Venture

Investment Prospects for Web3 Gaming

Date of Publication

June 2024

Author

Charlie Kellaway

Reading Time

15 minutes

Introduction

‘Web3’ is a buzzword heralding a paradigm shift in technology. Encapsulating all efforts of distributed ledger initiatives to rewire how the world wide web operates, Web3 seeks to move information storage, ownership and distribution away from centralised authorities to decentralised networks [1]. Numerous industries and people stand to benefit.

Gaming is one such industry. Distributed ledger technology (DLT), decentralised finance (DeFi) and non-fungible tokens (NFTs), which all fall under Web3’s purview, are being applied to introduce new elements to gameplay. For example, users can earn rewards (e.g., cryptoassets) by giving their time and skill to an application, redefining the value that can be derived from gaming. Web3 is decentralising the industry, shifting power away from central authorities into the hands of players.

There is value in this, and investors are taking note. The industry – also known as GameFi – is attractive for its potential to revolutionise digital ownership, enhance user experience and create new economic models. However, it is in its infancy and recent collapses in blockchain companies, coupled with regulatory uncertainty, have led to funding withdrawals. Competing with other emerging technologies, Web3 projects must find a way to stand out and become a hotspot for investment.

This essay explores the long-term investment prospects of Web3 gaming, discussing both the potential benefits and the inherent challenges of investing in this nascent field.

Overview of Web3 Gaming

The gaming industry has undergone exponential transformation in recent years. Rapid expansion of the internet has been pivotal and, accompanied by advancements in computer processor technology, enabled online multiplayer innovations and global deployment. From 2000-2020, gamers increasingly turned to massively multiplayer online role-playing games (MMORPGs), examples of which include World of Warcraft and RuneScape. Online capabilities have now become integral: of 3.09 billion people actively playing some form of video game, 1.1 billion play online [2].

The most popular games of today – Fortnite, League of Legends, Minecraft, PUBG and Apex Legends – all connect players, creating competitive rankings, organising battles and arranging meetups [3]. Even centralised publishers that traditionally focused on solo campaigns, like Rockstar (Grand Theft Auto) and Activision (Call of Duty), recognise that online gameplay outweighs offline objectives for many and now focus heavily on upgrading the connected experience. Game development has, therefore, pivoted to networking, community, world exploration and asset accumulation [4].

But there are issues with this model. In-game content is purchased with fiat currency or earned as rewards, as with EA’s FC 24 (formerly, FIFA) which lets players buy Ultimate Team Coins to spend on better footballers for their online team [5]. Users literally exchange fiat money for in-game coins to spend on in-game assets. But EA still reserves copyright, so gamers do not own in-game digital assets. They can trade but cannot take monetary value out of the game. Ownership in centralised gaming is simply a license to engage with features of the digital asset.

In addition, centralised administrators store and operate all game-related information on centralised servers. Players do not control their data, rather, operators mine it to monetise users from their own data. Centralised storage is also inefficient and exposed to cyberattacks, with administrators failing to appropriately safeguard player data. Identify theft has long been a vulnerability of MMORPGs, but newer consoles are also targeted by malware – in an attack on Sony in 2023, the ransomware operator declared that all data stolen was for sale [6][7][8]. In centralised systems, player data is exposed.

Application of Web3 technologies addresses these problems, used in the following ways [9]:

- Technical Decentralisation – relating to security of decentralised blockchains and smart contract protocols that create permissionless and verifiable ecosystems on which products and services can be built without the need for trusted central intermediaries.

- Economic Decentralisation – relating to new, digital assets and decentralised networks with their own decentralised economies.

- Legal Decentralisation – relating to legal aspects of how decentralised systems make use of digital assets.

Web3 economies operate autonomously on blockchains, self-regulating and accruing value from an array of sources. Decentralised gaming networks deploy NFTs to represent in-game items, enabling free-market ownership over virtual assets. As an example, a non-fungible tokenised sword would mean that only the player who owns the sword NFT can claim the asset’s value. This model derives tangible value from in-game assets. Web3 networks also enable interoperability of tokenised assets, so players can buy, sell and trade freely between different gaming platforms. Since ownership is recorded immutably on the blockchain, interconnectivity is increased without sacrificing transparency or security. These transformations cumulatively form the basis for economic incentivisation in Web3 gaming and catalyse adoption of DLT across many game styles [10]:

- Play-to-Earn: in games like Axie Infinity, players earn rewards for task completion, resource management and other behaviours.

- NFT-based Collectibles: games like CryptoKitties let players collect and trade NFTs that represent unique digital assets.

- Blockchain-based Virtual Worlds: players purchase, develop and monetise virtual assets within worlds built on blockchains.

- Blockchain-enhanced MMOs: games like Lost Relics combine traditional Massively Multiplayer Online gameplay with blockchain-based asset ownership, creating player-derived economies.

- Blockchain Card Games: games like Gods Unchained have NFTs represent unique cards which can be purchased, traded and used in strategic card battles.

- Blockchain Racing: players create and trade virtual cars and parts.

- Blockchain-Based Sports and Collectible Games: players own and trade virtual sports memorabilia, such as officially licensed NBA collectibles on NBA Top Shot.

Blockchain Art and Creativity: players create and trade digital art and collectibles as NFTs.

Additionally, Decentralised Autonomous Organisations (DAOs) create decentralised governance ecosystems, meaning players can participate in decision-making processes to influence game development and management. A DAO is a structure with no central authority; instead, power is distributed across token holders who collectively vote on proposals for the network to develop. Games run by DAOs are shaped by democratic governance, drawing expertise from a broad spectrum of contributors.

These unique features mark Web3 gaming as an investment opportunity.

Investment and Challenges

The features presented above suggest that Web3 technology, particularly NFTs, will influence game designs and business models [11]. Incentivising players to earn income will associate decentralised games with economic empowerment, which could be particularly transformative for citizens of developing countries. There is evidence of this already: in 2022, 40.53% of users of Axie Infinity were based in the Philippines, and other countries in the top five included Venezuela (6.31%), Thailand (4.73%) and Brazil (3.29%). The US placed third with 5.72% [12]. Web3 gaming can unlock very high user numbers, making it an extremely attractive prospect for business operators and investors.

Additionally, developers are adapting to more player-centric models, enabling a new form of in-game economy. Interoperable markets, where gamers can own and trade assets across different platforms, will lower barriers to entry, broadening participation and supporting new assets. For investors, there are opportunities to combine traditional revenue models (e.g., one-time purchases and microtransactions) with new streams based on the creation, sale and trading of NFTs. Thus, the fusion of gaming and decentralised finance to form GameFi.

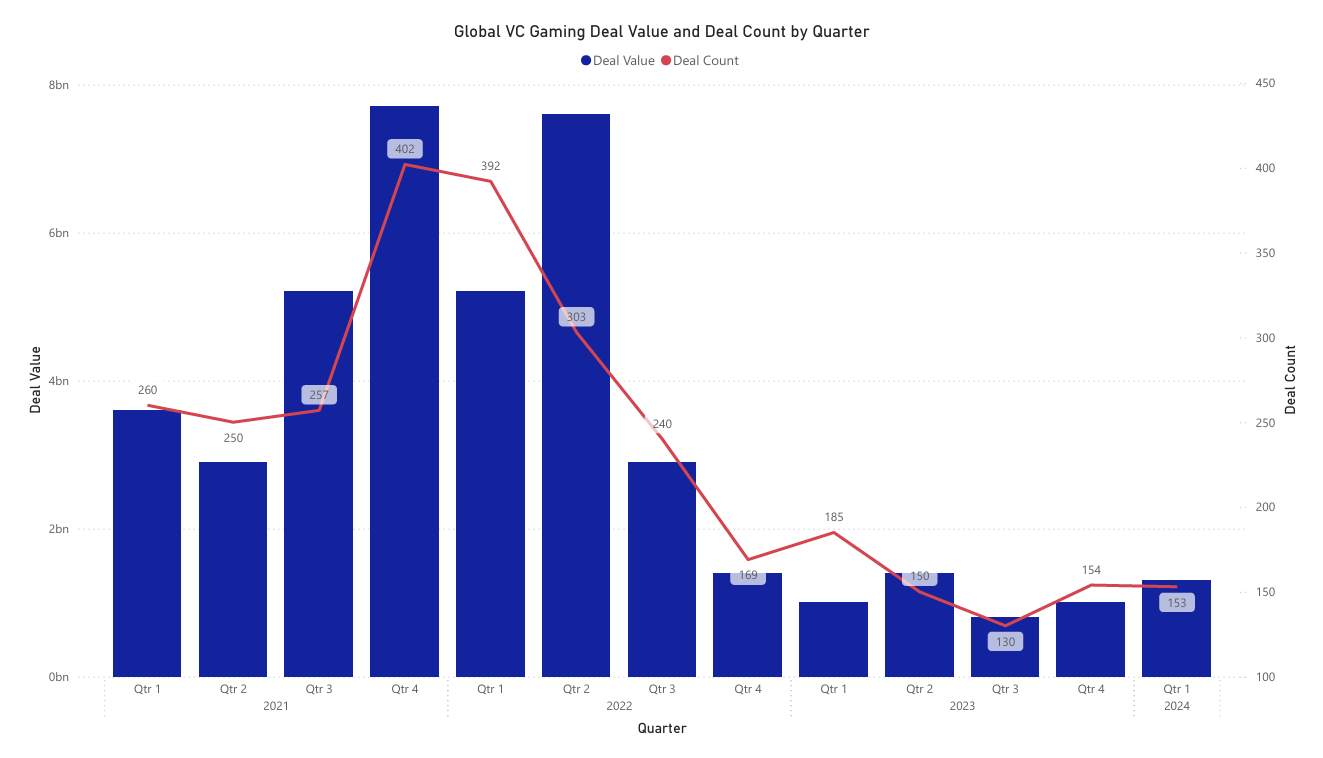

Investment in blockchain had been prevalent but fell sharply following the high-profile collapses of crypto-focused firms Luna, FTX and Three Arrows Capital in 2022 [13]. Spiking at 1,169 in 2021, the number of global venture capital (VC) gaming deals dropped 47% to 619 in 2023 [14]. This was accompanied by a starker 78.35% drop in total deal value across the same period, from US$19.4bn to US$4.2bn.

However, recent activity suggests a resurgence. Konvoy Ventures, a VC firm specialising in video games, reported U$594mm of funding in the US for gaming companies during Q1 2024, up 94% on Q4 2023 [15]. Galaxy, a digital assets manager, reported 603 blockchain deals in a 68% uptick, with 21% of capital (US$523mm) going to GameFi projects [16]. It was the second most backed category.

Global data on Web3 gaming deals by PitchBook also identifies an upturn. Average deal size in Q1 2024 was US$8.5mm, up 57.12% on Q1 2023. Total deal value increased by US$300mm quarter-on-quarter; Andreessen Horowitz closed US$600mm for its second gaming fund in April [17]; and Griffin Gaming Partners is targeting US$500mm for its third fund. There is renewed optimism.

Investor sentiment and market perception will be crucial. Positive sentiment, fuelled by high-profile endorsements and stories of institutional funding, can stimulate prolific private financing – a phenomenon well underway for other emerging technologies that focus on user experience.

A prime example is virtual reality. VR aims to create immersive experiences by simulating real or imagined environments and there is immense potential to integrate this with Web3 games. VR can enhance the experience, with one able to own NFT cards (e.g., decentralised Yu-Gi-Oh!) and battle with this asset in the virtual realm. Investments in VR have been substantial: private equity firms poured US$120bn into the metaverse in the first five months of 2022 alone and the industry is projected to have a US$125bn impact on the global gaming market by 2030 [18].

Artificial intelligence (AI) also promises to enhance user experience and redefine business models. Investment in AI has surged, with startups receiving billions in funding. Amazon and Microsoft recently committed a combined US$15bn to competing generative AI startups [19]; VC deal value in 2023 reached US$29.1bn (up 268.4% on 2022) [20]; Saudi Arabia is reportedly forming a US$40bn AI initiative; the European Union is financing a €540mm supercomputer for training AI models; and China’s spending on AI is projected to surpass US$38bn by 2027.

That said, AI is more mature than GameFi. AI technologies have been in development for decades and now have an established and diversified market presence, providing a more stable investment landscape. One in six UK organisations (432,000) have embraced a form of AI, whilst ChatGPT has over 180.5mm monthly users and received 1.8bn website visits in April 2024 [21][22]. GameFi is more speculative, and start-ups are in their infancy. The most popular Web3 games do not attract nearly as many users as ChatGPT, with Axie Infinity only engaging with 204,000 unique wallets daily. Even the most popular games, Matr1x and motoDEX, attracted just 2.5mm and 2.27mm daily users respectively in June, and user support of these networks is minimal. Total value locked (TVL) – the value of cryptocurrency in USD pledged by users to the protocol – is a key metric to gauge the popularity and activity of a decentralised application (dApp). Just US$469,640 and $1,370 is locked on these dApps [23].

If AI investments are deemed less risky than Web3 gaming, funding could move from Web3 to AI, stunting blockchain innovation. Deal withdrawals have harmed VR: there were no rounds of US$100mm or more in the US during 2023 for consumer-facing companies developing virtual worlds [24]. Accordingly, innovation has slowed and VR applications have struggled with high costs, technical limitations and a lack of killer applications to drive widespread use. Meta’s Reality Labs, which develops VR technologies, logged a US$3.7bn operating loss on U$276mm in sales during Q2 2023 [25]. GameFi could face similar obstacles and fail to deliver a compelling user experience if it does not receive the right investment

So, investors and GameFi need each other. Balanced investor sentiment, grounded in a realistic assessment of blockchain’s potential and challenges, is essential. Consideration and due diligence will foster environments in which astute VCs can support development teams to focus on technological innovation, asset proliferation and user expansion. An approach shaped this way can unlock substantial value for both investors and the Web3 gaming ecosystem.

Regulatory Considerations

Integrating DLT into the gaming ecosystem can be transformative. However, though it offers economic opportunity, it also raises regulatory and ethical questions – frameworks for which are vital to the long-term viability of Web3 gaming. Proactive regulation can boost investor confidence by providing clear legal guidelines and protections; overregulation might stifle innovation; and weak regulation exposes players to scams and frauds. It is imperative to assess these challenges.

A key obstacle (for cryptoassets more broadly) is the lack of clear definition for NFTs. With classification (e.g., as a digital asset, security or new class) comes certainty around investor protection, taxation and market oversight. This is critical to protect consumers, since entities operating in the industry will need to report transparent information on their activities and implement anti-money laundering (AML) and know-your-client (KYC) procedures [26].

Ethically, there are challenges too. Asset devaluation must be expected in traditional financial markets, but this is a new concept in online gaming ecosystems (we isolate Web3 gaming from online poker tournaments and games of that ilk). Ethical dilemmas will arise when players invest in NFTs with the expectation of long-term value, only to see a market downturn. Consider the downturn in 2022, during which digital arts selling for millions of dollars were suddenly worth a fraction, and 23 million people were left holding 70,000 NFTs worth 0 ETH. Such a severe reversal would devastate gamers who had invested time, skill and money into procuring assets [27]. It is imperative to balance Web3 innovation with ethical responsibility.

How might this look? Entrepreneurs and investors, in collaboration with regulatory bodies, must proactively implement guidelines on player data, dispute resolutions, transferability and liability to protect consumers while allowing economic exploration. As an example, networks could implement non-transferable “soulbound” tokens (SBTs): a concept in which a token belonging to a Soul –meaning a group or individual – can represent the credentials and affiliations of that Soul (we recommend reading the original paper for this concept, co-authored by Vitalik Buterin, Ethereum founder) [28]. This could protect data permissions and user rights in gaming networks but is just one example. Other innovations will likely be required. The right format will prime applications that support a sustainable and equitable decentralised gaming ecosystem.

Market Opportunity

Aside from private investment funds, centralised gaming institutions are also pouring research, development and investment into GameFi. 72.5% of the top video game companies by market capitalisation have actively ventured into Web3 by either directly investing in GameFi projects, developing their own games or hiring for blockchain-related positions [29]. Stand-out examples include Microsoft’s investment in WeMade, a blockchain game producer, and Ubisoft’s announcement of specific Web3 experiences in upcoming games [30].

Additionally, successful blockchain-native firms are investing heavily into fledgling projects. Leading GameFi firm Animoca Brands, a Fortune Crypto 40 corporation, is building an interoperable metaverse layer across its 400+ portfolio companies [31]. Meanwhile, NFT marketplace OpenSea recently partnered with Web3 game developer Gunzilla, enabling players to trade in-game items directly on its market [32].

Revisiting the current low interaction with leading games like Axie Infinity, we must consider that the blockchain industry is coming out of the crypto winter. User bases have not nearly returned to the peak levels of 2021, during which Axie Infinity had a market capitalisation of US$16.7bn and generated revenues of US$364.4mm in August alone [33]. Other dApps also profited: from the previous winter in January 2018 to the peak of the bull run in January 2022, the compound annual growth rate of GameFi reached 180% [34]. It is not unreasonable to expect similar, or greater, growth and revenues if player numbers are revitalised.

There is dedication from both centralised and blockchain-native firms to achieve this. As an industry, GameFi is immature, exploratory and open. It is waiting for the killer product that could catalyse mass adoption and the opportunity to support companies dedicated to this must be a key focus of investment. Unprecedented global interaction in new gaming economies will follow, and all the benefits that come with it.

Closing Remarks

This essay has explored the unique features of decentralised gaming and its market potential, drawing parallels with other emerging technologies. The long-term investment prospects for GameFi are promising, as it unlocks innovative business models and economic diversification. But Web3 also faces regulatory and market uncertainties.

Investors must adopt a balanced approach to recognise both the prospects and risks involved. Growth depends on continuous technological innovation, effective regulatory frameworks and responsible investment practices, all of which require continuous funding to support. Get the right mix and, together, Web3 developers and investors can revolutionise the gaming industry to create new economic opportunities in the digital age.

[1] Stackpole, T. (2022). What Is Web3? Available at: Harvard Business Review (Accessed: 01 June 2024).

[2] Howarth, J. (2024). How Many Gamers Are There? (New 2024 Statistics). Available at: Exploding Topics (Accessed: 02 June 2024).

[3] Phoenix Pixel. (2024). Top 10 Most Popular Online Games in the World: 2024 Rankings Revealed. Available at: LinkedIn (Accessed: 02 June 2024).

[4] Daniel, A. (2023). The Evolution of Gaming: Web3, NFTs, and the Future of Play. ResearchGate.

[5] EA. (2023). How to use Ultimate Team™ Coins and EA SPORTS FC™ Points safely. Available at: EA (Accessed: 01 June 2024).

[6] Bardzell, J., Jakobsson, M., Bardzell, S., Pace, T., Odom, W., & Houssian, A. (2007). Virtual Worlds and Fraud: Approaching Cybersecurity in Massively Multiplayer Online Games. Digital Games Research Association, 742-751.

[7] Layne, A. F. (2018). In The World Of Online Gaming: Who Is Protecting Whom From A Scam Artist’s Journey Into Obtaining One’s Information? Utica College ProQuest Dissertation & Theses, 10931755.

[8] Hollingworth, D. (2023). Ransomed.vc group claims hack on ‘all of Sony systems’. Available at: cyberdaily.au (Accessed: 04 June 2024).

[9] Jennings, M. (2022). Principles & Models of Web3 Decentralization. Available at: a16zcrypto.com (Accessed: 02 June 2024).

[10] Tkach, A., & Kalugin, O. (2023). What Is Web3 Gaming – A Deep Dive Into Decentralized Play. Available at: BDC Consulting (Accessed: 01 June 2024).

[11] Khelladi, I., Castellano, S., Ghamugi, N., & Doucet, V. (2022). Unveiling NFTs from Business Model Innovation Perspective. ResearchGate.

[12] Statista. (2022). Share of Axie Infinity players, by major country of origin in 2022. Available at: Statista (Accessed: 08 June 2024).

[13] Le, R. (2024). Crypto Report: Q1 2024. Available at: PitchBook (Accessed: 11 May 2024).

[14] Robbins, J. (2024). Griffin Gaming Partners targets $500M for downsized fund III. Available at: PitchBook (Accessed: 09 June 2024).

[15] Konvoy Ventures. (2024). Gaming Industry Report – Q1 2024. Available at: Konvoy (Accessed: 03 June 2024).

[16] Thorn, A., & Parker, G. (2024). Crypto & Blockchain Venture Capital – Q1 2024. Available at: Galaxy (Accessed: 11 May 2024).

[17] Horowitz, B. (2024). New Funds, New Era. Available at: Andreessen Horowitz (Accessed: 12 June 2024).

[18] Elmasry, T., Khan, H., Yee, L., Hazan, E., Kelly, G., Zemmel, R. W., & Srivastava, S. (2022). Value creation in the metaverse: The real business of the virtual world. Available at: McKinsey & Company (Accessed: 08 June 2024).

[19] Letzig, J. (2024). To fully appreciate AI expectations, look to the trillions being invested. Available at: World Economic Forum (Accessed: 08 June 2024).

[20] Hodgson, L. (2024). VCs go vertical in backing specialized AI. Available at: PitchBook (Accessed: 08 June 2024).

[21] Hooson, M., & Pratt, K. (2024). UK Artificial Intelligence (AI) Statistics And Trends In 2024. Available at: Forbes (Accessed: 12 June 2024).

[22] Ver Meer, D. (2024). Number of ChatGPT Users and Key Stats (June 2024). Available at: NamePepper (Accessed: 15 June 2024).

[23] DappRadar. (2024). Top Blockchain Games. Available at: https://dappradar.com/rankings/category/games?range=30d

[24] Glasner, J. (2024). Startup Investors Have Fled The Metaverse. Available at: Crunchbase (Accessed: 14 June 2024).

[25] Vanian, J. (2023). Meta’s Reality Labs has now lost more than $21 billion since the beginning of last year. Available at: CNBC (Accessed: 14 June 2024).

[26] Rosen, P. (2023). Remember when NFTs sold for millions of dollars? 95% of the digital collectibles may now be worthless. Available at: Business Insider (Accessed: 02 June 2024).

[27] Hennessy, L. (2024). Web 3.0 is a huge opportunity for gaming, but inconsistent regulation will present challenges. Available at: Clyde & Co (Accessed: 08 June 2024).

[28] Olhaver, P., Weyl, G., & Buterin, V. (2022). Decentralized Society: Finding Web3’s Soul. Available at SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4105763

[29] Boey, N. (2023). Top Video Game Companies Have Their Sights Set on Web3. Available at: CoinGecko (Accessed: 07 June 2024).

[30] Carter, S. (2024). Why Ubisoft And Other Studios Are Doubling-Down On Web3 And AI Gaming. Available at: Forbes (Accessed: 07 June 2024).

[31] Animoca Brands (2023). Animoca Brands to amplify Ubisoft’s Strategic Innovation Lab’s Web3 initiatives through Mocaverse. Available at: Animoca Brands (Accessed: 07 June 2024).

[32] OpenSea Crew. (2024). This Week in Web3 and NFTs: Doodles, Gunzilla Games & more! Available at: OpenSea (Accessed: 07 June 2024).

[33] Melinek, J. (2022). Why Axie Infinity’s co-founder thinks play-to-earn games will drive NFT adoption. Available at: TechCrunch (Accessed: 07 June 2024).

[34] Wu, W., & Hon, H. (2022). GameFi: Past, Present, and Future. Available at: Crypto.com (Accessed: 07 June 2024).