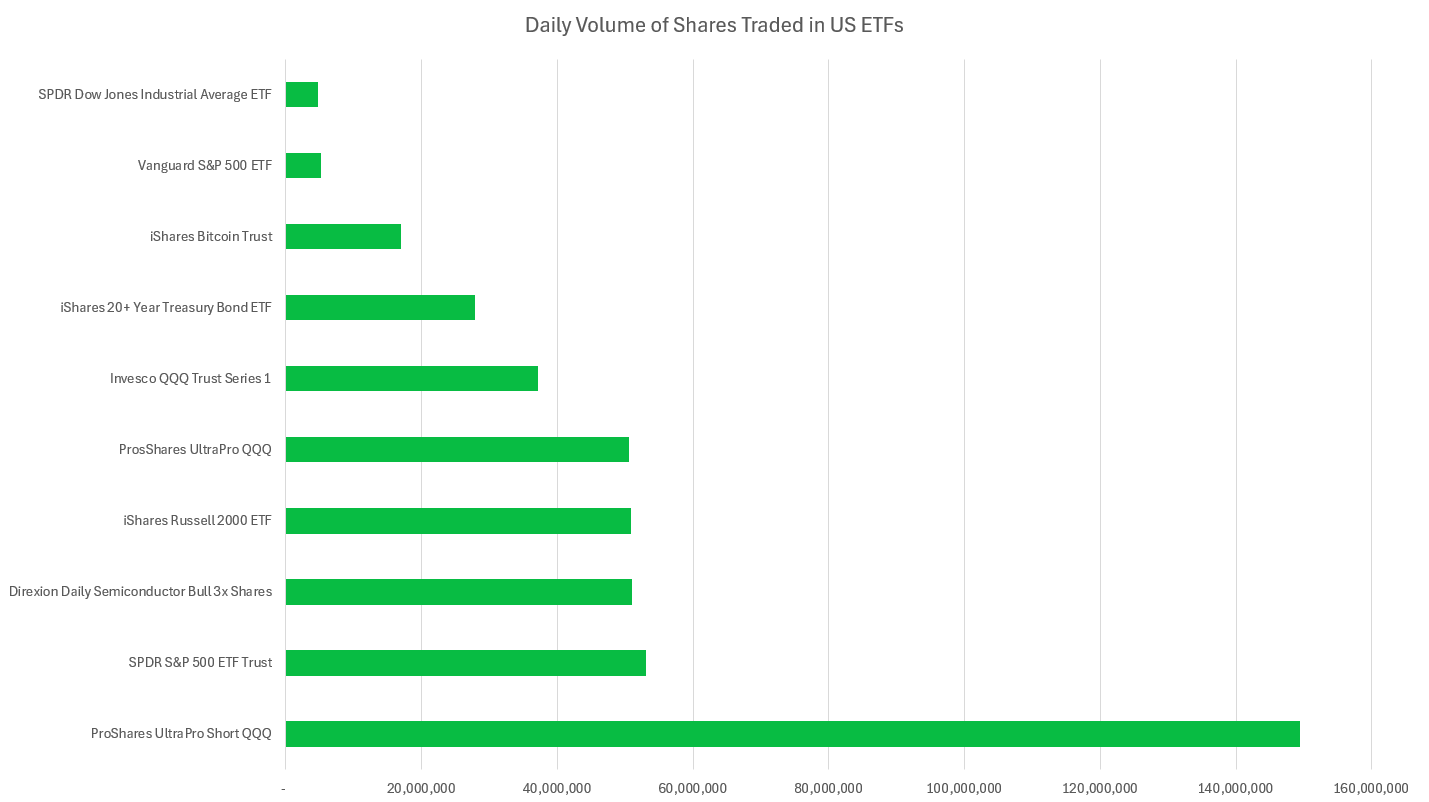

iShares Bitcoin Trust has kept pace with the volume traded in some of the most popular US ETFs – instruments that turnover extraordinary value each day. The Dow Jones Industrial Average ETF, for example, records a daily turnover of US$1.89bn. Their popularity hammers home recognition by some at the SEC of failure to foster innovation and an abuse of power to quell demand when, in fact, focus on safe deployment should have been paramount [17]. Bitcoin ETFs have provided accessibility to institutional and retail investors.

Investors could already gain exposure to bitcoin, through cryptocurrency exchanges, peer-to peer payment apps and futures. Bitcoin ETPs have traded in Europe since the WisdomTree Physical BTC ETP launched in 2019 [18]. But they do not meet a structure that enjoys the benefits of UCITS (Undertakings for Collective Investment in Transferable Securities), Europe’s regulatory framework for mutual funds. The SEC’s approval offers investors more protection in the world’s biggest market.

Firstly, sponsors must provide full disclosure, including public registration statements and periodic filings, creating transparency. Secondly, registered exchanges implement rules designed to protect investor and public interest and these standards apply to BTC ETPs. For example, fiduciary duty requirements are extrapolated under the Investment Advisers Act. Both outcomes are positive for investors who had previously gained exposure through less efficient and less protected means and suffered the consequences. Hacks and frauds have been abundant.

Lastly, regulatory approval of 11 ETPs creates competition, benefiting investors by encouraging more competitive terms, and have tested the waters for viability of other regulated digital asset instruments. Providers and investors have turned their focus to Ether, Solana and wider.

What Comes Next

Though the SEC approved certain spot bitcoin ETPs, they did not approve bitcoin. They also, until recently, rejected advances for Ethereum ETFs, despite accusations that they regulate digital assets by enforcement, rather than working with providers to foster innovation.

On 23 May 2024, this changed. The SEC approved applications from three major exchanges to list ETH ETFs, shifting their approach significantly [19]. Up to that point, the SEC had, in fact, undertaken enforcement action against Consensys, a global blockchain company founded by one of Ethereum’s creators, and appeared determined to categorise ETH as a security. But, after closing their investigation, the SEC’s stance softened.

These instruments will not be immediately open to investors. The SEC will review registration statements for each proposal and timelines for listing have not been provided. In addition, the SEC precluded any staking of Ether within the ETF [20]. Staking is key to the security of Ethereum’s blockchain, allowing users to pledge ETH in support of developmental activities and receive yield in return. Providers of ETH ETPs will not be allowed to engage in this activity.

When they do come to market, ETH ETFs will further enable institutions and retail to efficiently diversify their portfolios. But there is no roadmap to bring other digital assets into these vehicles and no expectation that bitcoin or Ether will be protected by US securities laws any time soon. Noting discontent at the preclusion of staking, it has also been suggested that ETH ETFs will not conjure the same trading activity as BTC ETFs, which is unlikely to quicken the SEC’s progress on regulating other cryptoasset funds.

The prospect of multiple cryptoasset ETFs would change the landscape for both digital and traditional assets, significantly integrating and likely correlating the two worlds. This scenario, however, still seems distant. The approval of ETH ETFs hints at a softening stance towards crypto and investors can glimpse a more stable and regulated environment. But the landscape evolves slowly and is dependent on proactive thought leadership from the SEC to guide an innovative, safe environment. Investors want it and investors need it. As regulator of the largest market in the world, the SEC must deliver it.

[1] Gensler, G. (2024). Statement on the Approval of Spot Bitcoin Exchange-Traded Products. Available at: U.S. Securities and Exchange Commission (Accessed: 11 January 2024).

[2] State Street. (2024). How ETFs Are Created and Redeemed. Available at: State Street (Accessed: 12 July 2024).

[3] iShares by BlackRock. (2024). Global ETP Flows – May 2024. Available at: BlackRock (Accessed: 12 July 2024).

[4] Straus, D., Zhang, T., & Ma, L. (2024). June 2024: U.S. Listed ETFs have pulled in $437 billion by mid-year. Available at: National Bank of Canada (Accessed: 12 July 2024).

[5] Leverage Shares. (2023). Our Story. Available at: Leverage Shares (Accessed: 12 July 2024).

[6] iShares by BlackRock (2024). 2024 ISHARES REPORT ON INVESTOR PROGRESS. Available at: BlackRock (Accessed: 11 July 2024).

[7] Issuers and Instruments Issuers Reports | London Stock Exchange.

[8] Poser, S. W. (2024). 2023: The Year in U.S. ETPs. Available at: NYSE (Accessed: 12 July 2024).

[9] Hughes, T. (2021). ProShares to Launch the First U.S. Bitcoin-Linked ETF on October 19. Available at: ProShares (Accessed: 12 July 2024).

[10] Cieplak, J., Gilbride, A., Valdez, Y. D., Wink, S. P., & Behar, D. (2024). SEC Issues Omnibus Approval for Spot Bitcoin Exchange-Traded Products. Available at: Global Fintech & Digital Assets Blog (Accessed: 13 July 2024).

[11] Smith, F., & Randall, D. (2021). Canadian regulator clears launch of world’s first bitcoin ETF – investment manager. Available at: Reuters (Accessed: 10 July 2024).

[12] Brief of Petitioner at 20, 34, Grayscale Investments, LLC v. Securities and Exchange Commission, No. 22-1142 (D.C. Oct. 11, 2022). Available at: gov.uscourts.cadc.38827.1208460857.0.pdf (courtlistener.com)

[13] Wade, J., & Adams, M. (2024). Spot Bitcoin ETFs: What Are They, And How Do They Work? Available at: Forbes (Accessed: 10 July 2024).

[14] Financial Conduct Authority. (2024). FCA updates position on cryptoasset Exchange Traded Notes for professional investors. Available at: Financial Conduct Authority (Accessed: 10 July 2024).

[15] LSEG. (2024). CRYPTO ETN ADMISSION FACTSHEET. Available at: crypto_etn_admission_factsheet.pdf (londonstockexchange.com) (Accessed: 24 May 2024).

[16] Davis, K. (2024). How Spot Bitcoin ETFs are Performing Across Exchanges. Available at: Cboe (Accessed: 13 July 2024).

[17] Pierce, H. M. (2024). Out, Damned Spot! Out, I Say!: Statement on Omnibus Approval Order for List and Trade Bitcoin-Based Commodity-Based Trust Shares and Trust Units. Available at: U.S. Securities and Exchange Commission (Accessed: 13 July 2024).

[18] WisdomTree. (2024). WisdomTree Lists Physically Backed Bitcoin and Ethereum ETPs on London Stock Exchange. Available at: WisdomTree (Accessed: 10 July 2024).

[19] Burgoyne, M. T., & Fouin, L. (2024). Securities and Exchange Commission approval of Ether ETFs. Available at: Osler (Accessed: 12 June 2024).

[20] Castelluccio, J. A., Pinedo, A. T., & Birdsall, J. B. (2024). SEC Approves Listings of Spot Ether ETFs: Waiting Is the Hardest Part. Available at: Mayer Brown (Accessed: 13 July 2024).