Chain of Events

Timeline of crypto and blockchain news across 2024

January 2024

Bitcoin starts the year at $42,152. 10 days into 2024, after years of applications from numerous entities, the U.S. Securities and Exchange Commission (SEC) approves the first Spot Bitcoin Exchange-Traded Products. It is declared a watershed moment in Bitcoin’s history, allowing mainstream investors to partake within regulated financial infrastructure.

February

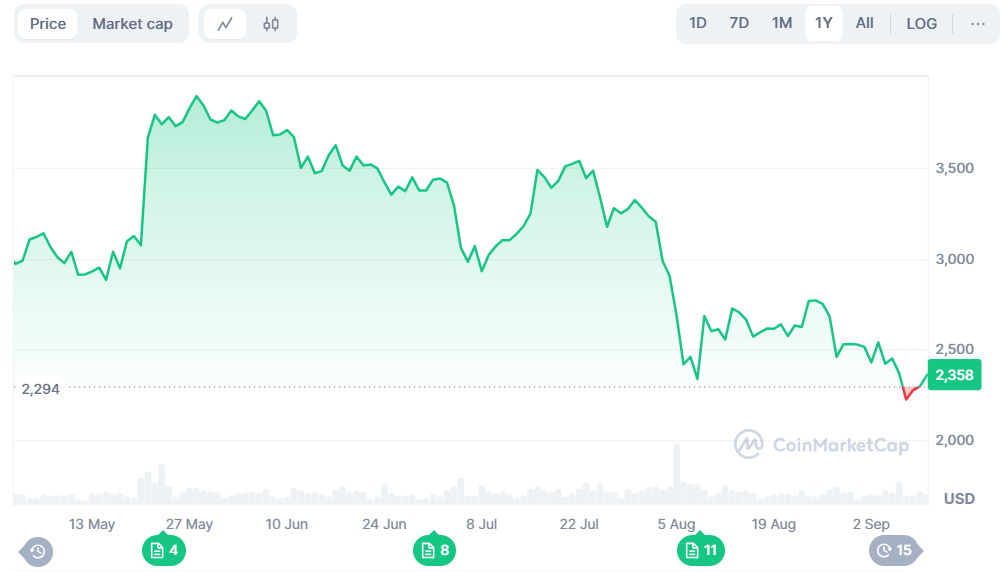

Bitcoin’s price rises 45% in February, breaking $60,000 for the first time since Q4 2021. Ethereum jumps 48%.

March 2024

Bitcoin hits a new all-time high of $73,664 on 13 March. U.S. Bitcoin ETFs receive record-breaking inflows of $102.5bn across the month, up 77% on February ($58bn).

On 28 March, Sam Bankman-Fried, founder of failed firms FTX and Alameda Research, is sentenced to 25 years for orchestrating multiple schemes that defrauded FTX investors of $1.7bn and defrauded lenders to Alameda of more than $1.3bn.

April 2024

The bitcoin halving on 19 April reduces block rewards from 6.25 to 3.125 bitcoins. It is block number 840,000 and, at this point, 93.75% of the maximum 21 million supply of bitcoin has been mined.

Changpeng Zhao, former CEO of Binance, is sentenced to four months after pleading guilty to money-laundering violations. He and Binance were fined $50mm and $4.3bn in 2023, respectively.

May 2024

On 23 May, the SEC approves applications from Nasdaq, CBOE and NYSE to list Ethereum spot ETFs in the U.S., making ether the second cryptocurrency approved for spot ETF trading. Trading will begin in July 2024.

June 2024

On 19 June, the SEC classifies ether as a commodity, aligning with the Commodity Futures Trading Commission (CFTC). It is a significant win for Ethereum, providing reprieve from potential regulatory actions had ether been classified a security.

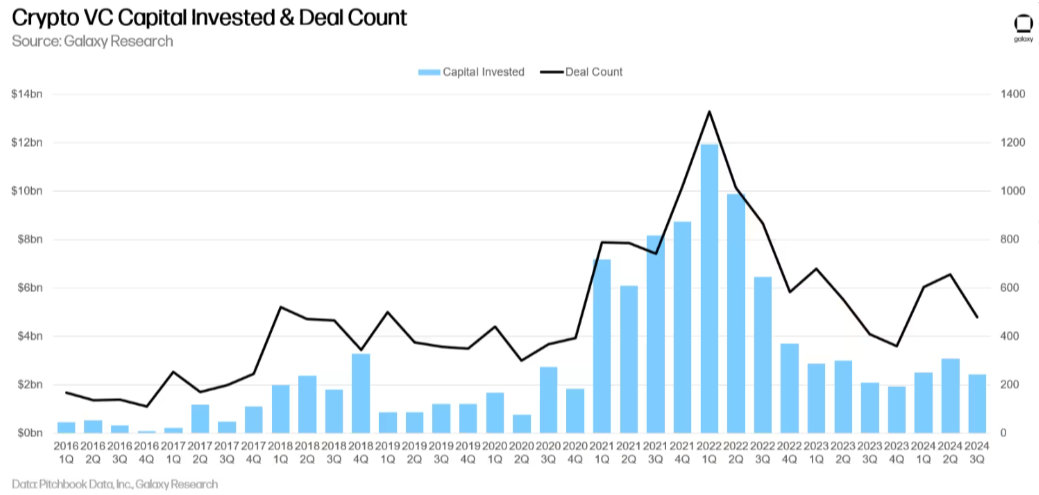

Across Q2, venture capitalists invest $3.19bn into crypto and blockchain companies: up 27.6% on Q1 and the highest allocation of capital since $3.7bn in Q4-22. Companies operating in the “Web3/NFT/DAO/Metaverse/Gaming” category raised the largest share, 24%, totalling $758mm. Infrastructure, Trading and Layer 1 companies received 15%, 12% and 12, respectively.

July 2024

Ethereum ETFs launch on 23 July. Immediately after, ether declines 8%, though the ETFs themselves fare well and attract $361mm across 9 issues within the first 90 minutes of trading.

August 2024

The crypto market loses 15% in the first week of August, falling from $2.33tn to $1.98tn. Bitcoin falls 13.28% across the period, Ethereum 23.89%: its steepest fall since 2021.

Investors are spooked by rising volatility and macroeconomic factors in global markets, and most crypto assets fall sharply over the month as fundamental usage wavers. The market cap of all Smart Contract Platforms closes August 12% lower than July.

September 2024

VC investment in crypto startups falls 20% in Q2 to $2.4bn across 478 deals (-17% QoQ). U.S.-headquartered recipients dominate, procuring 56% of investment from 44% of all deals globally.

Dubai’s Virtual Assets Regulatory Authority (VARA) grants full regulatory approval to crypto exchange OKX, following Binance and Crypto.com in the past year, as the UAE pitches to become “the global crypto hub”.

On 24 September, Caroline Ellison, former CEO of Alameda Research, is sentenced to two years for her role in the collapse of affiliated crypto exchange FTX. Ellison had faced a maximum sentence of 110 years but was the key witness for the prosecution against Sam Bankman-Fried.

October 2024

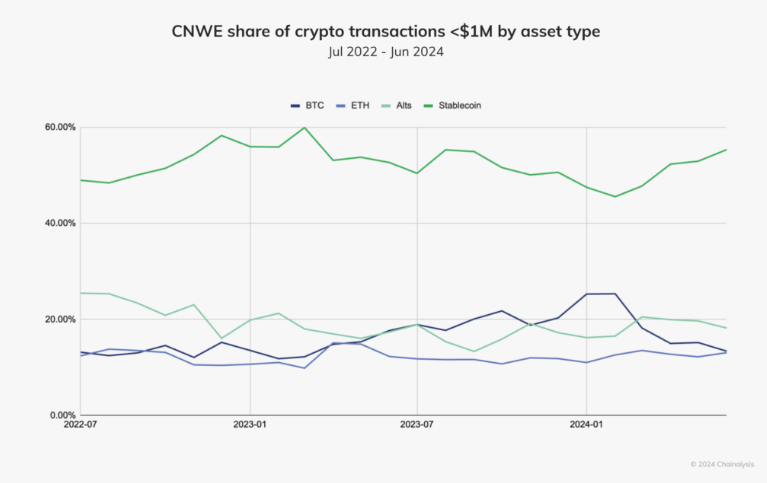

Tether’s USDt, the world’s largest stablecoin, surpasses $120bn on 20 October. One day later, payment processing giant Stripe agrees to acquire stablecoin platform Bridge for $1.1bn to support stablecoin payments. It is indicative of a strong year for stablecoins in which their share of transactions has increased, particularly in Central and Northwestern Europe.

FTX receives court approval of its bankruptcy plan to fully repay customers using up to $16.5bn in assets recovered since the exchange collapsed. FTX plans to repay 98% of its customers – those who held $50,000 or less on the exchange – within 60 days of the plan’s effective date.

Meanwhile, World, co-founded by Sam Altman and Alex Blania, launches its layer-2 blockchain: World Chain. The blockchain prioritises verified human users over bots, giving them access to block space and an allowance of free gas. 15 million human users have been verified using their irises and received ‘World IDs’.

November 2024

Donald Trump is voted in for his second term as U.S. President. In part due to Trump’s crypto-friendly stance, and the resignation of SEC Chairman Gary Gensler, investors bet on greater political and regulatory support from the incoming administration. Bitcoin reaches a new all-time high of $98,739 on 22 November.

MicroStrategy (MSTR.O), openly declaring leveraged bets on bitcoin, surges 68% across the month, from $229.35 to $386.32, topping at $470.98 on 20 November. By 2 December, MicroStrategy owns 1.9% of all bitcoin in circulation.

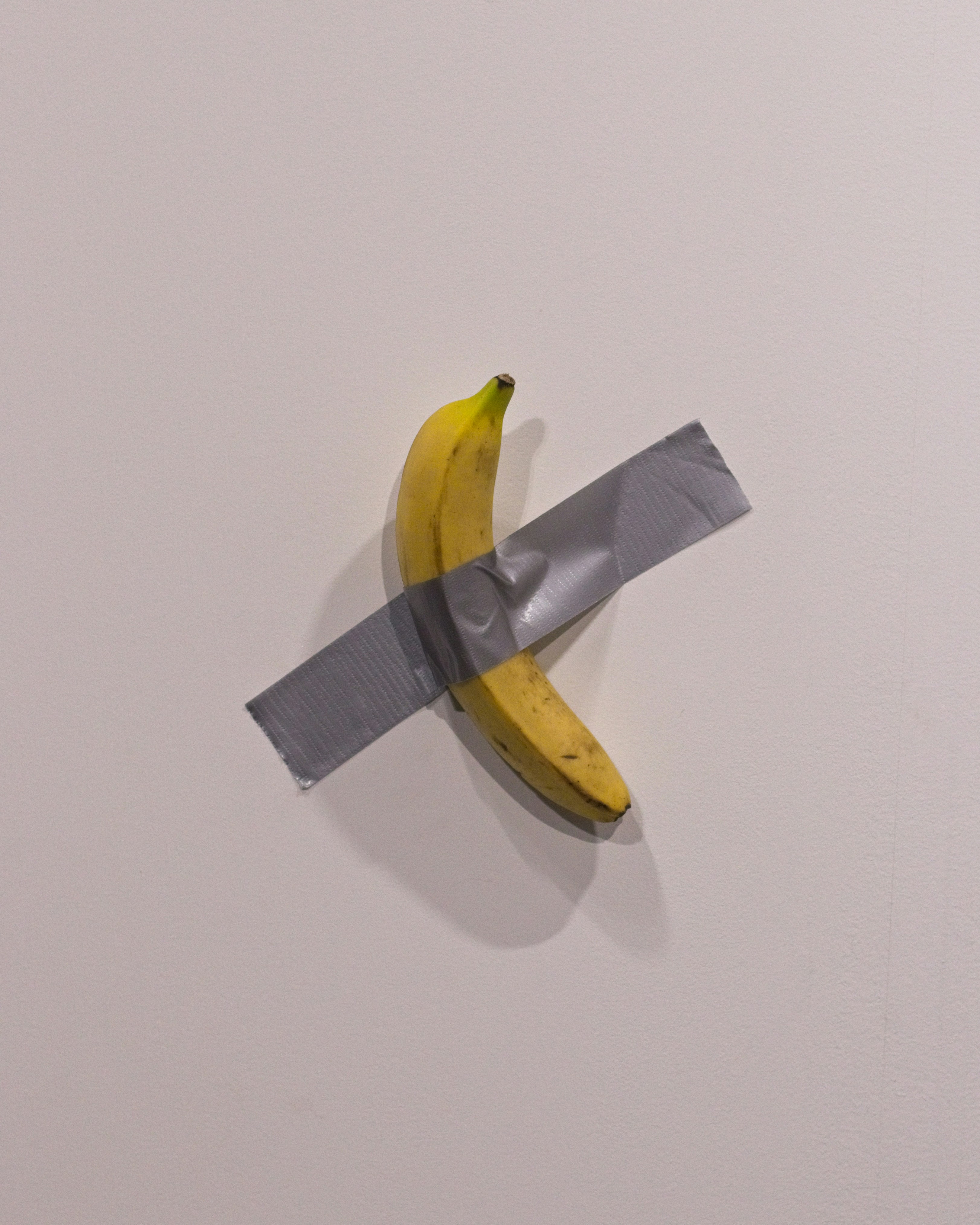

TRON founder Justin Sun acquires the artwork Comedian – dubbed the “world’s most expensive banana” – for $6.24mm on 21 November. Shortly after, TRON’s market cap rises 11.65% to $19.07bn in a stunt that encapsulates the value of attention in crypto. Mr Sun eats the banana a week later at a news conference in Hong Kong.

December

On 4 December, bitcoin surges above $100,000 for the first time in its history. On 15 December, Trump reveals plans for a bitcoin strategic reserve in the U.S., and bitcoin tops $107,756 a day later. It has appreciated 59% since Trump’s election victory and 156% across the year. $100,000 per coin values bitcoin over $2tn, making it the seventh most valuable asset in the world.

Gensler, G. (2024). Statement on the Approval of Spot Bitcoin Exchange-Traded Products. Available at: U.S. Securities and Exchange Commission (Accessed: 11 January 2024).

Bitcoin price – CoinMarketCap.

Sigel, M., & Bush, P. (2024). VanEck Crypto Monthly Recap for August 2024. Available at: VanEck (Accessed: 07 December 2024).

Thorn, A., & Parker, G. (2024). Crypto & Blockchain Venture Capital – Q2 2024. Available at: Galaxy (Accessed: 05 December 2024).

Ethereum price – CoinMarketCap.

Thorn, A., & Parker, G. (2024). Crypto & Blockchain Venture Capital – Q3 2024. Available at: Galaxy (Accessed: 07 December 2024).

Chainalysis Team. (2024). Stablecoins dominate market share, Bitcoin grows, and merchant services thrive in Central, Northern, & Western Europe. Available at: Chainalysis (Accessed: 05 December 2024).

MSTRO. price – Reuters.