Valuation Methodology for Protocols

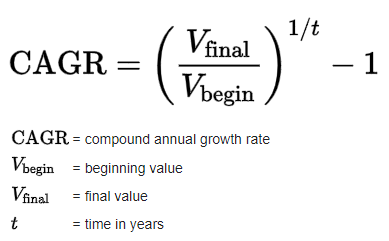

Compound Annual Growth Rate - the mean annual growth rate of an investment over a period longer than one year, calculated as: [(Final Value/Start Value) ^ 1/periods] - 1 Compound Quarterly Growth Rate - as above, but over quarterly periods. Discount Rate - the interest rate used to convert future cash flows into an equivalent present value. Discounted Cash Flow - financial model that determines whether an investment is worthwhile based on future cash flows, centering a company's value on how well it can generate cash flows for investors in future. Market Capitalisation/Net Assets Ratio - indicates how changes in a DeFi protocol's net assets affect its underlying value. Assets in the treasury are used to fund future projects voted on by holders of a protocol's native token. A similar calculation in traditional finance would be Price-to-Book. Market Capitalisation/Total Value Locked Ratio - TVL is the dollar value of funds currently being staked in a DeFi protocol, where a higher value benefits users more. Therefore, a ratio of less than 1.0 indicates strength of the platform. Present Value - the current value of a future sum of money or stream of cash flows, calculated as: PV = FV / (1 + discount rate)^period Price/Fees Ratio - indicates how the market values fees generated by a dApp. Can be used in place of P/S if a protocol does not generate revenues (rather, reinvesting them) and is a strong indicator of the long-term ability of the platform to sustain itself. Price/Sales Ratio - allows investors to calculate the price of a native token as a multiple of the protocol's revenues and also enables comparison with similar protocols. Note, though, that not all blockchains recognise revenues, with some reinvesting them back into the protocol for growth. Terminal Value - the present value at a future point in time of all future cash flows when we expect stable growth rate forever.