Venture

The Role of Venture Capital in Blockchain

Date of Publication

May 2024

Author

Charlie Kellaway

Reading Time

9 minutes

The Role of Venture

For a fledgling industry, there is little needed more than the investment and guidance of venture capitalist (VC) funds. VCs are experts at evaluating opportunities and rigorously screen markets, strategies, technologies, adoption, competition and founding teams to determine the upside and risks of a given investment. The goal is to connect private equity investors with money, but no ideas, to entrepreneurs with ideas, but no money (of course, primarily to provide investment return for Limited Partners (LPs) who entrust the fund with their cash). But without VC support, start-ups face the challenge of reaching the next stage of development on shoe-string budgets, so there is extensive economic benefit realised by astute venture investments.

Blockchain, or distributed ledger technology (DLT), is not yet mature and many firms are very much in their infancy. The guidance of global private equity investment can support growth in this industry. Recognising potential, VCs poured more than US$21 billion into crypto startups across 2021, in line with the historic bull run [1]. However, acute withdrawals followed during the crypto winter, with inflows dropping as low as US$0.5 billion in August 2023 [2].

Recent signs of institutional involvement with cryptoassets and DLT indicate that investors may be coming back. We investigate why blockchain projects need funding and why the industry is still attractive to private investors, to understand where private equity and DLT can take each other.

Why Blockchain Needs Venture Capital

Private equity holders collectively lost billions following the collapse of former cryptocurrency exchange FTX. Sequoia Capital, one of the world’s most distinguished VC firms, wrote off a US$214 million investment in FTX, and Tiger Global was also directly affected [3]. Subsidiaries of venture firm Digital Currency Group were in peril, with Genesis revealed to have lent hundreds of millions of dollars to Alameda Research (the hedge fund affiliate of FTX). This had further knock-on effects to cryptocurrency exchange Gemini, to which Genesis owed US$900 million [4].

FTX’s bankruptcy was last in a run of high-profile incidents in 2022, with crypto hedge fund Three Arrows Capital and stablecoin ecosystem Terra also collapsing. Investors reacted: though VC funding has shrunk across most markets, blockchain companies experienced an especially acute correction [5]. From the highest point in Q1 2022, during which VC funds invested US$12 billion into DLT projects, funding fell to under US$2 billion in Q4 2023 – a decrease of more than 83% [6].

Why is this important? Though it is estimated that only 1% of businesses in the US receive VC funding, a hugely disproportionate 60% of firms that go public are VC funded [7]. Globally, private equity investments drive innovation, economic growth and job creation, but they also support management with building a defensible business that is positioned for prosperity. Consider Apple, Meta and YouTube: some of the largest companies in the world. All were backed by VCs to get them where they are.

From proof-of-concept, through commercialisation to scale-up, VCs principally offer start-ups financial support and guidance to reach their potential. Connecting dormant capital with those harbouring the best ideas is fundamental to success, so a dearth of investment in blockchain-focused funds hinders innovation and growth in DLT. Blockchain projects have yet to reach their full potential.

Estimates place the cost of developing a public blockchain at more than US$500,000 and developing decentralised applications (dApps) at US$10,000-200,000 [8]. Infrastructure, security, regulatory compliance, storage and cloud costs must all be considered, plus long-term maintenance, upgrades and scalability. The technology demands highly qualified developers and engineers to succeed, is often experimental, continues to suffer from hacks and attacks and has experienced slow public uptake. For these reasons, many DLT companies are immature and capital-intensive but must move quickly to beat competition. Blockchain projects arguably need funding more than ever: it is critical to support operations, whilst the guidance experienced investment professionals provide to navigate product maturation can help transition DLT to an efficient, interoperable and accessible financial system.

Of course, VCs also benefit users of supported decentralised ecosystems. Funding is raised in discrete rounds, each supporting a start-up’s operations for a specified period to reach a predefined operating milestone. Staged funding allows VCs to assess progress and allocate follow-on capital to the best performing companies [9]. The large number of portfolio companies and high rates of failure require VCs to potentially write off underperforming investments quickly to refocus time and mentorship on the most promising. If done well, successful companies should be healthy, valuable and provide utility to users.

What Does Venture Capital See in Blockchain

The VC model takes minority stakes in start-ups seeking to develop defensible, fast-growing businesses by disrupting existing services through innovation. This investment style is characterised by tail-end returns, spreading capital out so that one or two home runs offset failed investments, which invites investors to look beyond traditional investments in search of new and alternative opportunities. With DLT, the opportunities are profound.

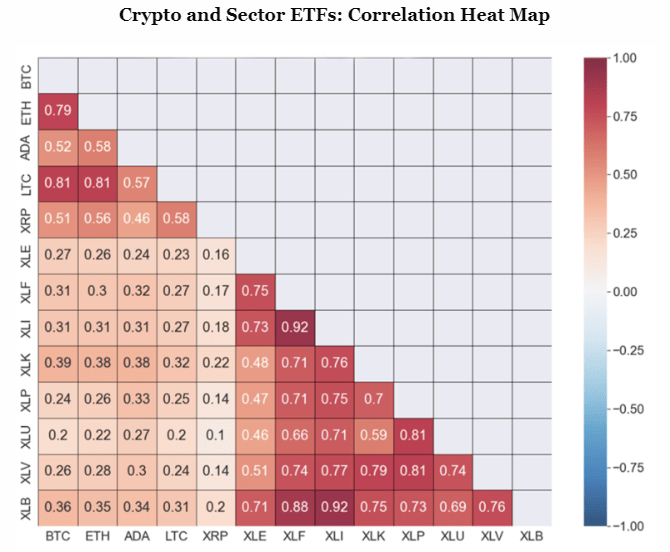

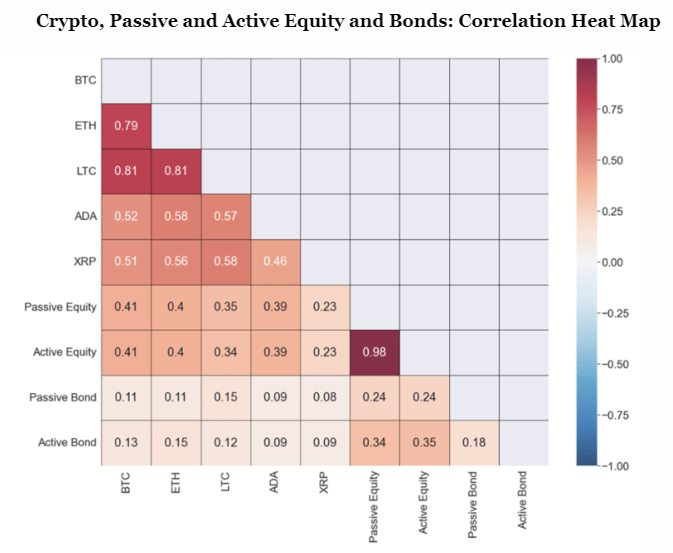

Firstly, blockchain investments offer diversification. Cryptoassets show weak positive correlations with US sector ETFs, weaker still with bonds and sometimes negative correlation with commodities [10]. Of course, exposure is not limited simply to cryptoassets; LPs can also invest in the private equity of a company operating a blockchain or dApp or provide capital to a VC fund investing in the space. Investing in decentralised finance (DeFi) applications on Ethereum, for example, may offer diversification benefits for long-horizon investors who can handle the short-term volatility that has become synonymous with DLT projects.

Secondly, DeFi has unlocked liquidity for private investors. With traditional investments, LPs are (usually) locked in until the initial public offering (IPO) or acquisition. But DeFi is a sector of decentralised applications focused on transforming finance with open-source, efficient and trust-less solutions. For example, by leveraging tokenised funds – funds that issue digital tokens to investors, rather than shares or units – LPs can efficiently adjust their positions on a secondary market, buying more or selling out to other investors ahead of fund maturity. Digital assets can be bought directly, which invites a more diverse group of investors into the private equity ecosystem, further increasing liquidity [11]. In theory, even retail investors could purchase tokenised funds and easily support fledgling companies with their capital.

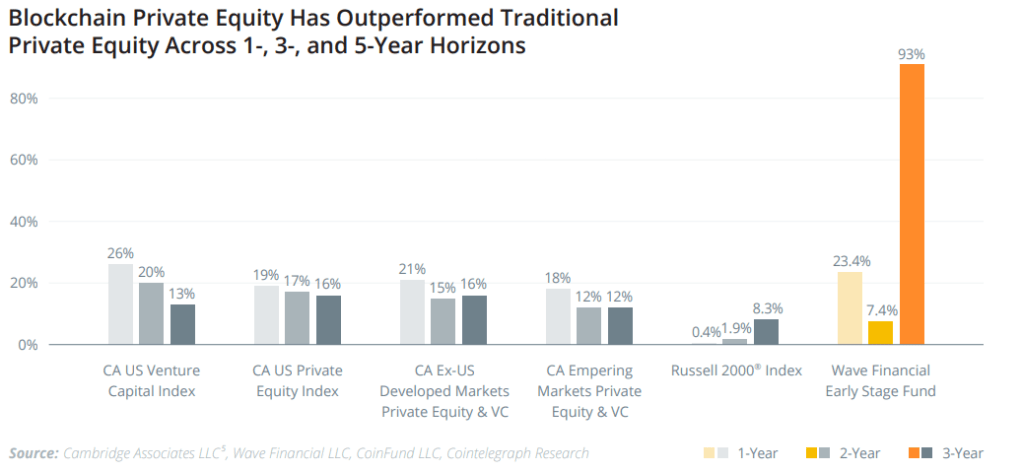

And, of course, there is the allure of finding the next unicorn. VCs will be attracted by the possibility for outsized returns – Cointelegraph’s Blockchain Venture Capital Report identified that the top blockchain VC funds consistently outperformed traditional VC funds (though we note this research is from 2021). Andreessen Horowitz (a16z), for example, first invested in cryptocurrency exchange Coinbase in 2013. Their cumulative stake was valued at US$11 billion when Coinbase went public in 2021 [12].

Unicorns are not an unrealistic goal. DLT is expected to revolutionise operating structures, grow as an industry from US$27.84 billion in 2024 to a market size of US$826 billion by 2032 and drive expansion of the next iteration of a decentralised World Wide Web – Web 3.0 [13].

Consider, for one, the integration of DeFi applications with traditional finance (TradFi) structures. TradFi institutions (banks and other financial intermediaries) initially approached crypto with caution, but more recently recognise the potential of blockchain to reshape numerous facets of financial transactions, from payment processing to asset management [14]. Several large financial institutions, including Citi, J.P. Morgan, Mastercard, Swift, U.S. Bank, Wells Fargo and Visa, are exploring tokenising financial instruments to settle trades on a single ledger, for example [15]. Firms must now decide how to invest in DLT. Participation requires new technological capabilities, which may be accessible to large traditional intermediaries but, for the majority of small or medium-sized enterprises (SMEs), building and maintaining in-house solutions will likely be cost prohibitive [16]. This opens to door to service providers in the crypto activity chain and hands the initiative to start-ups to partner and integrate with TradFi institutions. Existing examples include Franklin Templeton’s launch of the Franklin OnChain U.S. Government Money Fund (FOBXX), which uses the Stellar blockchain to process transactions and record ownership, or T. Rowe Price experimenting with FX swaps on Avalanche [17] [18]. Venture capital can support these partnerships.

Increasing interest from TradFi institutions also suggests existing intermediaries are working out that they must invest just to maintain relevance in a rapidly evolving financial landscape. DLT promises secure, transparent and efficient mechanisms for payments and settlements, cross-border transactions and the execution of smart contracts. Digital asset ecosystems support new value creation, diversification and product launches. Decentralised networks may deliver capabilities to reach 1.4 billion unbanked people globally [19]. The blockchain industry has created a robust financial ecosystem within a very short time frame and TradFi institutions face the risk of displacement.

For VC firms, this should be a win-win. Supporting businesses that partner with global financial leaders is one thing; supporting businesses that displace global financial leaders is another level. DLT might just get there, noting relevant disruption in other industries such as Insurance and Agriculture. We liken this period to getting in early on the largest internet companies of the 2000s and suggest that the opportunities for home runs in blockchain are abundant.

What’s Next

The blockchain industry has had a rocky couple of years, with notable projects collapsing, private equity withdrawing and cryptoassets such as Bitcoin (BTC) losing around two thirds of their value. Despite this, increased regulatory oversight and institutional adoption mark a shift in attitude towards blockchain, which should encourage safer innovation to better serve users. By way of example, the SEC approved BTC exchange-traded funds (ETFs) in January 2024, a step towards normalising cryptoassets and facilitating easier exposure to BTC for the likes of pension funds and retail investors [20]. In Europe, the Markets in Crypto-Asset Regulation (MiCA) entered into force during 2023 to regulate the transparency, disclosure, authorisation and supervision of cryptoasset transactions.

DLT has created new channels for collecting capital and there is evidence that projects are maturing. Protocols are gaining positive momentum, with many reporting their highest user adoption since the crash of FTX, whilst experienced developers working on blockchain projects increased by 16% across 2023 [21]. The cryptoasset market rose in Q1 2024 and Bitcoin even surpassed its previous record market capitalisation, set in 2021.

There are signs that VCs are responding to this optimism. As reported by Galaxy, after three consecutive quarters of declining deal count and capital invested, both rose in Q1 2024, with US$2.49 billion invested across 603 deals. Deal count shot up 58% quarter-on-quarter, though the median deal size remained steady at US$3 million. About 80% of funding focused on early-stage companies. Infrastructure was the most popular investment focus (24% of capital allocation), followed closely by Web3/Gaming (21%) and trading/exchange functions (17%).

Where will funding come from? Established venture firms have taken a keen interest in the industry, for the reasons stated above, and include:

- a16z: one of the most recognisable venture firms globally launched their crypto fund for web3 and crypto startups, having first invested in Coinbase in 2013.

- Draper Associates: founder Tim Draper was an early backer of Bitcoin and his firm is investing more and more in decentralised science, decentralised government, decentralised real estate and decentralised insurance.

- Pantera Capital: participates in seed round, early-stage, and later-stage funding, primarily in the blockchain and software-as-a-service sectors.

- Sequoia Capital: announced a crypto investment fund in 2022 but has since cut the fund size by over 50% in response to the downturn in private markets.

This has encouraged participation from established financial institutions. The table below shows the number of VC deals undertaken by TradFi intermediaries since 2017, as of September 2023 [22].

| Traditional Finance Institution | Deal Count |

| Franklin Templeton | 19 |

| The Goldman Sachs Group | 12 |

| Citigroup | 10 |

| JP Morgan Chase | 8 |

| Barclays | 8 |

| BNY Mellon | 7 |

| Monex Group | 5 |

| United Overseas Bank | 5 |

| UBS Group | 5 |

| Canaccord Genuity | 3 |

Additionally, crypto native enterprises are deploying their own venture arms to support pre-seed, seed and scale projects. Examples include:

- Algorand Ventures: allows the Algorand Foundation to support pre-seed, seed and scale blockchain projects through various strategic initiatives.

- Animoca Brands: a blockchain gaming company with venture capital operations to support DeFi projects.

- Binance Labs: invests in blockchain startups and communities that help build the decentralised web and grow blockchain ecosystems.

- Coinbase Ventures: the venture arm of Coinbase which specialises in early-stage VC deals and operates almost exclusively in the blockchain space.

- EMURGO Ventures: the venture capital and investment arm of Cardano’s blockchain founding entity EMURGO, which supports Web3 projects and startups.

And, of course, VC firms have been set up to focus specifically on blockchain and crypto:

- AU21 Capital: prefers seed, early-stage, and later-stage investments in companies expanding the frontiers of blockchain technology.

- LD Capital: focuses on seed, early-stage and later-stage investments in blockchain securities, equity investment and trading companies.

- NGC Ventures: serves as both an investor and incubator to blockchain and cryptocurrency projects around the world.

- Polychain Capital: an investment management firm focused on cryptocurrency and blockchain investments.

- Shima Capital: seeks to invest in early-stage cryptocurrency and blockchain startups.

Closing Remarks

DLT is promising. Within 15 years it has spawned a new financial system from scratch and entrepreneurs are exploring innovations across a number of industries. Finance is a key area of focus and the decentralisation of operations is an alluring prospect for users. But confidence must be rebuilt. A swathe of collapses and market retractions has damaged trust in the industry.

VCs still see the promise. Firms focusing on this sector provide financial backing, strategic guidance, market analysis and operational support to portfolio companies. By returning to this market, they must play a crucial role for the ecosystem by supporting innovation, adoption and growth. They are integral to rebuilding confidence in crypto. Done right, and the opportunities for reward are abundant.

[1] Cervantes, C. (2024). 12 VC firms investing in blockchain and cryptocurrency. Available at: PitchBook (Accessed: 10 May 2024).

[2] Plexus Research. (2023). Analysing the Current State of Venture Capital in Crypto. Available at: Plexus (Accessed: 08 May 2024).

[3] Auslender, V. (2022). How did some of the world’s largest VCs miss all the warning signs and invest in FTX. Available at: Calcalist (Accessed: 18 May 2024).

[4] Manda, V. K., & Yadav, A. (2023). The Aftermath of the FTX Cryptocurrency Exchange Collapse. Financial Dynamics: Emerging Trends and Strategies (pp.104-110).

[5] Rajan, N. (2024). 2023 Annual European Venture Report. Available at: PitchBook (Accessed: 10 May 2024).

[6] Thorn, A., & Parker, G. (2024). Crypto & Blockchain Venture Capital – Q1 2024. Available at: Galaxy (Accessed: 11 May 2024).

[7] Kaplan, S. N., & Lerner, J. (2009). It Ain’t Broke: The past, Present, and Future of Venture Capital. Journal of Applied Corporate Finance, 22(2), 36-47.

[8] Rejolut. What Are Costs Of Blockchain Implementation? Available at: Rejolut (Accessed: 17 May 2024).

[9] Zeisberger, C., Prahl, M., & White, B. (2017). Mastering Private Equity: Transformation via Venture Capital, Minority Investments & Buyouts. Hoboken: Wiley.

[10] Doyle, J., & Soni, U. (2022). How Do Cryptocurrencies Correlate with Traditional Asset Classes? Available at: CFA Institute (Accessed: 17 May 2024).

[11] Hays, D., Elkov, D., Rosenberg, H., Malkhasyan, N., & Kravchenko, I. (2021). Blockchain Venture Capital Report. Available at: Mercury Redstone (Accessed: 07 May 2024).

[12] Lipton, E., Wakabayashi, D., & Livni, E. (2021). Big Hires, Big Money and a D.C. Blitz: A Bold Plan to Dominate Crypto. Available at: The New York Times (Accessed: 22 May 2024).

[13] Fortune Business Insights. (2024). Blockchain Technology Market Size. Available at: Fortune Business Insights (Accessed: 17 May 2024).

[14] Le, R. (2024). Insights From Paris Blockchain Week. Available at: PitchBook (Accessed: 16 May 2024).

[15] Langton, J. (2024). U.S. banks undertake blockchain experiment. Available at: Investment Executive (Accessed: 21 May 2025).

[16] Oliver Wyman. (2022). Navigating Crypto. Available at: Oliver Wyman (Accessed: 06 April 2024).

[17] Radosevich, R. (2023). Franklin Templeton Announces the Franklin OnChain U.S. Government Money Fund Surpasses $270 Million in Assets Under Management. Available at: Franklin Templeton (Accessed: 05 May 2024).

[18] Ledger Insights. (2023). T. Rowe Price, Wellington test FX swaps, DeFi on Avalanche public blockchain. Available at: Ledger Insights (Accessed: 05 May 2024).

[19] Santander (2023). How far has global financial inclusion come in the last 10 years? Available at: Santander (Accessed: 10 May 2024).

[20] Gensler, G. (2024). Statement on the Approval of Spot Bitcoin Exchange-Traded Products. Available at: SEC (Accessed: 11 January 2024).

[21] Shen, M. (2024). 2023 Crypto Developer Report. Available at: Electric Capital (Accessed: 06 April 2024).

[22] Le, R. (2023). Integrating Digital Assets and Crypto Into Traditional Finance. Available at: PitchBook (Accessed: 10 May 2024).